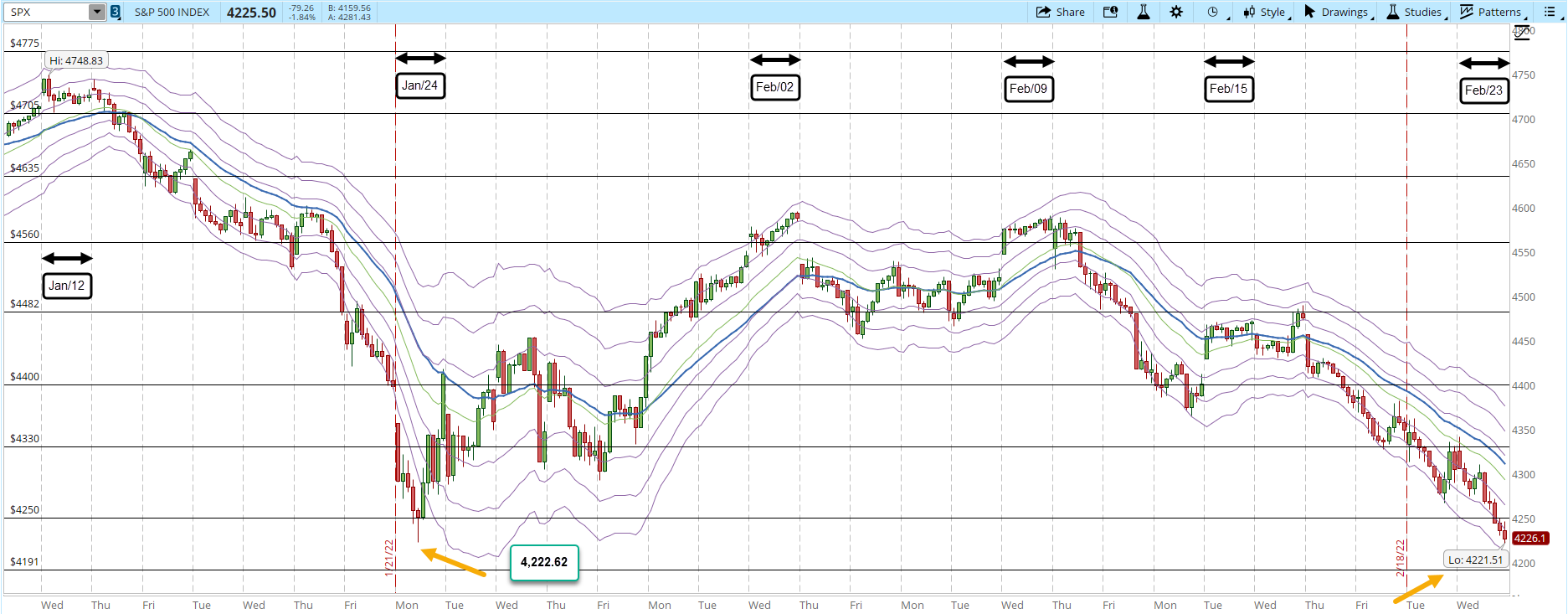

The Correction resumed its course, today the selling pressure was a lot higher than yesterday. There was no attempt to rally towards the end of the session, the S&P 500 broke below the 4,250 and now it's heading to test the weekly support of 4,191. If that support is also broken, I'll start adding new supports to start tracking the action of the next few days.

Reviewing the 39-min chart it's easy to see how we are at the lowest price levels reached during Jan/24 (orange arrows in the screenshot below). The question that I posted yesterday is, will the S&P rally again? The full analysis which also described the posibility of this scenario happening was posted during my Weekend Market Overview (link below, check the section Scenario #2 towards the end of the article).

Feb/20 - Weekend Market Overview - Another Market Support BrokenIf the selling pressure continues, then it's too early for my way of trading, to start thinking about opening new long positions. Bears are in complete control at this point. If the Market rallies but gets to a lower high, then the chart will start to look like a downtrend, which is basically a series of lower lows and lower highs.

The daily chart is also bearish, it's easier to see what's going on with a higher level picture of the action I described above. However, on Jan/24 when the lows were reached (orange arrow in the screenshot below) the same day the price rejected the lows and rallied to 4,400. Today we got to the same level and there was no rally back to 4,400, the price closed at its lows (red arrow, you can click the images in order to zoom in).

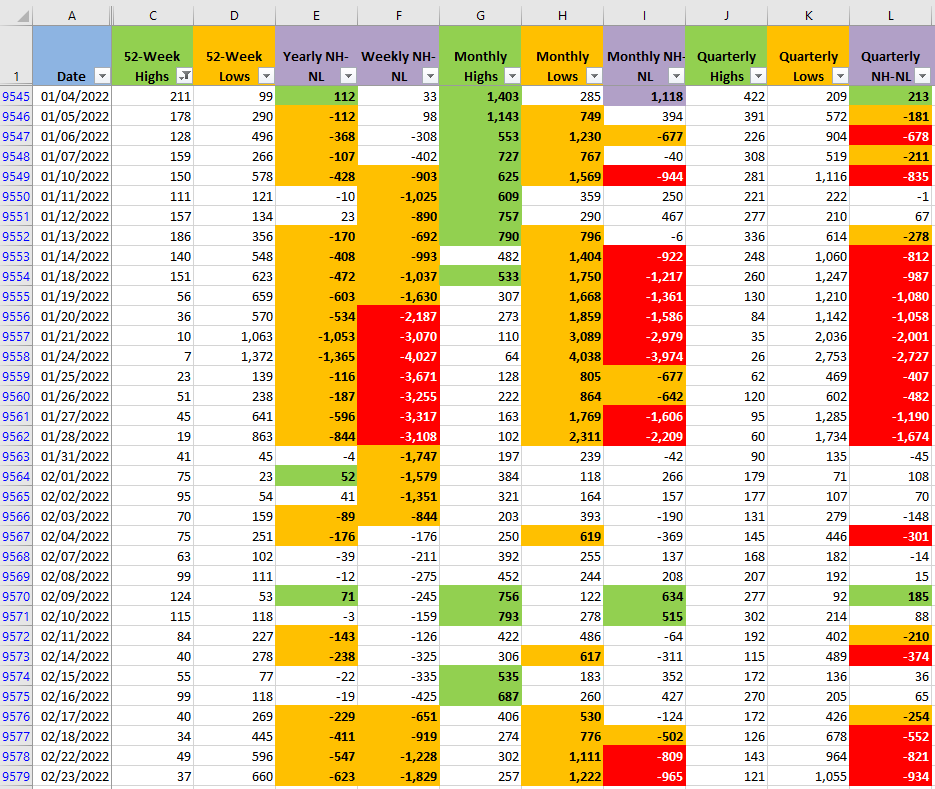

Below are the New Highs and New Lows numbers for the different timeframes I track. The numbers confirm the power of the Bears, if you check the last row, columns G, H and I, that's the fastest timeframe. The New Monthly highs are decreasing and the New Monthly Lows increasing. It's important to monitor those columns, when there is finally an important rally, those will be the first numbers that will change.

As a summary, Bears are in control, we got to a critical support level. If the Market keeps falling, the chart patter will start to look more like a downtrend. I'll add new support lines to the chart if necessary to see where are the potential places where the S&P could stop the decline. At this point, it's key to monitor 4,250 and 4,191.

Protect your capital, I have been constantly mentioning that risk management is key in order to survive these Corrections. I have been stopped out from most of the positions I had open, only a couple left, and I tightened the stops for those still open. Usually we think of buying or selling short as the only positions we can take in the Market. Staying on the sidelines protecting your capital is also a position, one that becomes advantageous once a new uptrend begins.