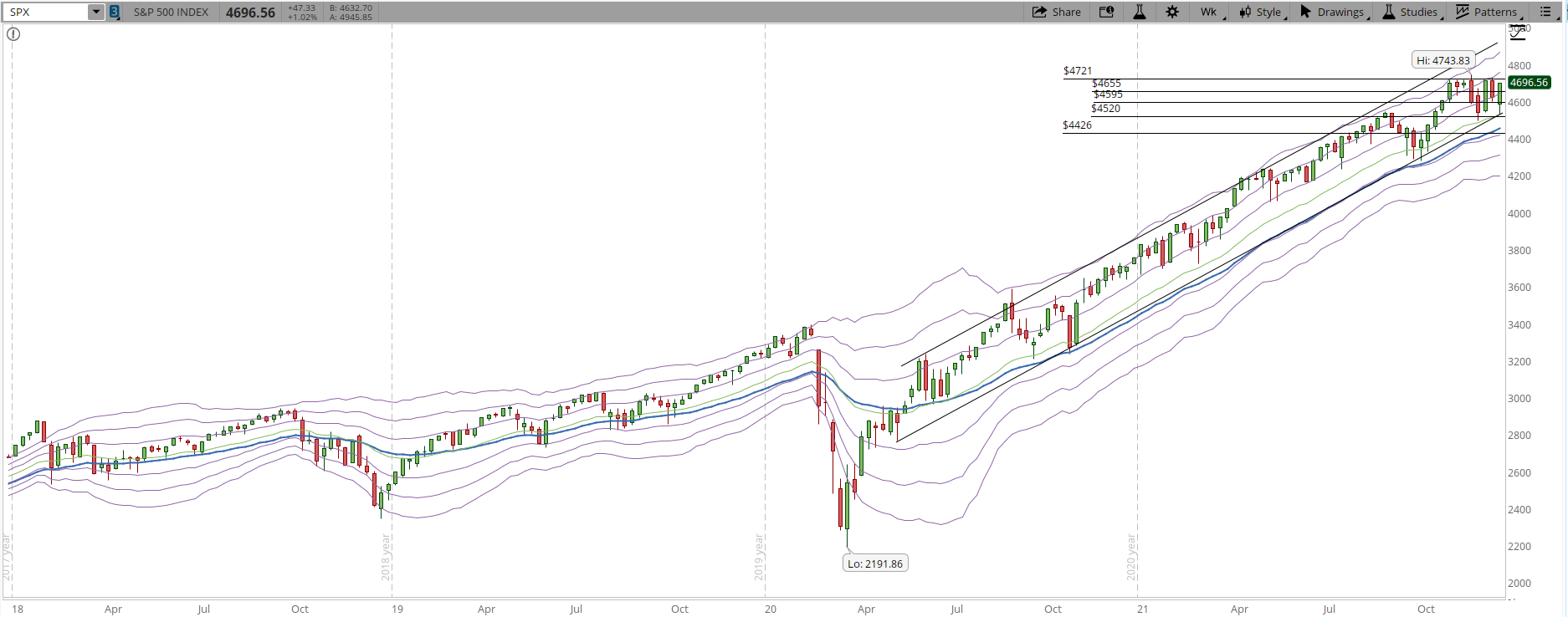

Two days of Bull's leadership and this relief rally still looks fragile. The S&P 500 is back to the resistance line of 4,721 which hasn't been able to break and stay decisively above it, there have been a couple of tests, but it collapses after that (red circles in the screenshot below). The short-term support I added, in order to better understand the price action, is at 4,655. The S&P movements since Nov/10 are shown in the 39-min chart shown below (you can click in the image in order to zoom in).

I think there is potential for a rally that is longer than a couple of days. However, so far that's just speculation, the Bears try to lower the price and eventually in a few days it's back to the trading range where the S&P is right now. The selling pressure is diminishing, unfortunately Bulls are not showing much force yet.

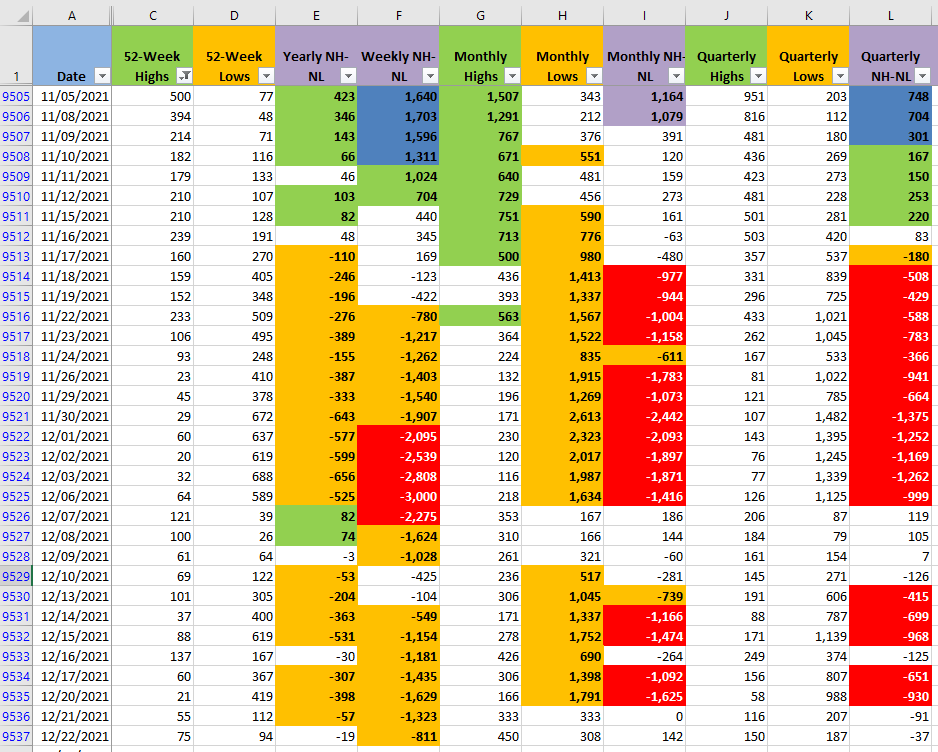

Reviewing the New Monthly Highs vs Lows (NH-NL) it confirms that the selling pressure diminished, but the demand doesn't seem to be increasing significantly (columns G and H of the screenshot below). Currently the force of Bulls and Bears seems to be at balance. Recently this happened on Nov/11 and Dec/07 and it just lasted for a couple of days before the Bears took control over the Market again.

If your strategy allows you to take risks with this kind of volatile Markets then the current situation will allow you to trade. For my particular strategy where I trade the weekly charts, it's getting harder to find good patterns, and when one of the tickers I follow triggers an alert they are usually from a reduced number of Industries.

On the weekly trend, there isn't much change but it's definitely one of the things that I check on daily basis. Eventually the trend will break, it might be tomorrow, in a month, a year or more, but when that happens I'll be ready to start tightening my stops and maybe even closing some positions.

Despite the fragility of the rally I still opened a long position today, Cushman and Wakefield PLC (CWK), I understand the risks:

- I might be entering too early, and that means the trade could fail (that translates into losing money) and if the setup is still valid, I might have to enter more than once, after being stopped out, in order to profit from the opportunity.

- The Market might still stay for a while in a trading range or going down as it has for several weeks now.

- This one is my fourth stock in the Real Estate Sector, I have been really bullish with these stocks since July/2021.

However CWK fits my plan, if the trade fails, so be it, my success percentage using Stan Weinstein's methodology is 70%. Second-guessing my plan will risk this trade and the rest of the positions I still have open and my success rate will sink. Eventually the bullish dominance will end and I'll have to take the hit, since there is no way to perfectly time when that will happen I'll keep trading with a very strict risk management schema in place to minimize the damage.

I tried to open another position today in the Chemicals Industry, CF Industries (CF), unfortunately the price of the stock never went down to the price I was willing to pay, so the order expired. I might still get an entry and if the Market is behaving accordingly to what I expect, if that happens I'll still open the position.

My portfolio is not that diversified right now, but the opportunities that I find and the stops that get executed are what drive my trading not my opinion about certain stock or Industry. Below is a screenshot of the current positions that I still keep open. I wouldn't recommend any of those tickers, the ones that already will generate a profit (all except ACC and CWK which both were opened recently) they are long gone to trade them long term. ACC and CWK still could be losers, I just opened them so I have no idea if they will work or not.