Usually I begin my posts from Monday to Thursday with a 39-min chart describing my point of view about the Market action of the day. Today I think it's more illustrative to show the daily chart. It becomes very evident the weakness when the S&P tries to get past 4,700. There was an attempt today but it failed as it has failed since the beginning of November. The only time it was able to close and stay for a few days above 4,700 was towards the end of December starting on Dec/23.

From now on, everything that happens will be a clue about if that resistance will be eventually broken or not. As I have mentioned in several of my previous posts, I'm still bullish but I'm not blind to the great possibility that the weekly uptrend might be getting close to its end. There are a few rallies, very short rallies, from time to time, but the Bears are running the show, every attempt to rally has been stopped in four days or less.

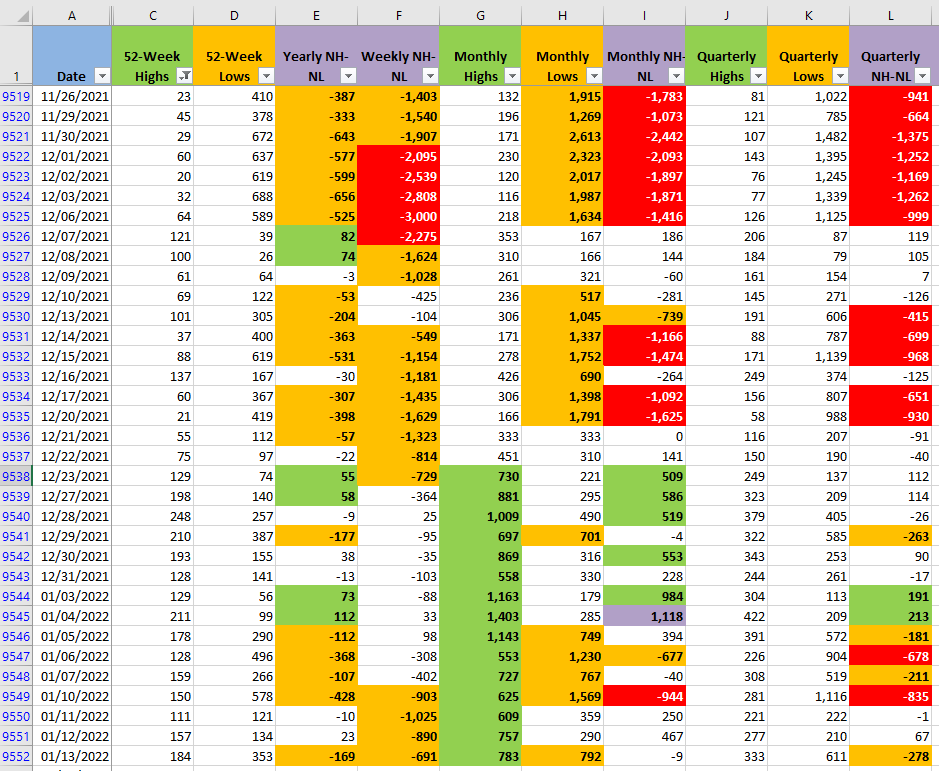

The New Highs vs New Lows (NH-NL) in all the timeframes now are something between neutral and bearish. If there is a possibility that the weekly uptrend resumes, then the S&P needs to be able to break past 4,700 and that must be reflected in the NH-NL numbers, first in the Monthly numbers which is the fastest timeframe and then propagated to the Quarterly and Yearly timeframes.

Right now I check, and if necessary I update, all the stops of every position I have open. With all the weakness shown in the Market things could get ugly pretty fast. Risk Management will be essential if eventually my account takes a hit.

A couple of members of the Fed (Lael Brainard, Patrick Harker) gave their support to fight inflation and the Nasdaq got crushed. Powell had already mentioned this a couple of days ago and when the Fed minutes got published around a week ago and still the Market stumbles. It would seem that the Market is so weak that it keeps discounting the same old news about the inflation and the virus. Whatever the catalyst for Friday is, Risk Management is essential to preserve capital.