Tomorrow the 2-day Fed policy meeting will end and that could become the main catalyst for Wednesday's trading session. Today, there were moderate gains in the most important indexes and some slightly positive news on the technical side.

Reviewing the S&P 500 daily chart the index closed only 16 points below the 4,191 weekly support. Since May/2021 when the indexes has tested the 4,191 it has generated at least a reaction rally in the next day or two after testing the weekly support (green arrows).

So the good news is that the weekly support is still holding. The bad news is that it hasn't been able to break past and hold above the 4,191 level. With the index at oversold conditions, I was expecting a rally at least to 4,300. It would be much better a move to 4,400 and in order to show some potential force that could continue for more than a week break past 4,500. None of this has happened yet.

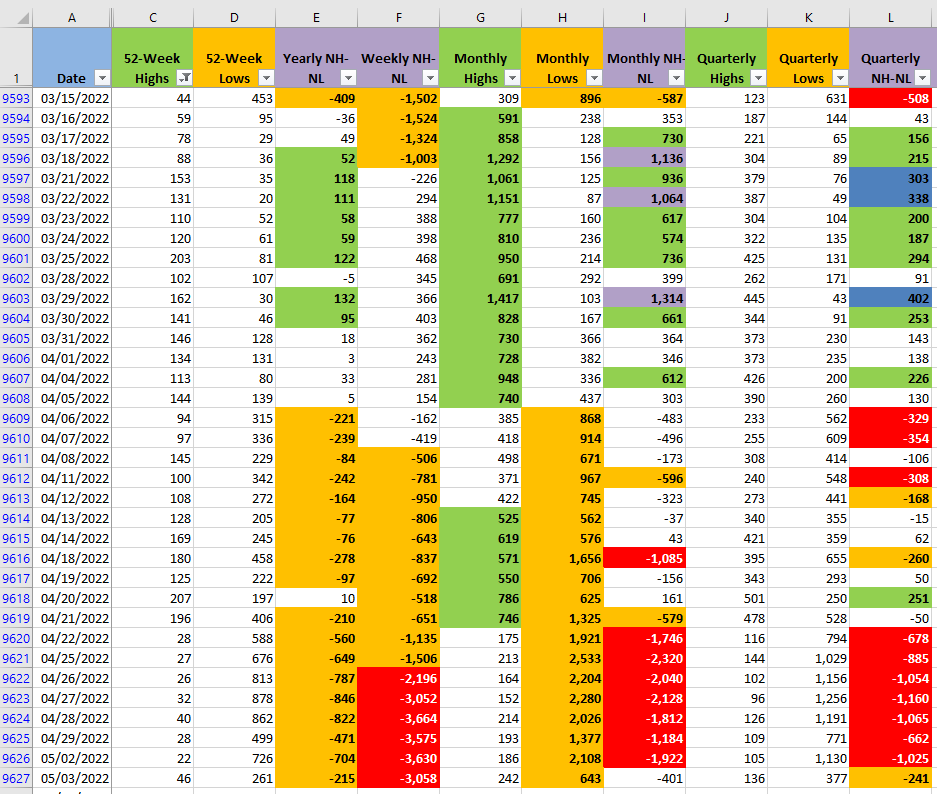

The selling pressure had an important decrease today, the New Monthly Lows decreased almost by 70%. The New Highs and New Lows (NH-NL) is a leading indicator. If we continue to see an important decrease in the Monthly Lows (fastest moving timeframe) and eventually that's also reflected in the price action, there could be a multi-day rally that really takes the S&P 500 back at least above 4,500.

A change in a single indicator during a single day doesn't mean much. When multiple indicators confirm each other and the movement lasts for several days with volume added to the mix then the interpretation becomes more meaningful. Right now, the S&P 500 is stuck below the 4,191 weekly support with still elevated New Monthly Lows. The rejection of lower prices and the significant decrease of New Monthly Lows give some hope for the Bulls if the upward movement takes off during the rest of the trading week.

I'm still on the sidelines, all cash, waiting for a good opportunity to start opening again long positions. Strict risk management will be essential if you still keep positions open. There can be plenty of news and volatility in the remaining three trading days of the week.