If we pay attention to the statistics around 80% of the individuals that trade the Markets are actually losing money. That number goes up to around 95% for riskier instruments like Futures. It should be simple, the Market only can go up, down or sideways and the idea of buying low and selling high sounds simple enough.

A lot of people prefer to ignore the statistics and seem to be attracted to the rare cases where a trader gets rich and famous quickly. One of those rare cases was Keith Gill also known as 'Roaring Kitty'. He led the movement that made the stock of GameStop (GME) skyrocket from around 0.64 cents of a dollar to 120.75 USD which would be an increase of 18,767%. There is a short 4 min video below where he explains his methodology for picking stocks. His estimated fortune is now somewhere between 30 to 48 million USD. I'm still very skeptical about the way he chooses what to trade.

Whether you decide to pay attention to the statistics or not, the only certainty we have is that as human beings we are emotional. In times of uncertainty, the only way to stay on track is to have a plan that can keep us focused, one that you trust, understand and actually follow.

Market Overview

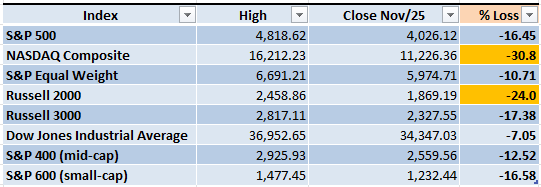

During the week of Thanksgiving 2022 there weren't surprises in the Markets like the one we had last year where the discovery of the Covid Omicron mutation in South Africa caused a sharp decline. The most important indexes are mostly unchanged, only a couple of them remain in Bear Market territory (a loss of 20% or more from the previous high):

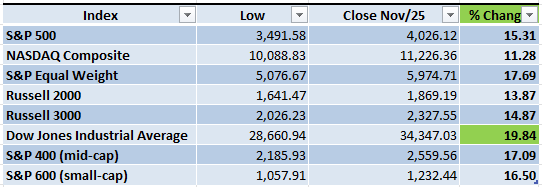

What if we look at the opposite side? the last six weeks we have seen the Market rally, the Dow Jones Industrials is close to be officially considered in a Bull Market (an increase of 20% or more from the previous low):

This is where it gets tricky, on one side we have a few indexes that are still in Bear Market territory, and some others that are close to be officially in a Bull Market. My personal criteria is that the weekly downtrend that is easily observable in the S&P 500 chart is still intact, so the Bears are still in control.

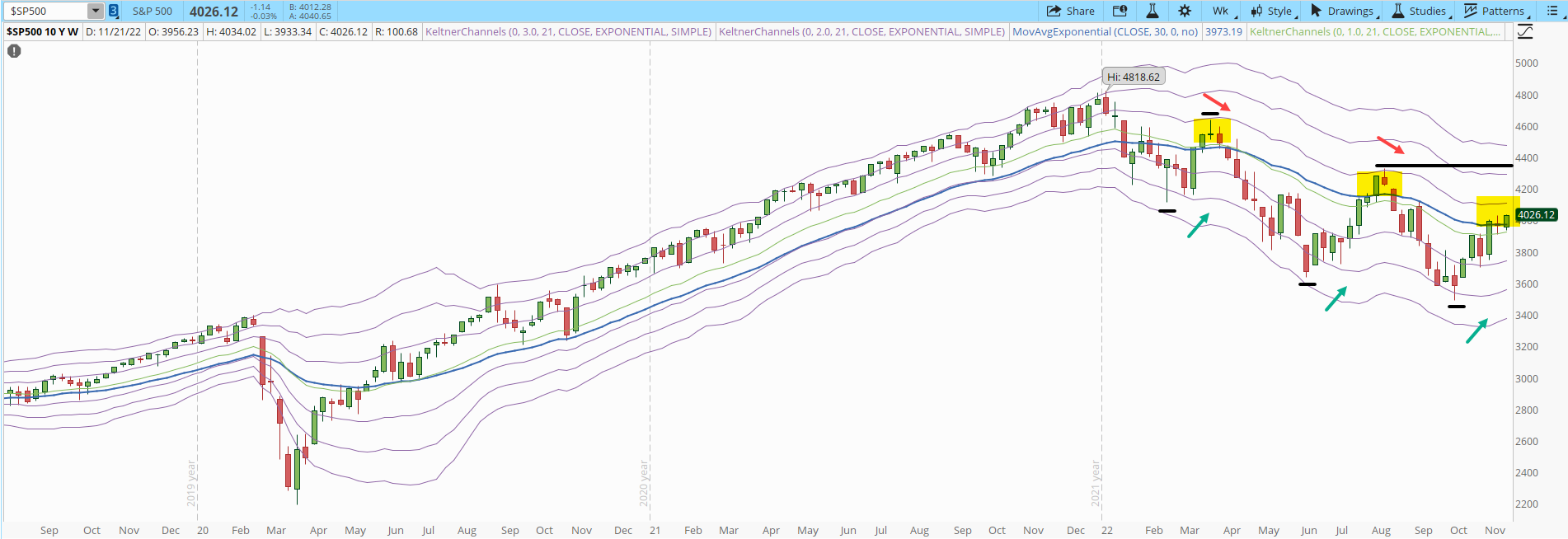

I have mentioned in my previous articles that during 2022 the weekly chart of the S&P 500 has formed a pattern. First, it's in a downtrend (lower lows and lower highs highlighted by the horizontal black solid lines). Second, every time it reaches the +1 Keltner Channel (KC) there's a sharp decline (red arrows). Third, every time it gets to the -3 KC it rallies (green arrows).

This pattern won't last forever, eventually the Bulls will be able to stop the downtrend, at this point in order for that to happen there has to be a rally that takes the S&P 500 above 4,350. That would damage the structure of the weekly downtrend and would take the index for the first time in 2022 above the +1 KC.

If we get a closer look by zooming into the daily chart of the S&P 500 the news aren't great. In this chart every time the index gets to oversold conditions (-3 KC or below) there is at least a small reaction rally (green arrows). However, I'm concerned about that the index has been able to reach the +3 KC only three times during 2022 (highlighted in yellow). During the first two, sharp declines followed. Again, there aren't guarantees in the Market, but if this behavior repeats it would signal that the Bulls are still very weak despite the rally we have seen lately.

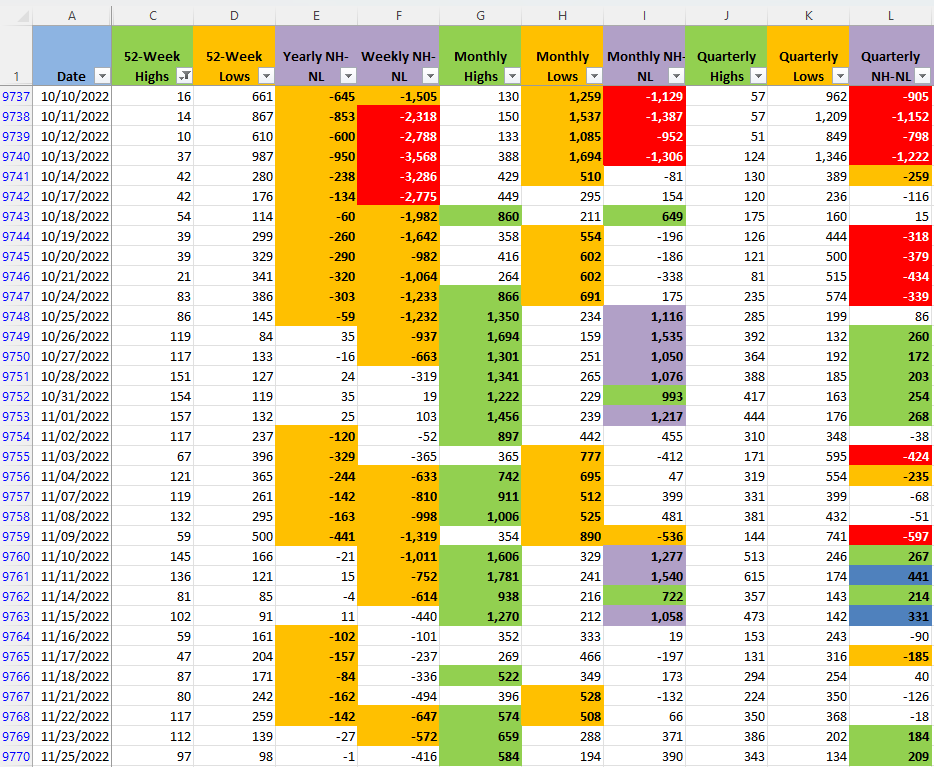

I didn't find much insight in the New Highs and New Lows numbers after the abbreviated week. The Bulls have a very slight edge in all the timeframes but nothing significant in order to reflect this in the charts.

Industries

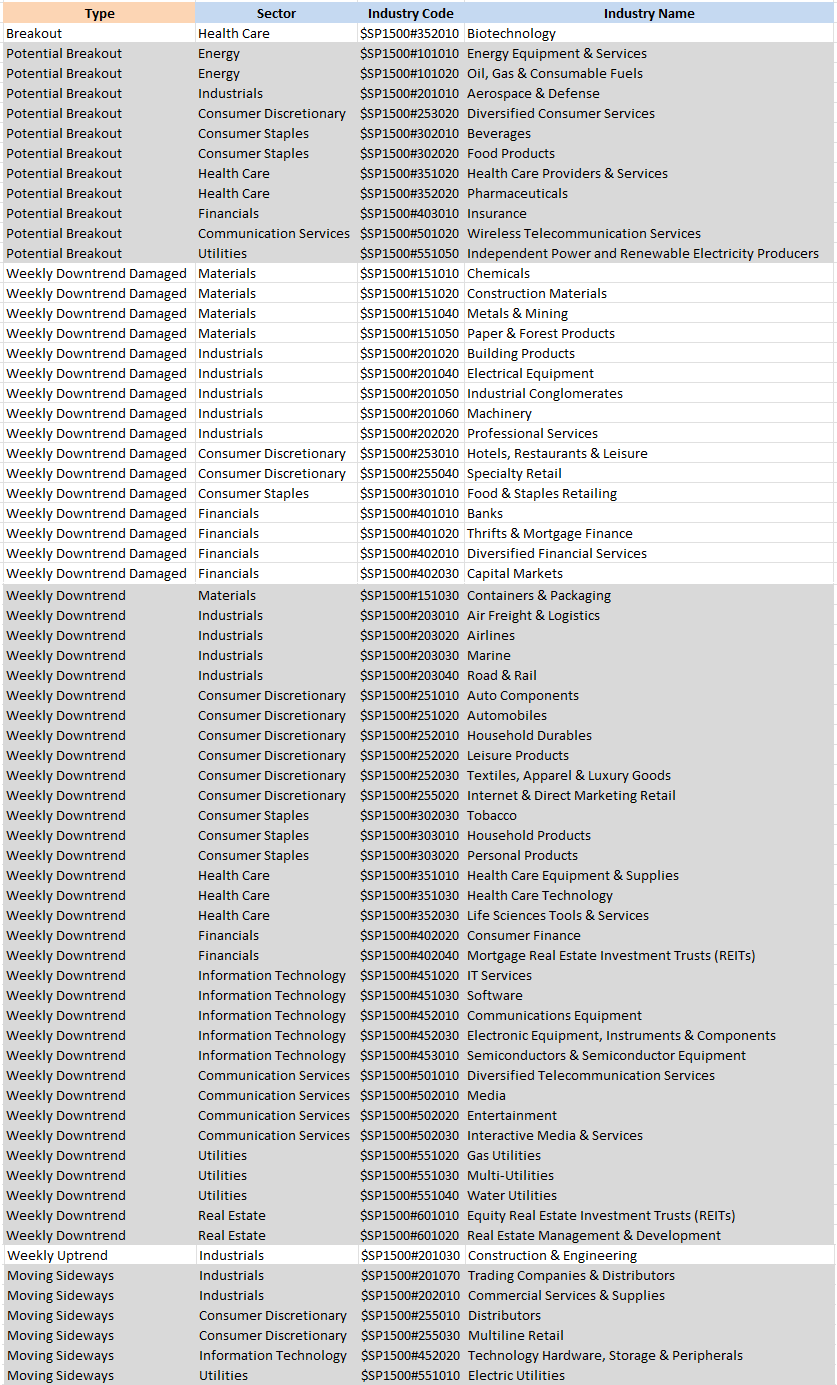

This week I'll classify in a different way the 68 Industries that compose the Global Industry Classification Standard (GICS):

- 49% of the Industries are still in a confirmed weekly downtrend

- 24% of the Industries had the structure of the downtrend damaged after the recent rally

- 16% could have a potential breakout

- 1% is in a confirmed uptrend

You can see the detail of the Industries below, including the classifications not mentioned in the previous list.

I keep monitoring and updating these Industries in order to find out at an early stage where I am likely to find the leaders of the next Bull Market.

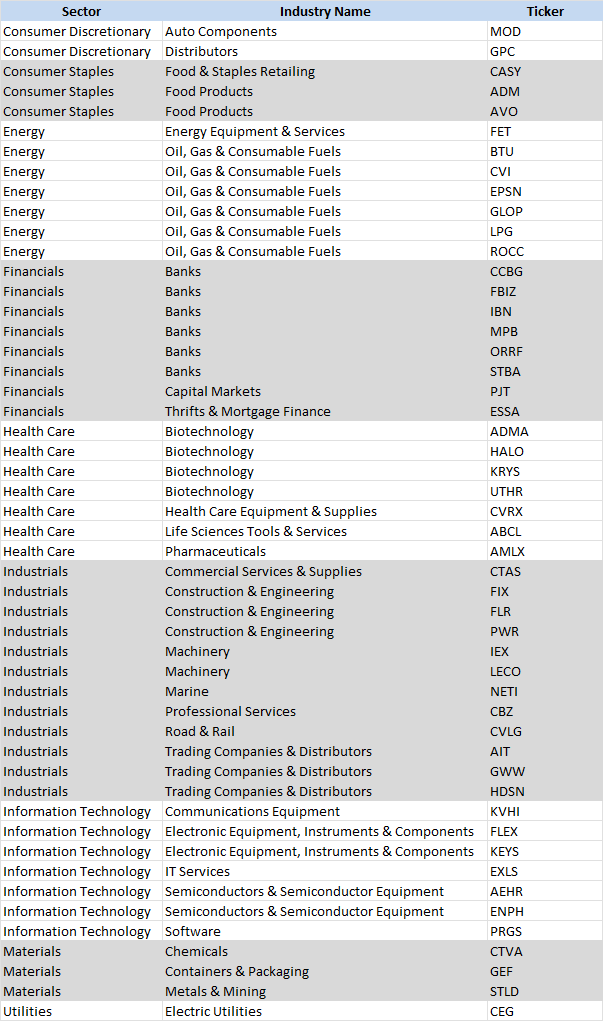

Stock Monitor

During the week I'll be monitoring 50 tickers, I follow Mark Minervini's trading method (there are 2 books describing the method, it won't be explained in this blog). Most of them won't match all the conditions to be traded, they shouldn't be traded blindly. If you take one of the tickers below and decided to trade it, it's your responsibility. Following this method, a good trader will lose money in around 50% of the picks and you have to be good enough to profit with the other 50% in order to compensate for the losses.

Scenarios:

Scenario #1: My point of view is that during the trading week of Nov/28 we will see a pullback, it doesn't necessarily will be a sharp decline but it will allow us to see how strong Bulls and Bears are. During the last couple of weeks the rally stalled, oscillating between 3,900 and 4,000. If the index moves higher, it will be back to overbought territory in the daily chart (+3 KC or above). Additionally, the other two times that the S&P 500 reached that level during 2022 there were sharp declines. A pullback at this point would be expected.

Scenario #2: The second most likely scenario is that the index continues moving sideways until there is a strong catalyst in the Market that finally decides in which direction it will end moving. Basically a continuation of what has been going on for the past couple of weeks.

Scenario #3: The least likely scenario is that the Market resumes the rally. There has to be some good and surprising news that can fuel the rally to new heights. Maybe something surprising regarding the inflation or amazing numbers for the holiday shopping season could trigger some risk appetite.

Summary

The Market is a chaotic place with some moments of order along the way. No one has been able to consistently forecast the future, but there are multiple legendary traders that have been able to make incredible fortunes by having sound strategies that limit their risk during difficult times.

Remember, most of the people that try to outsmart the Market lose money, that would be at least 80% of the ones that attempt to successfully play the game. It's important that we keep learning from the ones that have succeeded. Books like ones in the Market Wizards series give us some insights in what works in the Markets.

Whatever is your strategy remember that capital preservation is the most important part of the game. If you blow up your account you can't continue playing.