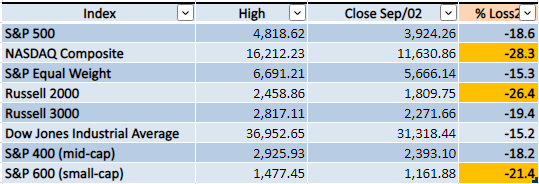

I'm glad my Market analysis skills are improving, I correctly predicted the decline (though the timing was off), which allowed me to stop opening positions and close the existing pilot trades with limited losses. We are close to be back to Bear Market territory in all the important indexes (a decline of 20% or more from the previous high). In this article I want to go through the different signals and indicators in order to understand the probabilities that the decline will continue.

Market Overview

The key point to understand is that the S&P 500 went back to oversold levels (it closed at the -3 Keltner Channel or below). Since Aug/2021 the index has rallied at oversold levels, which is natural and expected. We will have an abbreviated trading week in observance of Labor Day, a realistic target if the index does rally would be 4,150 where it will most likely stall or decline because of the high trading volume in that area.

I'm unlikely to open new positions unless I see a very strong reaction from the Bulls. I'm not liking the weakness that I see in the weekly S&P 500 chart. Certainly, the downtrend structure (lower highs and lower lows, highlighted by the horizontal solid black lines) was damaged by the powerful rally that lasted from mid-July to mid-August. However, the Bears are fighting back, and if they manage to take the index below 3,600 then we are back to a scenario where fear will be dominating the Markets and the decline is likely to continue.

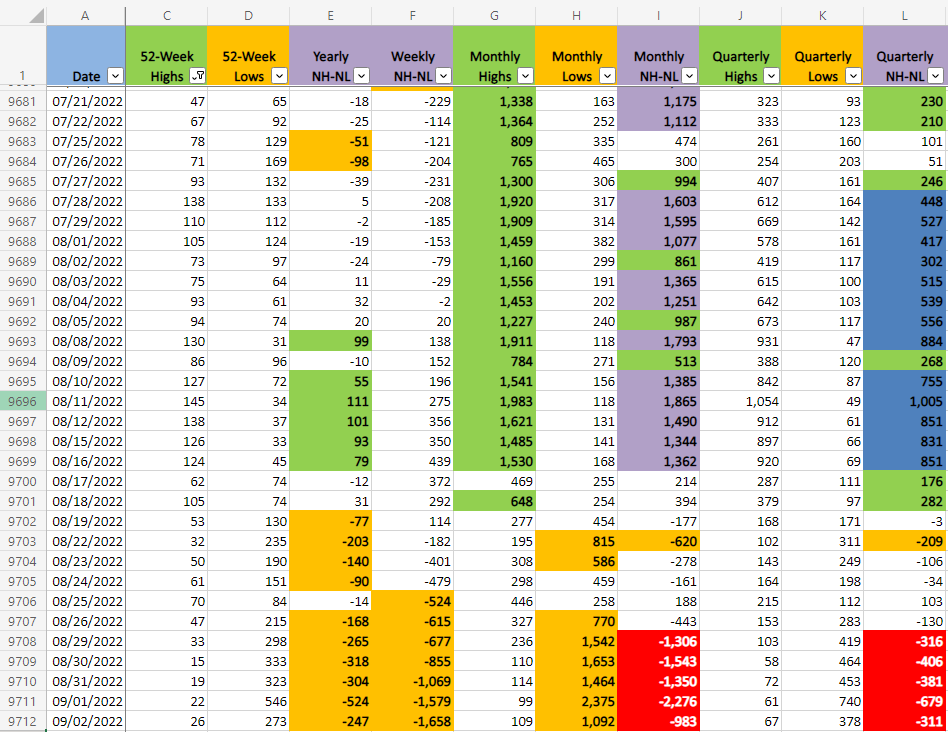

The New Highs and New Lows indicator (NH-NL) is confirming the power of the Bears without many hopes of a decrease in the selling pressure yet. When the Bulls finally decide to attempt a rally the first columns that will change are the Monthly ones (G, H and I).

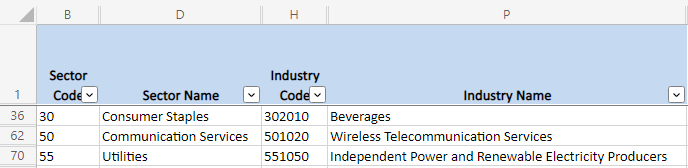

Industries

The sharp decline that we experienced during the past two weeks keep the same strong Industries without change. From the 68 Industries that compose the Global Classification Standard (GICS), there are only three that could be considered strong. Two of them are in defensive Sectors which signals a risk adverse scenario ('Consumer Staples' and Utilities Sectors).

Even with the resilience that these three Industries are displaying, I still think it's too early for me, to start opening new pilot trades and definitely I won't risk taking an aggressive strategy when the Bulls are displaying so much weakness.

Scenarios

Scenario #1: Bears could still try to take the S&P 500 to a lower level at the beginning of the week. Despite the abbreviated trading week, I think that at some point a rally could emerge with a realistic target of 4,150. I see this scenario as the most likely. This doesn't mean a change in the Market direction, just an expected and natural reaction rally. We would need to see further evidence that the Bulls are taking over the control again, at this point the Bears are in command.

Scenario #2: The second most likely scenario would be that the Bears manage to take the Market lower. The last couple of weeks the index has been closing at its lows in the weekly chart. If the selling pressure doesn't decrease even at oversold levels, then the Bears are much stronger than I think. A scary scenario would be if the Bears can continue the decline and close below 3,600.

Scenario #3: If the Bulls can't start a rally, maybe they can at least manage to stop the decline and start tracing a bottom. I don't see this very likely, we haven't had a shortage of strong negative and positive catalysts. However, in the unlikely scenario where both Bulls and Bears equal their forces, next week we will see the decline stop and the S&P 500 will just start to move sideways.

Summary

The one-month rally that lasted from mid-July to mid-August gave some hope that the Bear Market would be over. The Market had other plans and the Bears are back, the last two weeks the Bulls have been unable to stop a shar decline that is close to take all the important indexes back to Bear Market territory.

September is historically one of the weakest months in terms of Market performance. It would be very risky at this point to try to catch a bottom. Even if someone is lucky enough and indeed we are at a bottom, the Market could move sideways for an extended period of time. Personally, I'll be monitoring the Market waiting for the next powerful rally and see if that rally can actually take the index back to the highs we saw in Jan/2022.

The one-month rally that we saw previous to the current sharp decline gave us a good reference to track. The Bulls were unable to take the S&P 500 above 4,300. It will be of great interest the next time they try to break that resistance.