Today, most of the day the main indexes were trading with moderate to heavy losses. Once the Federal Reserve released its minutes, the losses stopped and some indexes were able to partially recover. The minutes showed that the central bank is going to be aggressive in its efforts to fight inflation.

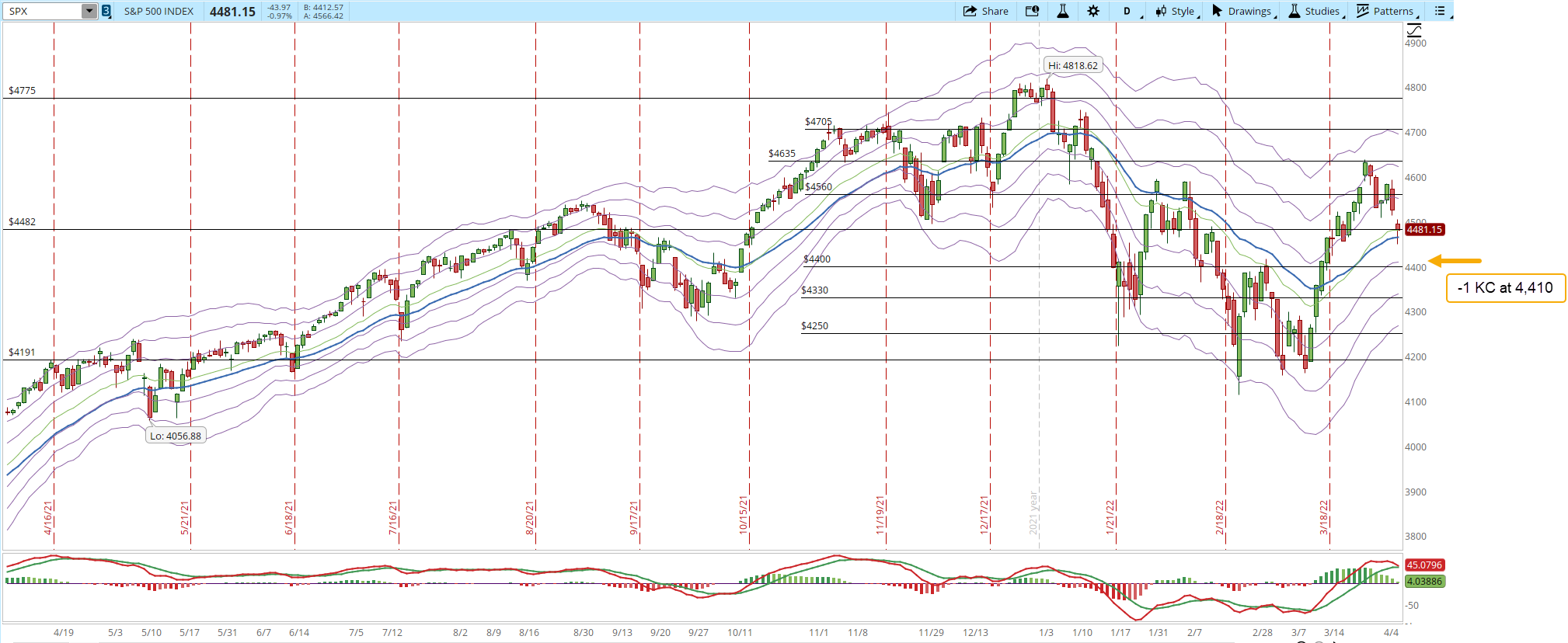

If we review the S&P 500 daily chart, the index gapped down and went as low as 4,450. If the pullback is going to be moderate with the expectation that the rally continues and eventually it could turn into an uptrend, the pullback shouldn't go below the -1 Keltner Channel, which today is at 4,410.

The S&P 400 (mid-cap) is already testing the -1 KC level. It seems that the 2,742 resistance will require a lot more demand in order to be broken, the S&P 400 already failed multiple times right around that level (orange arrows in the screenshot below).

The S&P 600 which has been the weakest of the three, already closed significantly below the -1 KC. The S&P 600 failed multiple times around the 1,378 resistance, however, lately it wasn't even able to get near the resistance before starting to decline.

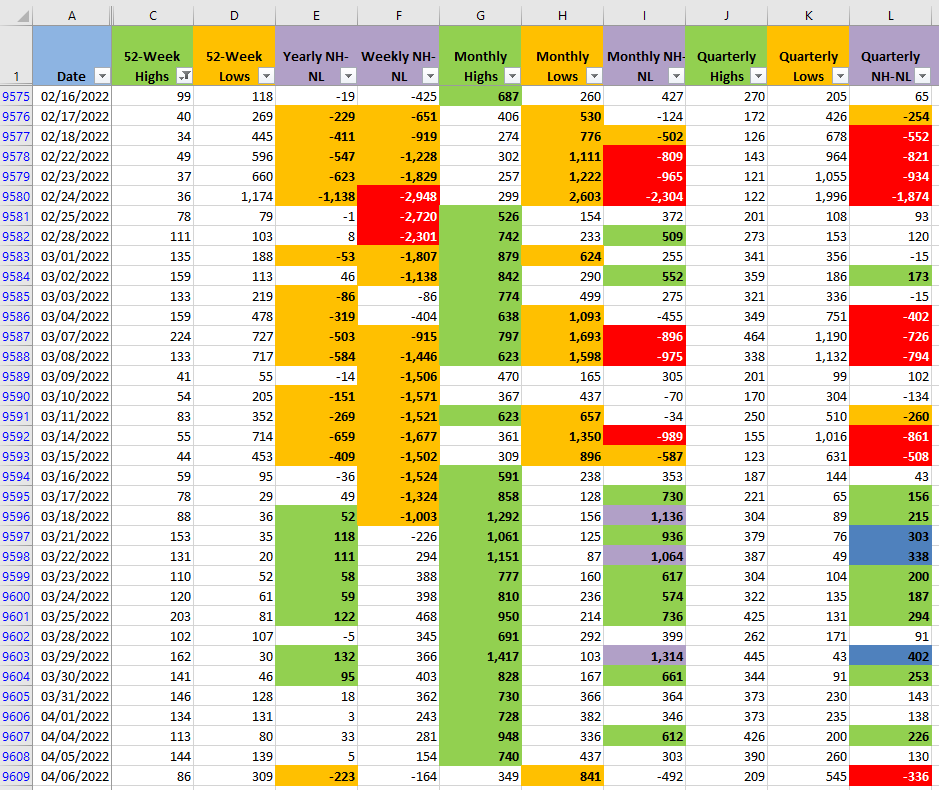

The New Highs and New Lows turned bearish in all the timeframes. The next couple of days we will be able to see if it's just something temporary or if the Bears are gaining real force.

I was stopped out from one more long position I was using to test the Market. If the selling pressure continues I'll be back to cash only in the next few days. However if the -1 KC holds for the S&P 500 and S&P 400, and then there is a rally, things could turn pretty interesting next week. I'll wait and see until the Market gives more clues about where it could be heading.