The important indexes moved sharply higher, however that's still not the force I'm waiting in order to start opening long positions aggressively. Remember the statistic that I keep repeating? No rally since Nov/05/2021 has lasted more than four days.

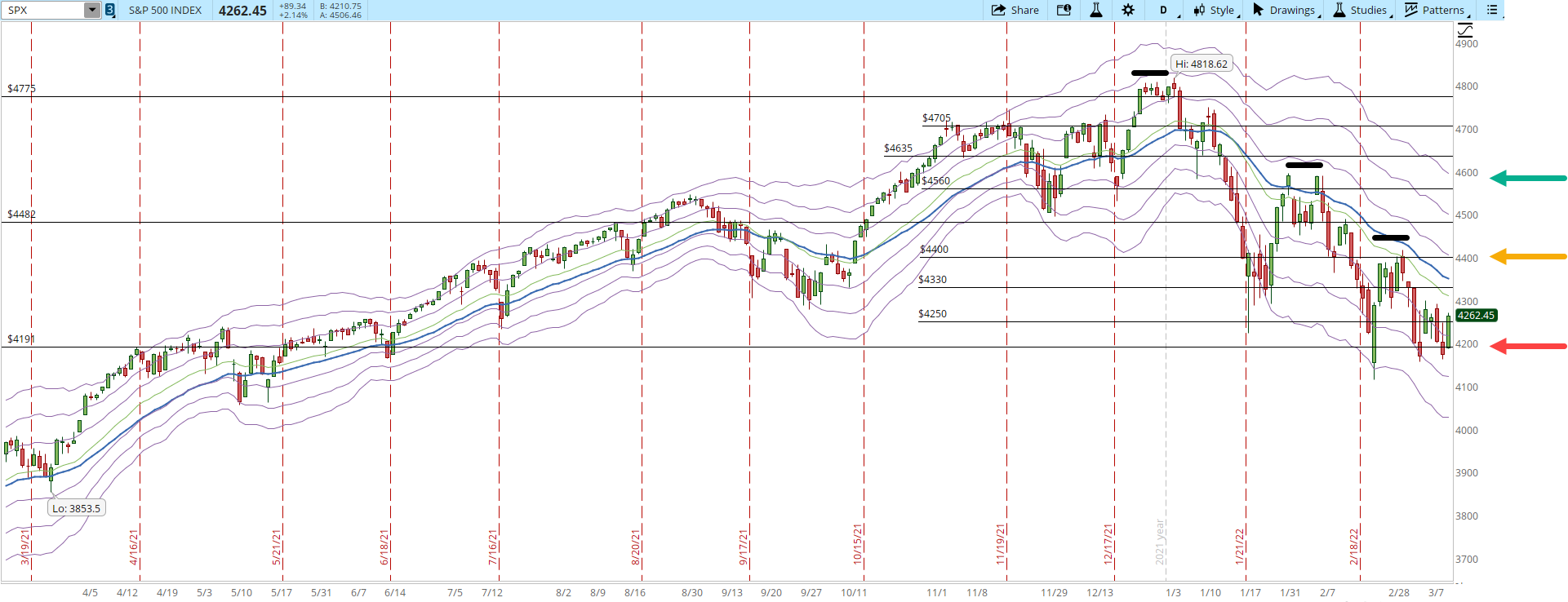

Taking a look at the daily chart the support at 4,191 is still holding (red arrow). In order for the rally to get past 4,400 (orange arrow) it still needs to move past the 4,250 and 4,330 resistance levels. Ideally I would like the S&P on it's way to 4,600 (green arrow) in order to be more aggressive opening long positions. But since the recent rallies haven't lasted long, I'll wait and see if it can get past 4,400 first.

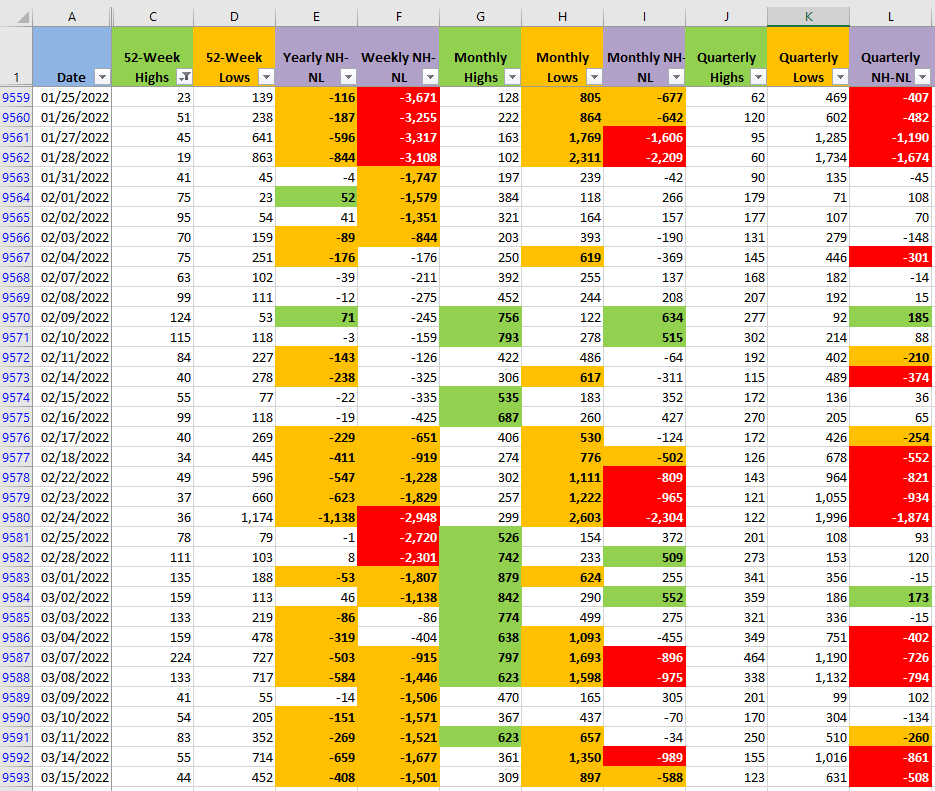

I don't like the numbers I see for the New Highs and New Lows. Certainly, the number of Lows in all the timeframes diminished significantly. What I don't like is that the number of Highs in all the timeframes are also lower.

Today we witnessed some strength from the Bulls, but one day doesn't change the weakness we have seen for months. I'll wait and see how the Market behaves the rest of the week. The Market might be able to rally to 4,400 in a couple of days if the rally continues. To get to 4,600 would take all this week and at least a few days of the next one. The most likely scenario, from my personal point of view, is that the rally will be killed fast as it has happened in the past.