When the rally began, back in March/15, I started opening long positions. The idea was to test the Market, today I was stopped out of Ryman Hospitality (RHP) which is a REIT company. I still hate the feeling of being wrong, the damage was limited but the learning was the most important part of the process. Out of the four positions I initially had, I still keep one open, an S&P 400 company in the Construction and Engineering Industry. Despite the failure of three long positions, today's Market action turned things into something pretty interesting, a potential First Higher Low.

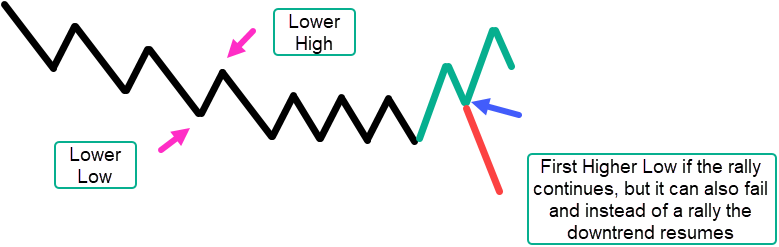

What is a First Higher Low? The concept is very simple actually, when a stock has been declining for a certain period of time, let's say a month, eventually it reaches a bottom. The stock can recover in a V-shaped way or it can move sideways first and eventually rally. In the screenshot below, a stock is in a downtrend tracing several lower lows and lower highs (one of them marked by a pink arrow). When the behavior of the stock changes and it finally rallies, inevitably sooner or later there is a pullback, if the stock starts to reject the lower prices and instead the rally continues, that will mark the First Higher Low.

Does it mean that a First Higher Low marks a change on the trend? Definitely NO, sometimes it will, sometimes it won't. There aren't guarantees in the Markets. However, there is a chance to profit from that rally (blue arrow), or test if it can become a multi-day/multi-month uptrend. Remember that this pattern as any other pattern can fail, risk management is key to survive the failure of the pattern (red line).

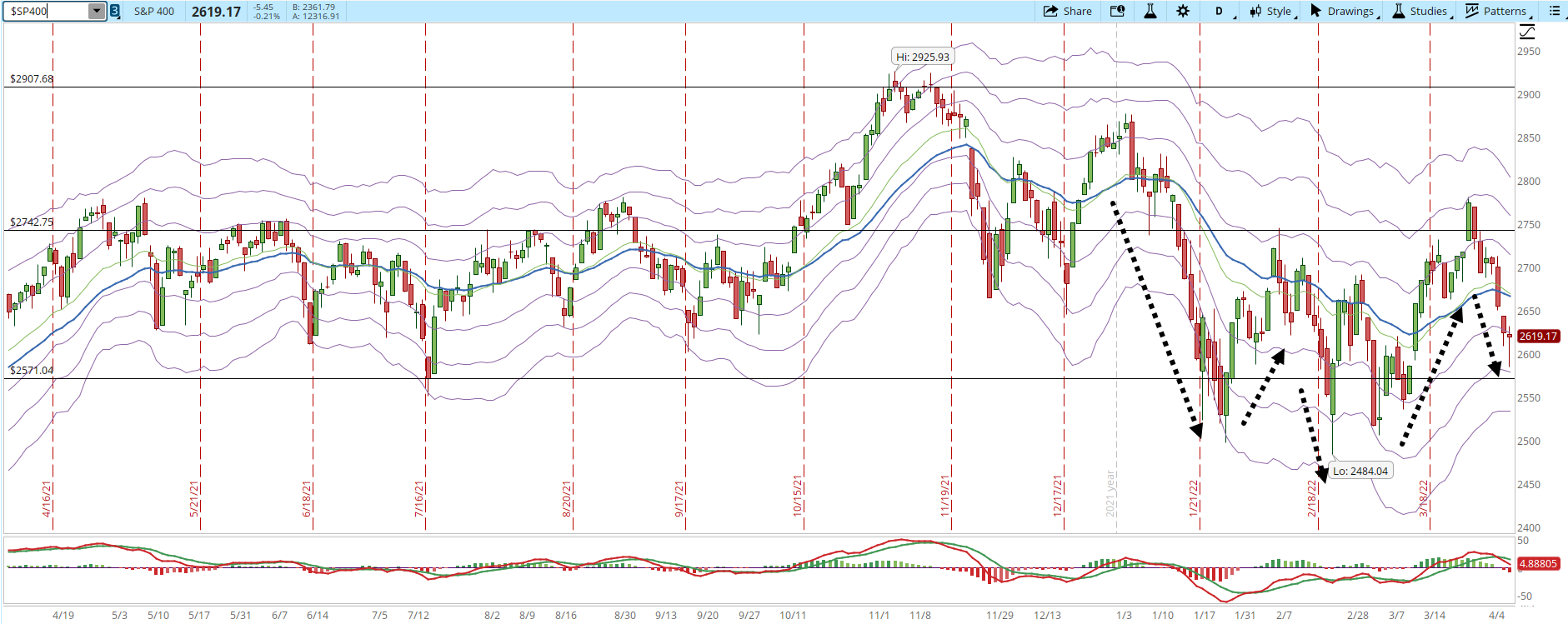

That First Higher Low pattern is potentially forming in the S&P 500 and S&P 400 (mid-cap) daily charts. The S&P 600 (small-cap) continues being the weakest index in terms of capitalization and I wouldn't risk to trade small-cap stocks just yet. If you check in the screenshot below the downtrend is clear using the dotted arrows. Then the March/15 rally comes and now that the index is pulling back, there could be a potential First Higher Low.

Moving to the S&P 400 daily chart, in the next few days we should see if there is a chance that the rally begins. Ideally, if the S&P 400 rallies tomorrow, holding above 2,620 would be a beautiful pattern. However, we have to deal with whatever the Market gives us, not with an ideal textbook situation that might not develop.

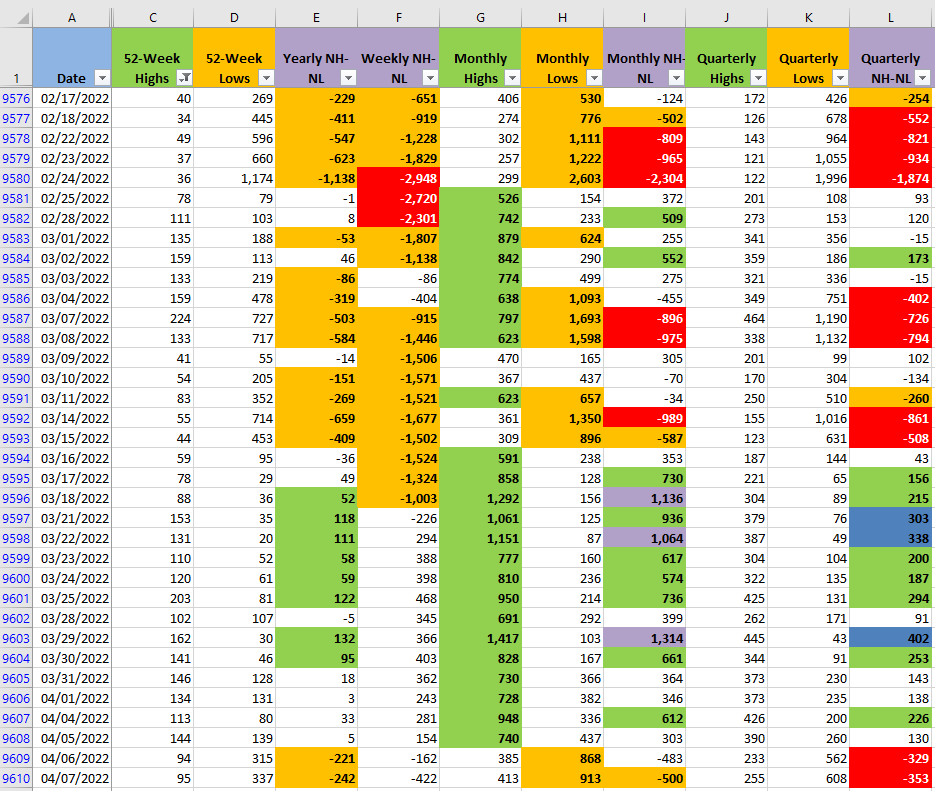

The red flag comes from the New Highs and New Lows numbers in all the timeframes. I especially pay attention to the Monthly columns (G, H, I) which move faster than any other timeframe displayed. The numbers have been deteriorating and now the Bears seem to be in a much better position than the Bulls. This is like a rocket trying to get out of planet Earth, it has to be stronger than the gravity force in order to get out of the atmosphere. If we suddenly double the force of the gravity, the rocket needs to be even stronger now to get the same result. Our rocket called The Market will have a hard time beating the gravity if those Monthly Lows keep increasing.

Keeping strict management is essential, even if the First Higher Low pattern develops successfully, it can still fail.