One of the catalysts that has been moving the Markets for months now is the inflation and the actions that the Fed is taking in order to bring it under control. Tomorrow the Consumer Price Index report (CPI) will be published, that report is one of the most frequently used measures of inflation and deflation. The consensus is that there will be a slight decline in the inflation numbers, which could be interpreted as the inflation finally peaking.

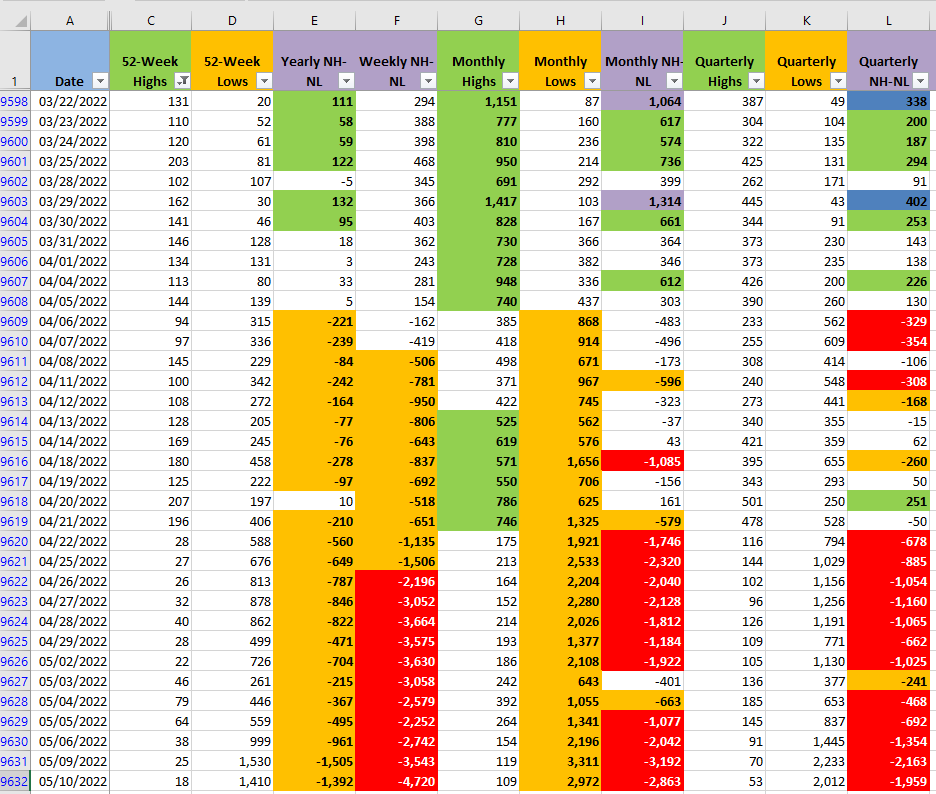

The main USA indexes closed the day mixed. At some points during the trading session, they tried to rally but none of them could close near their highs. Even more important than the particular charts of the indexes are the New Highs and New Lows numbers (NH-NL). The selling pressure continues being too high, there can't be a powerful rally if at least the New Monthly Lows don't come down below 500. There is an entire book at www.spiketrade.com that discusses the indicator, it's an indicator that is worth understanding and tracking if you see value in its signals.

Even if you don't read the book or are interested in the NH-NL indicator, check the Monthly columns in the screenshot below (G, H and I). Column H means that if you take the last month, today 2,972 stocks made a New Low in that period of time. Only 109 were able to make a New High. Those numbers improved from yesterday, if you are trying to make money going long, your strategy better account for those companies that are actually making New Highs, which is a very small number.

The issue is not only the current numbers, the issue is that the high amount of New Lows has been going on for 24 consecutive days, since April/06. With that many days of selling pressure a reaction rally would be expected and instead we see today that the S&P 500 is struggling to keep above 4,000.

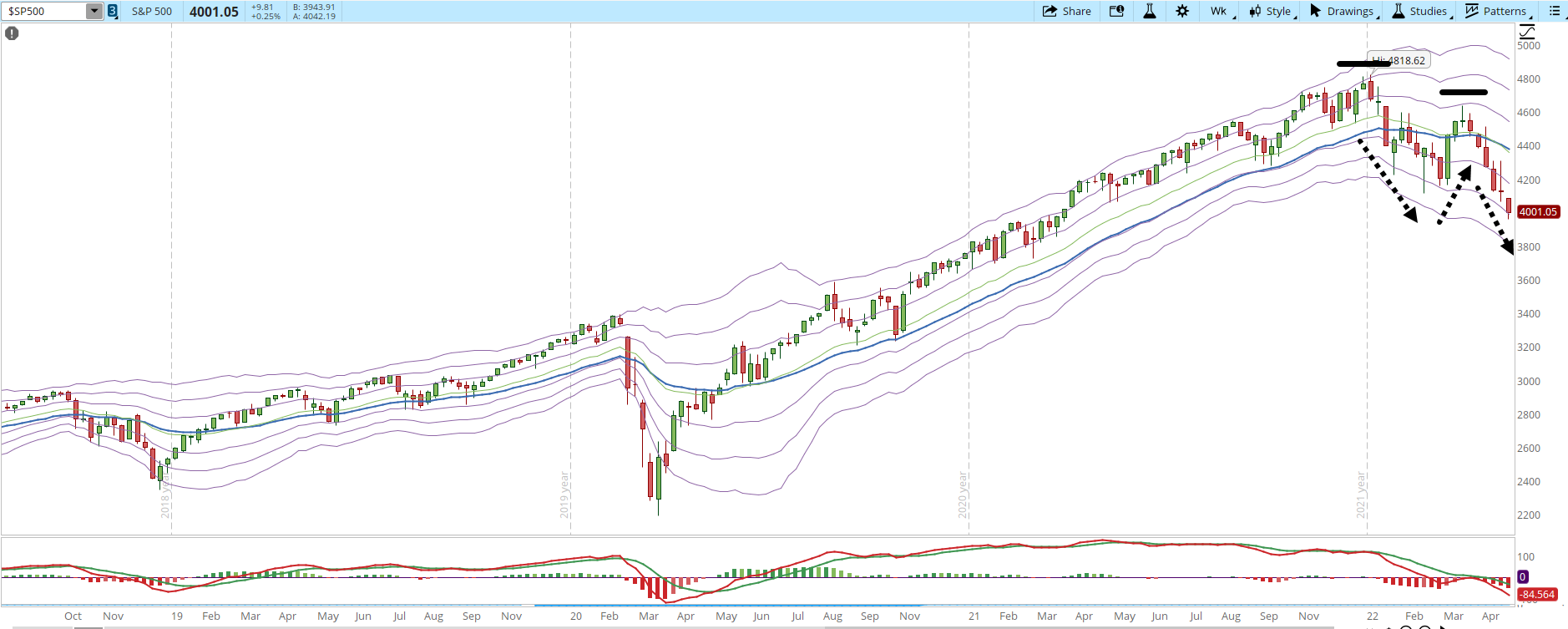

The signals are still very bearish, in the daily chart of the S&P 500 below we can see that the 4,000 support is being tested. We are now in oversold territory, the price level is at the -3 Keltner Channel (KC). In the past, there has been at least a small reaction rally (green dotted arrows), if we don't see that in the remaining trading days of the week, the 3,900 support will likely be tested.

I'm more concerned about the weekly S&P 500 chart, it seems to be tracing a downtrend pattern of lower highs and lower lows. If that's the case, the main question will be, where will it stop? What will be the support that is strong enough that will stop the decline and start to form a bottom.

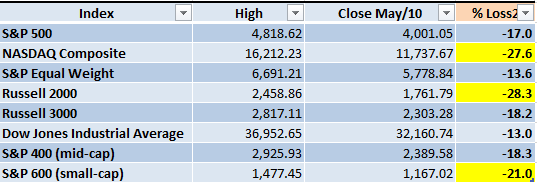

Below you can see the updated status of the losses suffered until now from the main indexes. The ones in yellow are the ones in confirmed Bear Market territory (a loss of 20% or more compared to the previous top).

I keep mentioning since months ago that risk management is essential. We are not living those times where the indexes just went up and even if you relaxed your risk controls nothing tragic was likely to happen. We are living difficult times with a lot of negative catalysts and selling pressure. I think the Correction is likely to continue and send the rest of the indexes to confirmed Bear Market territory. Whatever happens I'm happily observing the Market action from the sidelines.