When someone starts to think that has figured out the Markets we eventually get a humility lesson that makes us remember how hard trading can be. A couple of days ago I started to open a few long positions (link below), yesterday the Market didn't do anything impressive and today's action just adds to the confusion. The S&P gapped up and later went to test the 4,775 line, rallied a little bit and closed flat. The NASDAQ had a sell-off because of the worries about high interest rates. Finally, the Dow Jones Industrials posted an all-time high. This is definitely a signal of weakness.

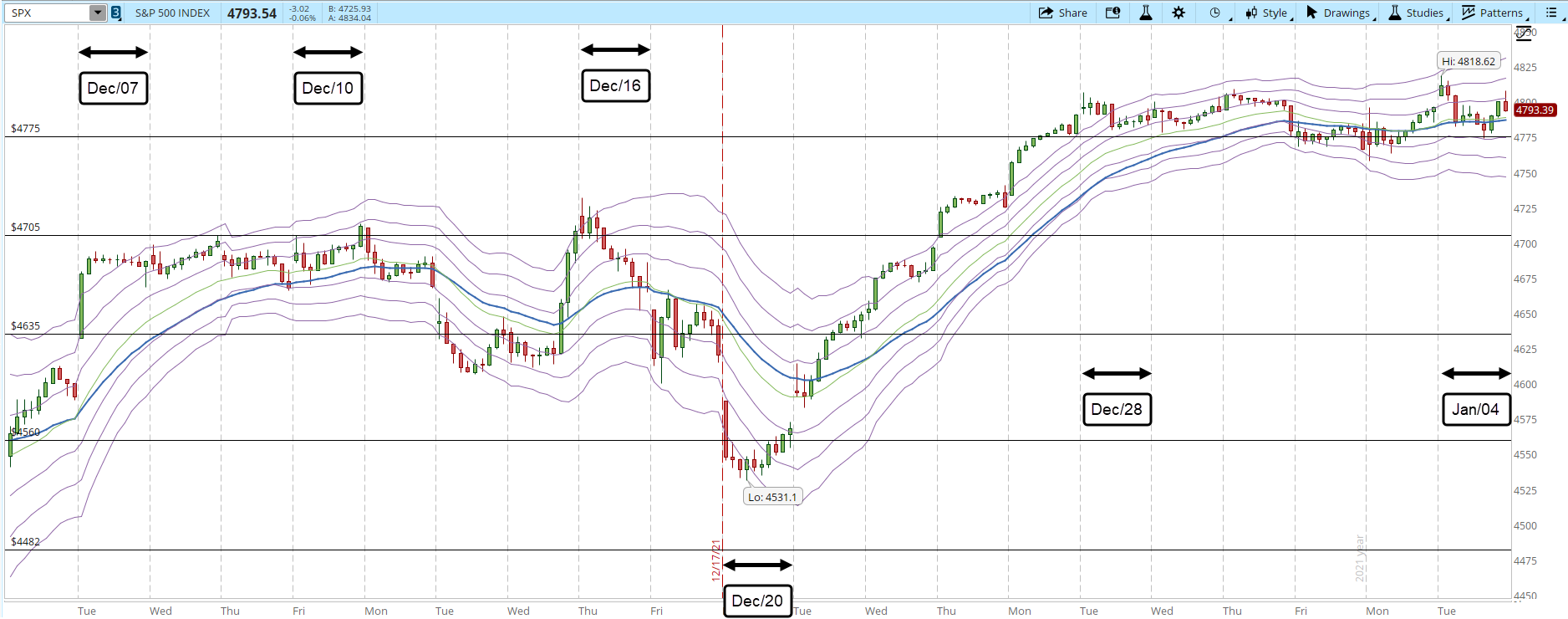

Jan/03/2022 - Manic-Depressive MarketReviewing the 39-min S&P chart (screenshot below, you can click on the image in order to magnify it) the S&P keeps rejecting the 4,800 level. At the beginning of the session, the index gapped up and tested the 4,800 just to go down and finally close flat. It's easy to see the consolidation in the chart, the uncertainty comes about if this is a pause in the trend or we are at the top of the chart right before a correction.

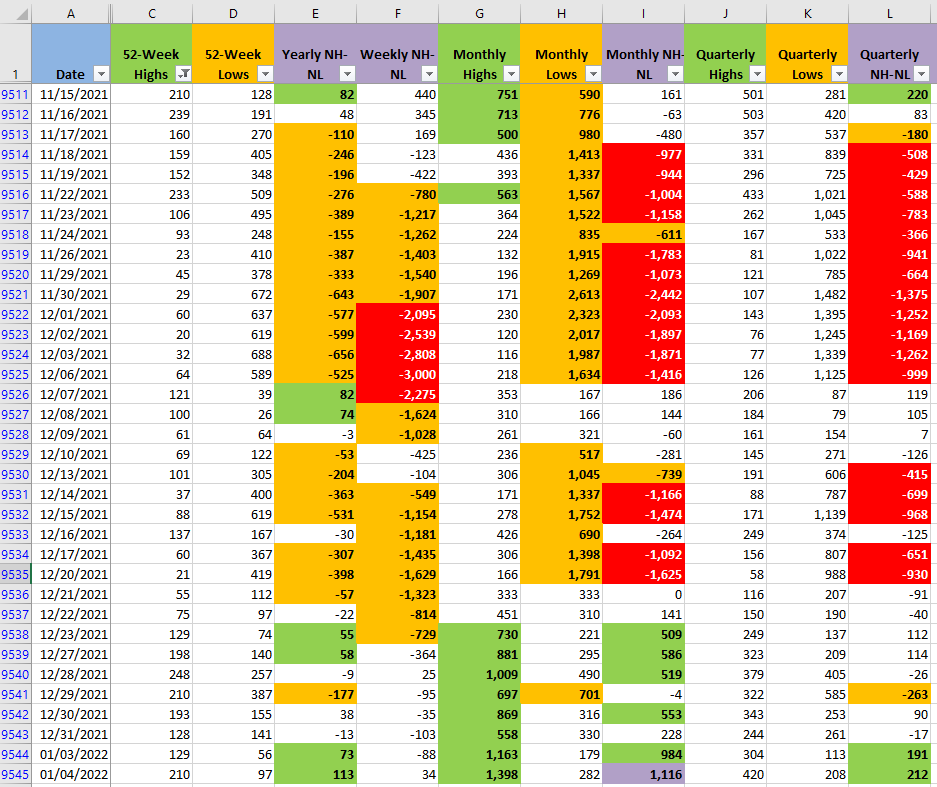

There is still force in the New Highs and Lows (NL-NL), the timeframe that moves faster is the Monthly one (columns G and H in the screenshot below). When all this kind of contradictions emerge, the three big indexes all going in different directions, the NH-NL showing strength, it's time for my particular way of trading to be on the sidelines again. I'm still bullish, fifteen alerts of potential trades triggered today, I didn't open any new positions, not until I see more evidence that the S&P will be able to cross and stay the above the 4,800 level that keeps rejecting.