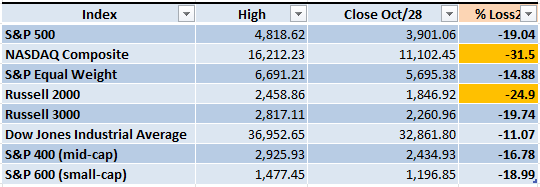

An exciting week in the Markets, the inflation/recession news keep dominating the media, we saw some of the Tech Mega-Cap companies stumble and despite the negative catalysts the S&P 500 managed to gain 160 points and it's now at 3,901. Even if it's by a small margin, most of the important indexes are out of Bear Market territory (a loss of 20% or more from the previous high).

At the current level, the S&P 500 is still losing 19% compared to the levels we had during Jan/2022. The current rally gives some hope that the Market direction could be turning, but what are the risks involved?

Market Overview

There is a great book that Peter Lynch wrote, one of the legendary investors of all time, it's called "One Up On Wall Street". This guy shares his knowledge in simple terms that anyone can understand, one of the quotes that applies perfectly to the current Market situation is about trying to catch a bottom:

"Bottom fishing is a popular investor pastime, but it’s usually the fisherman who gets hooked. Trying to catch the bottom on a falling stock is like trying to catch a falling knife. It’s normally a good idea to wait until the knife hits the ground and sticks, then vibrates for a while and settles down before you try to grab it. Grabbing a rapidly falling stock results in painful surprises, because inevitably you grab it in the wrong place."

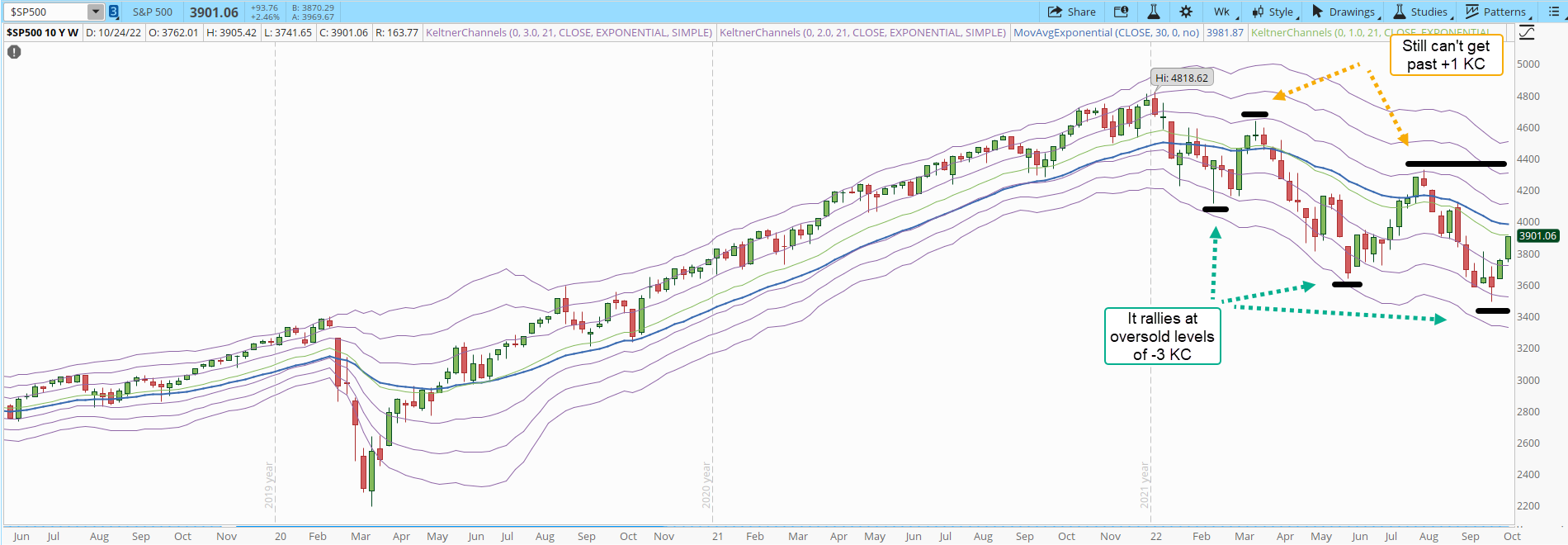

The current rally, which might still continue, doesn't necessarily mean that the Bears are done. The structure of the weekly downtrend is still intact (lower highs and lower lows highlighted by the solid black lines). The behavior of the weekly S&P 500 chart since Jan/2022 is simple, when it gets to the +1 Keltner Channel (KC) the index declines. When the index is at oversold levels (-3 KC or below) the index rallies. During these oscillations, every time the Market is moving towards lower highs and lower lows.

The structure of the downtrend won't be damaged until the S&P 500 decisively closes above 4,350. Resistances are real, and nowadays we all have easy access to the same charts. When a good number of traders start to see strong levels of resistance, some of them will wonder if the chart will keep going up and might decide to sell. That in turn increases the selling pressure.

The closer the S&P 500 gets to 4,200 my interpretation of the chart tells me that the selling pressure will spike and the index will have a hard time getting past that level with a high probability of a pullback.

It's important to understand that the daily chart of the S&P 500 will be at overbought levels (+3 KC or above) if it gets around 4,200 (horizontal black dotted line). It's possible that the chart stays at overbought levels for a while, greed is a sentiment that can last much longer than fear, but eventually a pullback is expected and even healthy.

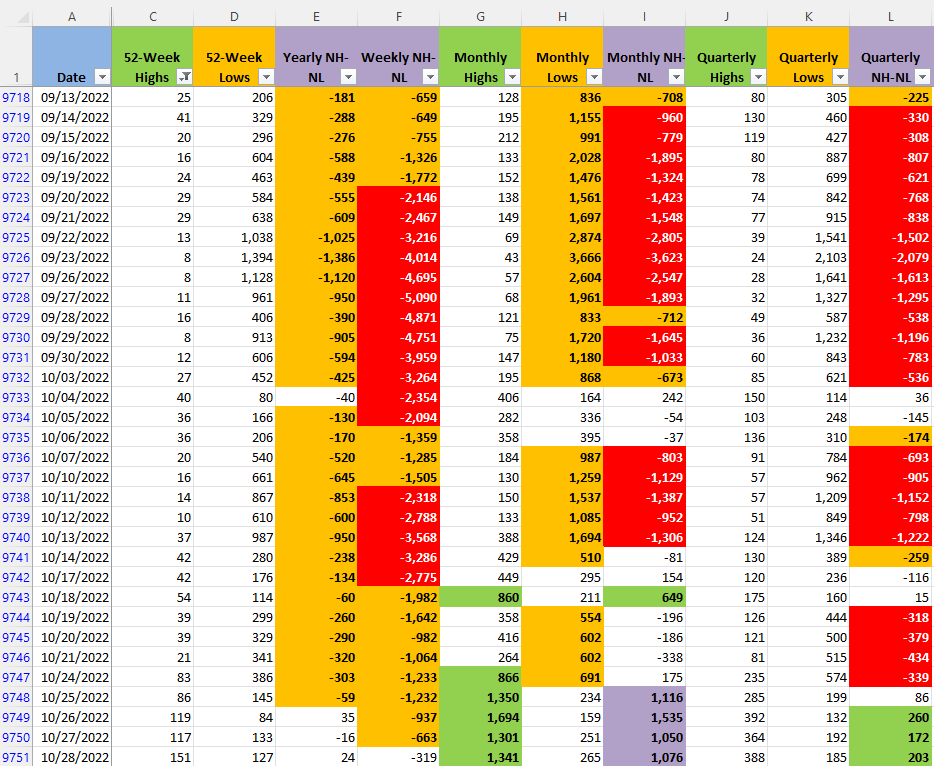

The New Highs and New Lows (NH-NL) indicator is confirming the force of the rally. In the Monthly columns (G, H and I) which are the ones that move faster from the timeframes that I track, the Bulls managed to go to New Highs above 1,300.

That means that if you pick for example Oct/28, during that day 1,341 stocks made a New High that day considering a timeframe of the last month. During that same timeframe, only 265 tickers made a New Low. If you are trading on the long side, you are more likely to pick a winner when a good number of companies are making New Highs.

Industries

Some Industries had amazing upward movements during the trading week. If we take for example 'Technology Hardware, Storage & Peripherals' ($SP1500#452020) or 'Wireless Telecommunication Services' ($SP1500#501020), they both had some crazy rallies, just on Friday they moved more than 7% each.

Even with the rally, I still cannot find one or more Industries that are in a strong uptrend. From the 68 that compose the Global Classification Standard (GICS) some of the Industries are still in a clear downtrend, others are moving sideways, potentially starting to trace a bottom.

Patience will be a key element, this section might not change often, but the potential to find at an early stage which are the Industries that might lead the next Bull Market could be worth the wait. As I mentioned in previous articles, one day we will start to see some outliers, Industries that won't care about the Bear Market or sharp declines, they will rally despite all the negative Market conditions. Those Industries could be the leaders that start to change the Market direction and others could eventually follow.

Scenarios

Scenario #1: During the next trading week, the most likely scenario from my point of view, is that the rally will begin to stall. With the advance that we saw last week, I don't see very likely that the rally will continue past 4050 for the S&P 500. Since Oct/2021 only four times the S&P 500 has been around the +3 KC, every single time after reaching that level, it eventually had sharp declines (red dotted arrows). Eventually this behavior will change, there are no guarantees or written rules in the Markets, anything can happen, but so far the weakness of the Bulls hasn't been able to sustain a rally without a sharp decline that sends the indexes to new lows.

Scenario #2: The second most likely scenario is an immediate sharp decline. The earning season hasn't been great. The problems that have been acting as strong negative catalysts are still there and are far from being solved (i.e. inflation/recession, supply chain crisis, Ukraine war, tensions with China). The Bears don't need that much in order to send the indexes back to Bear Market territory.

Scenario #3: The least likely scenario, from my point of view, is that the rally continues, at least to 4,200. In order for that to happen, some good and surprising news are required next week in order to fuel the rally. Especially since in order to get to those levels, the index will enter into overbought territory.

Summary

The current rally gives some hope that the Market could be changing direction. I think that it's still too early to confirm that, the weekly downtrend of the S&P 500 is intact. Most of the indexes are only 1% or 2% away from going back to Bear Market territory. The daily chart of the S&P 500 shows the inability of the Bulls to stop sharp declines once the index gets to the +3 KC.

I will start looking for attractive candidates to trade in case that the rally does keep going and the Bulls are able to start changing the Market direction. Even if I start to open positions, they will be likely pilot trades of limited size and tight stops. Whatever is your trading style remember that if you blow up your account you won't be able to continue playing this game. It's still a risky Market, protect your account, follow your plan, risk management will be key in order to profit from the Bull Market that eventually will begin.