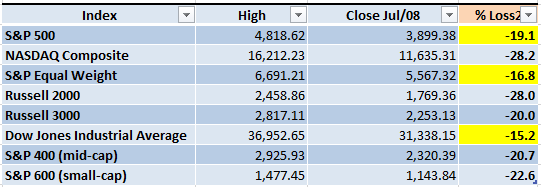

The Bear Market isn't over yet, below is an updated chart with the most important indexes, the ones in yellow are the ones that aren't officially in Bear Market territory (20% loss or more from the previous high). The abbreviated trading week didn't gave that many clues about the Market direction, however the next trading week might be able to shed some light about the future Market behavior.

Market Overview

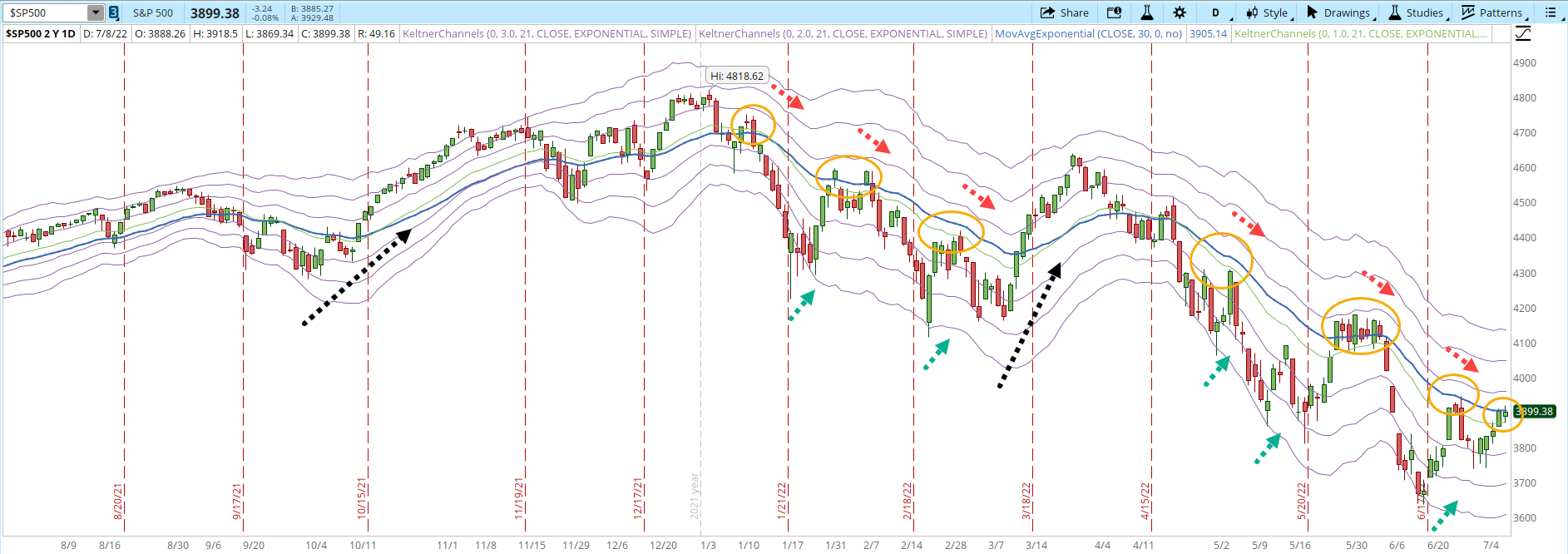

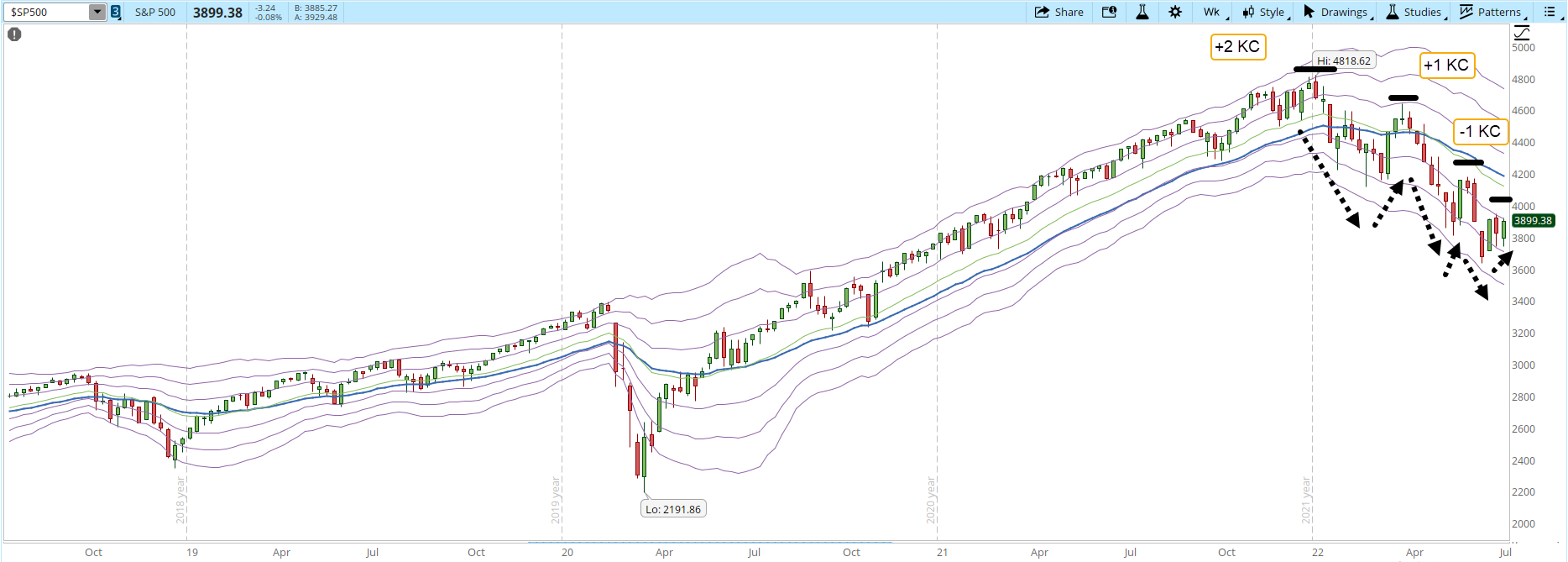

It's interesting to see the consistency in which the daily chart of the S&P 500 has behaved during 2022. In past articles, I have described a few behaviors that have reliably repeated during the current year.

Behavior #1: Only two rallies, since Oct/2021, have lasted more than 4 days (black dotted arrows), the rest were killed by the Bears pretty quickly.

Behavior #2: Each time that the daily chart of the S&P 500 got to oversold levels (-3 Keltner Channel or below, signaled by the green dotted arrows), there was at least a modest rally that took the index out of the oversold zone.

Behavior #3: Almost every single time when the S&P 500 reached the 30-day EMA (blue line), there was a pullback (orange circled areas). This behavior is important to consider as we are about to start the next trading week right at the 30-day EMA line. Will the behavior continue?

I have also clarified in my past articles, that anything can happen in the Markets, these behaviors won't keep repeating forever. Every time they repeat, they reinforce the idea that the Market is still weak. Eventually the Bulls will be able to break the pattern and that will be a signal that things could start to change.

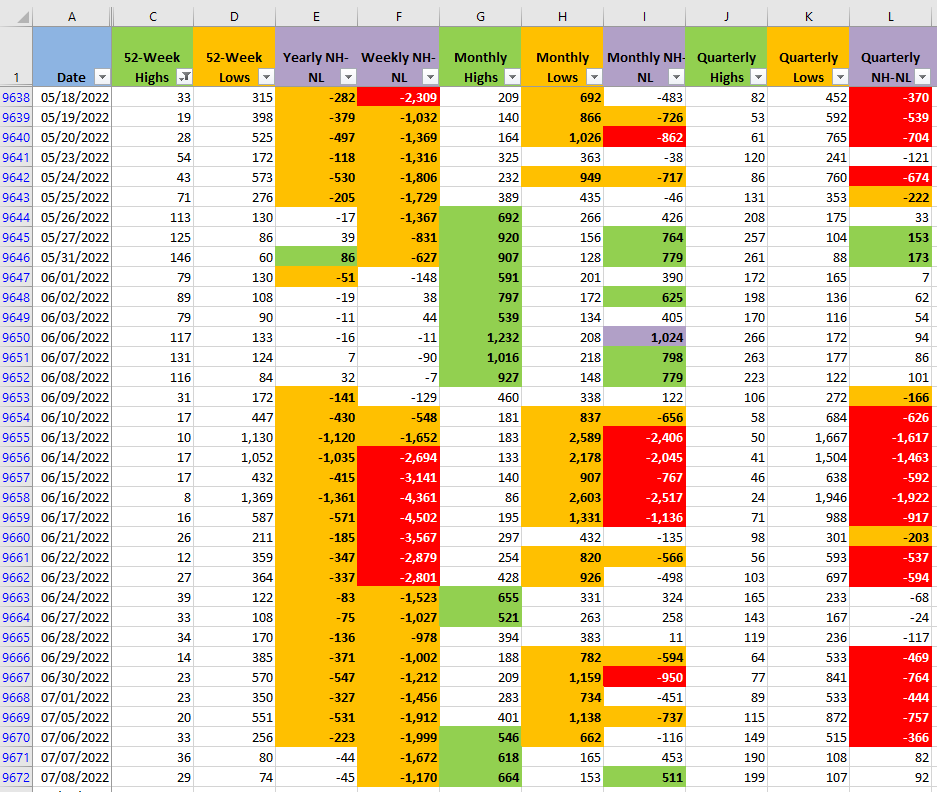

It's also important to keep monitoring the different timeframes of the New Highs and New Lows indicator (NH-NL). The Monthly timeframe is the one that changes faster from the all the ones that I track (columns G, H and I). The selling pressure has diminished compared to the numbers that we saw during the decline that took place between April and June. However, the Bulls haven't been able to increase significantly the amount of New Highs. The diminished amount of supply might allow the rally to continue, or at the very least to stop the decline and start tracing a bottom.

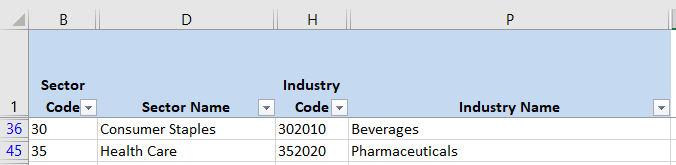

Industries

From the 68 Industries that compose the Global Classification Standard (GICS) this weekend, I could only find a couple of Industries that I would still consider strong. Beverages, which belongs to a defensive Sector and Pharmaceuticals where I still keep a long trade open. Two strong Industries is still a very low number, but eventually some Industries will start to rally despite the Bear Market. It's still too early to tell which will be the leaders of the next Bull Market.

Scenarios

Scenario #1: I still think that the rally could continue, at least to the target I set last week of 4,000. The news about the negative catalysts will continue, some of them like the recession news, will still be around for at least a few more months. If the Bulls start to display some force, despite the negative news, that will be a signal of strength.

Even if the S&P 500 manages to get to a level around 4,000 that would still only be considered a reaction rally, not a change in direction in the Market trend. I have mentioned in multiple occasions my concern about the clear downtrend in the weekly chart, lower highs and lower lows (highlighted by horizontal solid black lines). In order to start breaking the downtrend the rally would need to close decisively above 4,200 at least. I like to track those values as references of how strong or weak the Market really is, according to my trading method based on Mark Minervini's books.

Scenario #2: The second most likely scenario, from my point of view, is that the Bear Market resumes its decline. I'm still optimistic about the continuation of the rally, at least to a level around 4,000, however we are in a Bear Market. The negative news keep coming with just a few good news in between. I keep certain references in order to keep perspective of where we are and where we are likely going. In Jan/2022 there was a historical high of 4,818 and no matter anyone's opinion, right now we are almost a thousand points below that level. There's no discussion that the Bears are in charge at this point.

Scenario #3: The least likely scenario that I foresee is that the rally stalls, if the selling pressure doesn't increase there's a chance that the Market can start tracing a bottom. I don't see this very likely, for better or worse the Market has had strong reaction to the news. At least during 2022, there have been few periods of sideway movement. We aren't that far from starting another earnings season, a lot of people will be looking for clues about the recession during that time and that could start a period of elevated volatility.

Summary

Back in March and April I did a few trades to start testing the Market strength. Most of them failed, some other just broke even. The last week of June/2022 I started opening again several trades, I was already stopped out from three of them, I keep open nine. Six of them with paper profits, three of them with slight losses. The trades in Biotechnology and Pharmaceuticals are the ones that have been working the best.

My learning from those new trades? There's at least a slight chance that the Bulls can start a significant rally that could challenge the dominance of the Bears. Unfortunately I don't have a crystal ball to see what's going to happen, however, if a powerful rally starts I'll be ready to increase the size of my current positions or I have a few other interesting candidates where I can try to make a profit.

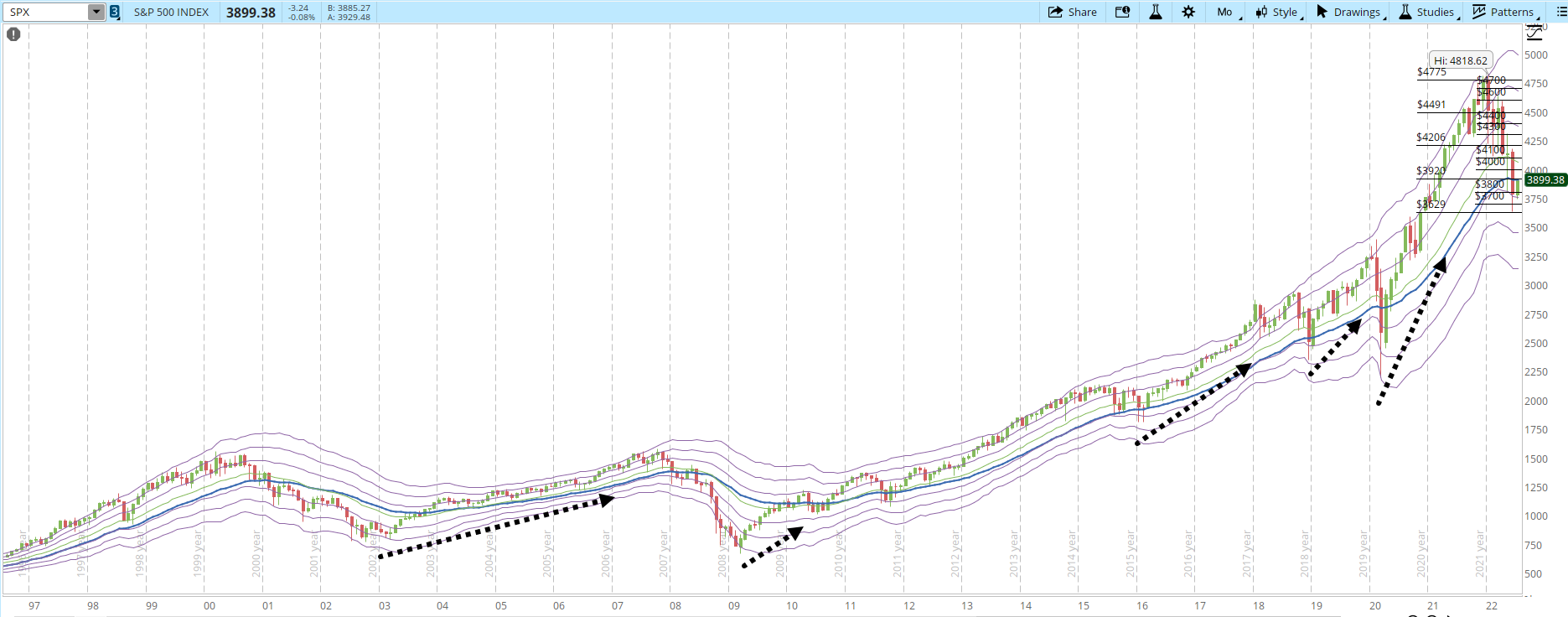

Last week I showed a monthly chart of the S&P 500 since the Market crash of 1998. After the Market finally bottomed, there was a powerful multi-month rally (black dotted arrows). The bottom is easy to see in hindsight, not that easy to tell before it actually happens. Strict risk management will prevent a fatal damage to your account, no matter what, follow your rules, if the Bear Market resumes (which I have mentioned, I don't think is over yet), limiting the damage to small losses will keep you playing this game.

There is a fine balance between being late to the party when a new Bull Market finally emerges and the Bear traps that we will face before that Bull Market finally starts. Small pilot trades with tight stops are a way of facing the uncertainty without blowing up a trading account.