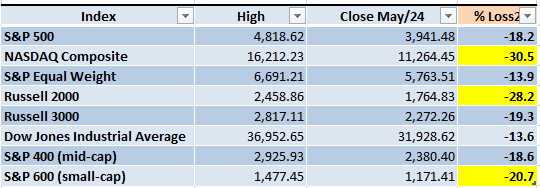

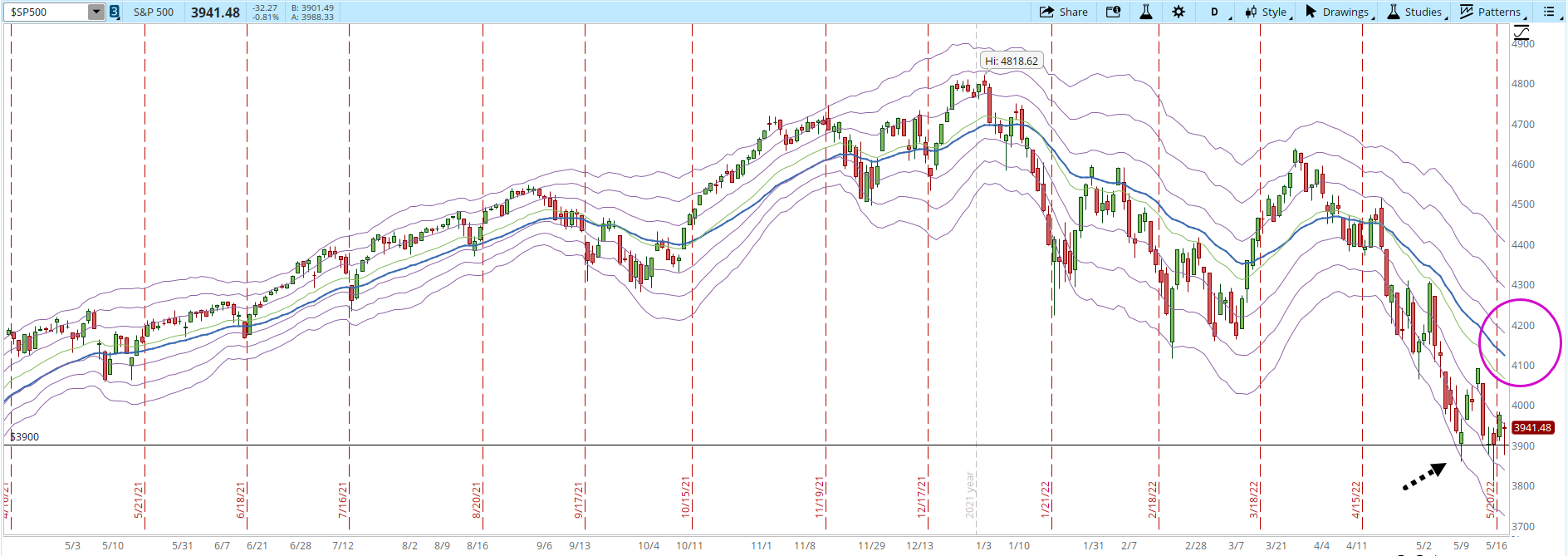

Yesterday there was some hope that the Market could at least have a reaction rally and from my estimates, a target between 4,100 and 4,200 seemed reasonable. The Bears don't seem to care about that, the upward movement was crushed today and only the Dow Jones Industrial Average ended with marginal gains of 0.15%. Below are the updated losses compared to the previous high, the indexes highlighted in yellow are already in confirmed Bear Market territory.

The rally can't be discarded, in fact, eventually it will have to happen, in the screenshot below I have highlighted in the pink circle the area that the rally could achieve if it happens this week. The S&P 500 daily chart (screenshot below) could be tracing a bottom around the weekly 3,900 support. It's important to understand that the selling pressure is still strong. Yesterday I commented that since Oct/2021 only two rallies have been able to last more than four bars in the daily S&P 500 chart.

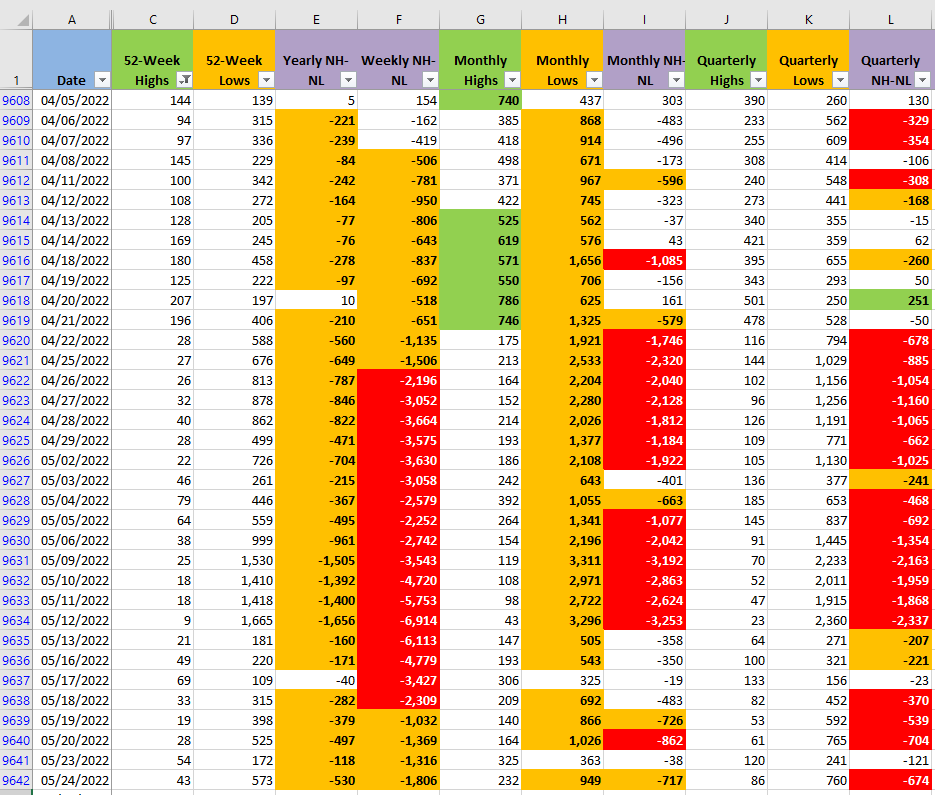

In terms of the New Highs and New Lows numbers (NH-NL), the indicator started deteriorating again. The Bulls aren't being able, since March/2022, to move the balance of the NH-NL in favor of the Bulls with a price confirmation backing up the NH-NL numbers.

On the positive side, the S&P 500 keeps rejecting prices below 3,900. The weekly support is still holding but that doesn't guarantee that it won't break. If the New Monthly Lows (fastest timeframe of all displayed) don't go below 500 soon and the S&P 500 isn't able to at least rally to the target area of 4,100 - 4,200, eventually lower prices are likely to follow.