The statistic that I constantly repeat in my posts is that since Nov/05/2021, no rally has lasted more than four days. In the current rally, the S&P 500 has already moved up four days in a row. Can it rally one more day?

Market Overview

Even if the S&P 500 rallies a fifth day, it's not a guarantee that a powerful uptrend will start. It would be a signal that the Bears are losing strength and Bulls are getting stronger. Reviewing the charts there is a chance that the Correction is at least starting to trace a bottom.

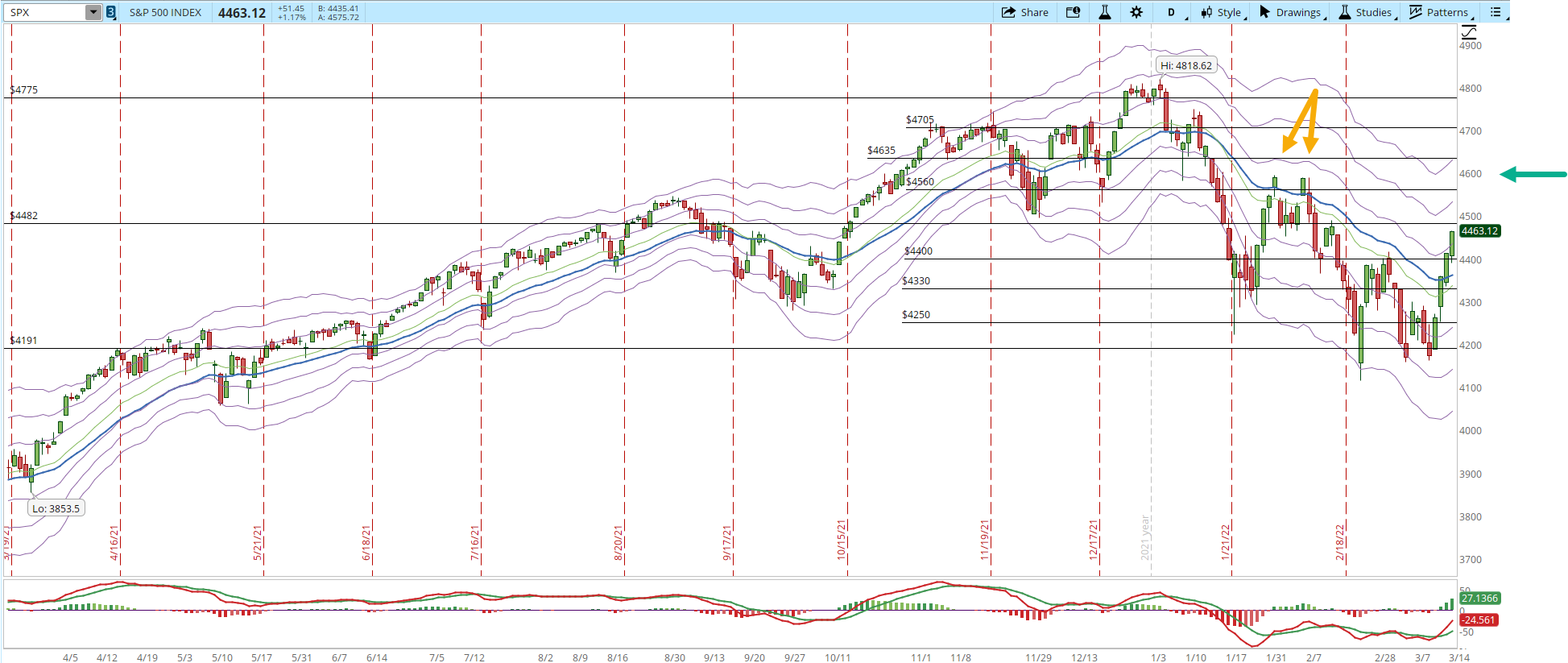

Starting with the daily chart the 30-day EMA (blue line) already stopped declining. The price level of the S&P is already above the 30-day EMA, a level which has been rejected multiple times after the top in Jan/04. Every time the S&P went above the 30-day EMA after that date, it almost immediately went down, it was acting as a resistance.

The S&P closed the week above the +1 Keltner Channel (KC). Since Jan/04 the S&P was unable even to reach the +1 KC. On Monday we will be able to see if the S&P can hold above 4,400 and maybe even rally. Reviewing the last four bars of the chart the movement has been powerful, all the four bars closed at their highs, a movement of almost 300 points.

I still consider that in order for this rally to be significant it needs to close above the 4,600 level (green arrow). That's where the S&P has collapsed in the past (orange arrows). Obviously the S&P will face even more resistance as it gets close to 4,700 , there is a lot of congestion and failed attempts at that level. However, if the S&P cannot make it to 4,600 there is no point in worrying now about something that might not even happen.

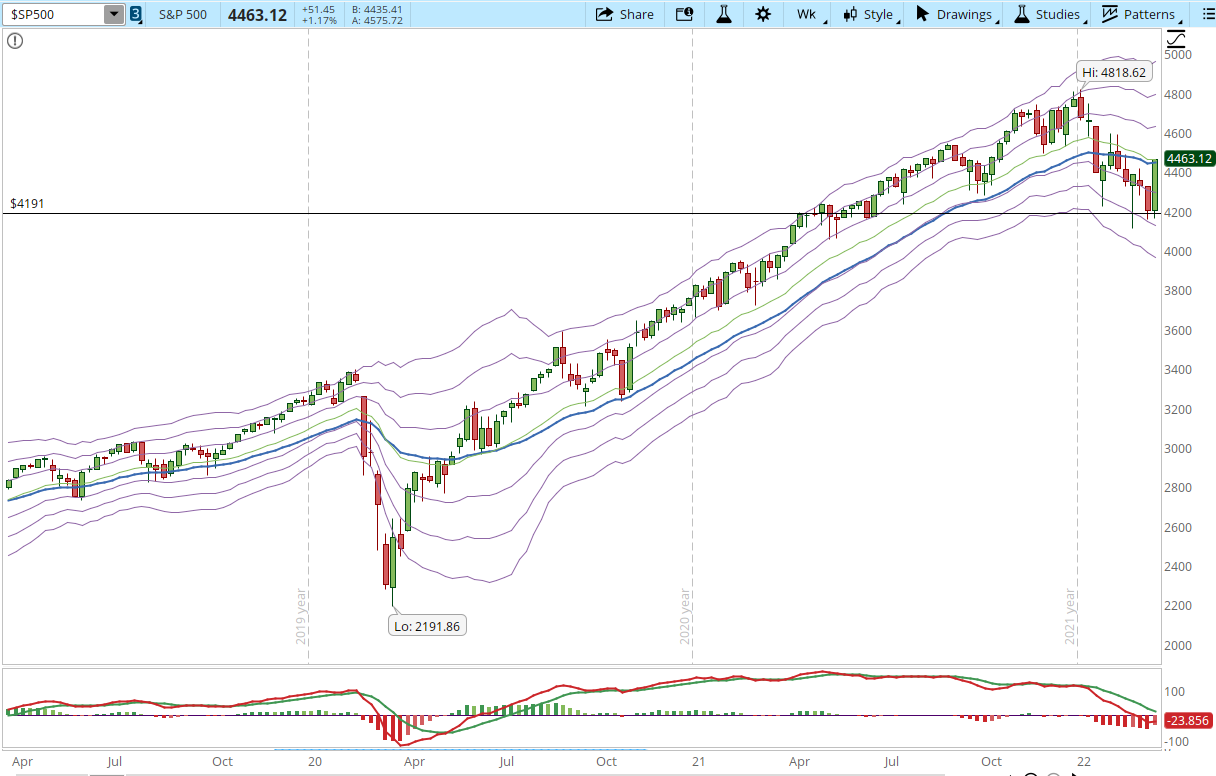

The weekly chart is interesting in order to keep perspective of where the S&P is right now. The challenging part is that in the weekly chart the 30-week EMA (blue line) is acting like a resistance, something similar as in the daily chart. The last bar on the weekly chart is attempting to close above that line but until the end of next week we won't be able to know if the attempt will be successful or not. The 30-week EMA also flattened and the 4,191 is surprisingly holding.

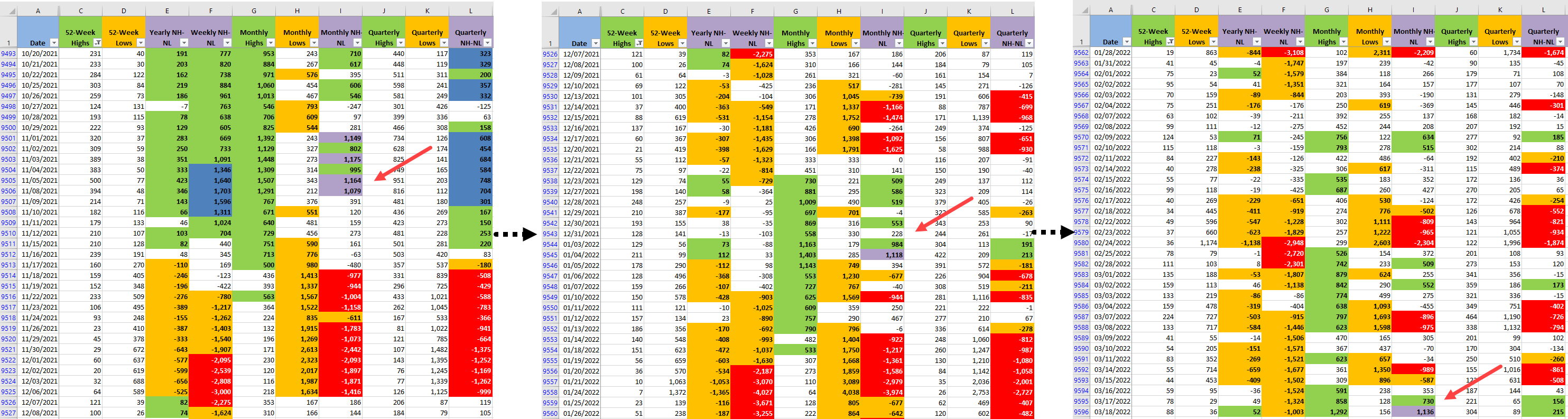

I have some mixed feelings about the New Highs and New Lows numbers (NH-NL), especially on the Monthly timeframe, which is the one that moves faster from all the ones displayed. The past two times that the NH-NL got that bullish on the Monthly timeframe (red arrows) it just lasted a few days before the S&P went down to the -3 KC on the daily chart. If the selling pressure is finally exhausted and/or the Bulls are now strong enough to absorb the supply that enters the Market then finally we will have a significant rally.

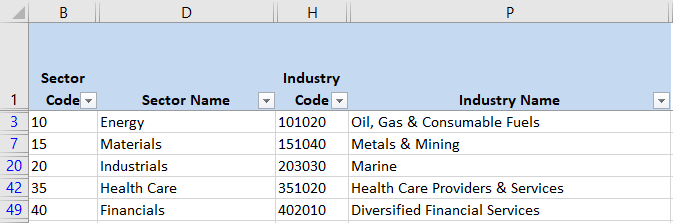

Industries

The Industries that I see strong, based on the 68 that compose the Global Classification Standard (GICS), are the same from last week. The difference this time is that I already opened four long positions in order to start testing the Market with real money. Three long positions in the Industrials Sector (Construction and Engineering / Machinery / Marine), one of them in the Health Care Sector (Health Care Equipment & Supplies).

Scenarios

Scenario #1: From my personal point of view the most likely scenario is that the rally will stall next week. I don't want to be the party pooper but before I move aggressively to open long positions I would like to see a strong rally that breaks the 4,600 level decisively. Since many traders will be monitoring more or less the same resistance levels, some of them will also question how high the S&P can go. The Ukraine war, the virus, the hawkish Fed and the inflation haven't changed drastically during the last week. I'm wondering what will keep the Market rallying for a few more days. If the rally stalls, my guess is that the S&P would be oscillating between 4,191 - 4,482.

Scenario #2: The second most likely scenario from my perspective is that the selling pressure returns and kills the rally during the first few days of the week. If this happens I'll start closing the long positions I have opened to test the Market. It would signal that the Market is not ready to turn into an uptrend and the Correction could still resume its way down. Other than the price and volume, the Monthly NH-NL numbers are going to be a key indicator that could give a heads up on the potential danger ahead.

Scenario #3: The least likely scenario is where the rally continues, the Bulls are able to, not just hold above 4,400 , but also to continue on their way to 4,600. If this happens, with such strength I would open new long positions or add to the existing ones if they have the right setup. In this scenario, even the negative news about the war, the virus or the inflation don't affect the advance of the important indexes in a significant way. Anything can happen in the Markets and at some point another powerful uptrend will erupt, however at this point I don't get to see what would be the catalyst for that powerful movement next week. I have a list of candidates that I would be able to trade in this scenario, hopefully the party continues and the rally can keep breaking resistances.

Summary

The S&P 500 made a big movement for a single week, almost 300 points. From being below the -1 KC on the daily chart to being above the +1 KC. There is force in this rally, whatever is fueling it hopefully it has enough force to keep going during the next trading week. I'm still not convinced that finally the Bulls are ready to make an important movement, that for me, means breaking and holding above the 4,600 level.

I have hard stops in the four long positions I have opened to test the Market. If I don't see that the force of the rally continues next week I'll likely close them even if the stops haven't triggered.

There is a great explanation about Mr. Market that Warren Buffet gave on 1987 to the Berkshire Hathaway shareholders and I think applies perfectly to the current situation where there is not a clear direction in the Markets. Don't fall mindlessly under Mr. Market's influence.

Ben Graham, my friend and teacher, long ago described the mental attitude toward market fluctuations that I believe to be most conducive to investment success. He said that you should imagine market quotations as coming from a remarkably accommodating fellow named Mr. Market who is your partner in a private business. Without fail, Mr. Market appears daily and names a price at which he will either buy your interest or sell you his.

Even though the business that the two of you own may have economic characteristics that are stable, Mr. Market’s quotations will be anything but. For, sad to say, the poor fellow has incurable emotional problems. At times he feels euphoric and can see only the favorable factors affecting the business. When in that mood, he names a very high buy-sell price because he fears that you will snap up his interest and rob him of imminent gains. At other times he is depressed and can see nothing but trouble ahead for both the business and the world. On these occasions, he will name a very low price, since he is terrified that you will unload your interest on him.

Mr. Market has another endearing characteristic: He doesn’t mind being ignored. If his quotation is uninteresting to you today, he will be back with a new one tomorrow. Transactions are strictly at your option. Under these conditions, the more manic-depressive his behavior, the better for you.

But, like Cinderella at the ball, you must heed one warning or everything will turn into pumpkins and mice: Mr. Market is there to serve you, not to guide you. It is his pocketbook, not his wisdom, that you will find useful. If he shows up some day in a particularly foolish mood, you are free to either ignore him or to take advantage of him, but it will be disastrous if you fall under his influence. Indeed, if you aren’t certain that you understand and can value your business far better than Mr. Market, you don’t belong in the game. As they say in poker, “If you’ve been in the game 30 minutes and you don’t know who the patsy is, you’re the patsy.

Warren Buffett