Today we witnessed another attempt of the S&P to rally. Early in the session, there was optimism because the U.S. weekly jobless claims fell more than expected and the Q4 GDP expanded faster than expected. The rally didn't last long, several important companies moved sharply lower. The electric vehicle companies were crushed today (i.e. LCID -14.10%, TSLA -11.55%, NKLA -9.01%). Semiconductor companies also didn't have much luck (i.e. INTC -7.04%, AMD -7.33%).

Looking at the charts, there isn't that much change from yesterday, three days in a row where the S&P tries to rally but it can't hold above 4,400 and ends declining. After the Market got to such oversold conditions even a relief rally would be expected, the selling pressure is killing every attempt of the Bulls to take control over the Market or at least have a reaction rally.

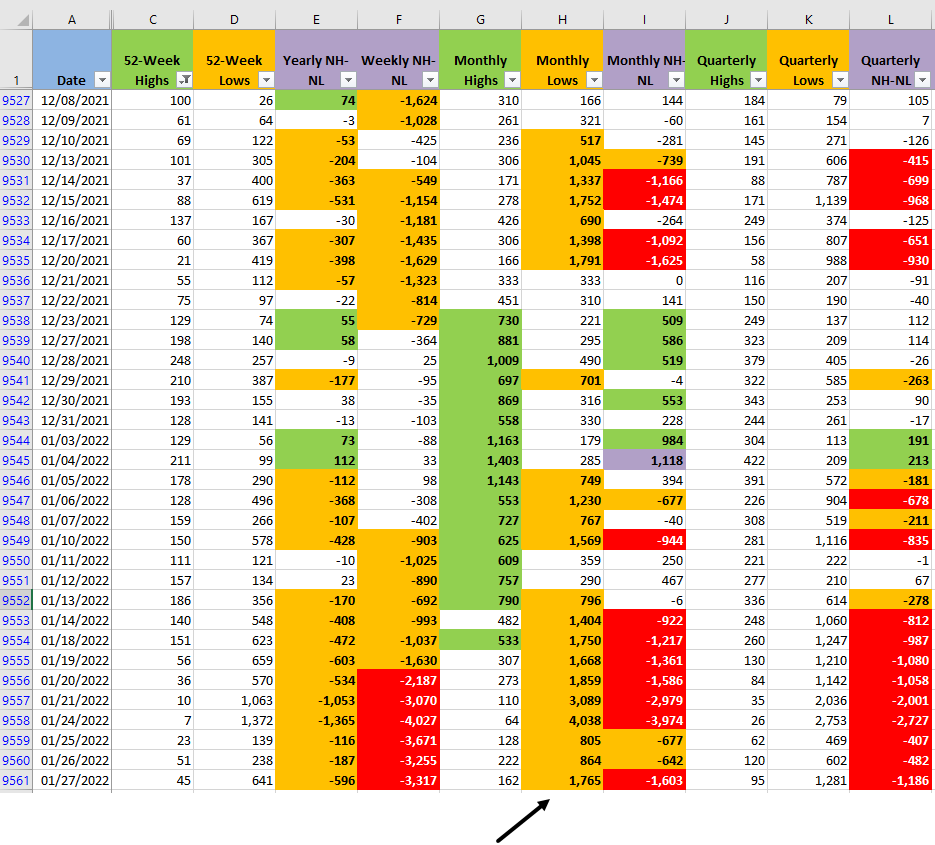

Checking the numbers for the New Highs and New Lows (NH-NL) there is no sign that the selling pressure is gone. The Number of Monthly Lows, which is the fastest timeframe I track, started deteriorating again (columns G and H). These numbers only confirm the weakness of the Bulls. As long as the Monthly Lows don't decrease significantly, the selling pressure will keep killing the rally attempts and the Correction might even resume the Market decline.

It's always very attractive to see someone forecast and call whatever is going to happen next in the Markets. We can all eventually make a few great predictions, however I don't trade based on a crystal ball, it's a very risky business to do that and more than trading it feels like a gamble. Right now, staying on the sidelines it's boring and it's testing my patience, but there aren't any good signals of strength yet. The Correction might not even be over, when the signals come I'll trade. For now I'll just wait, I'll keep my mind busy with my side Market projects and when the time comes I'll be ready.