A week ago, I was warning about this scenario where the Correction could resume its decline (link below). There is still a chance that we get a rally since there is a lot of movement around the short-term supports at 4,330 and 4,250 where the S&P has rallied before.

Feb/13 - Weekend Market Overview - Testing the Support - Market WeaknessMarket Overview

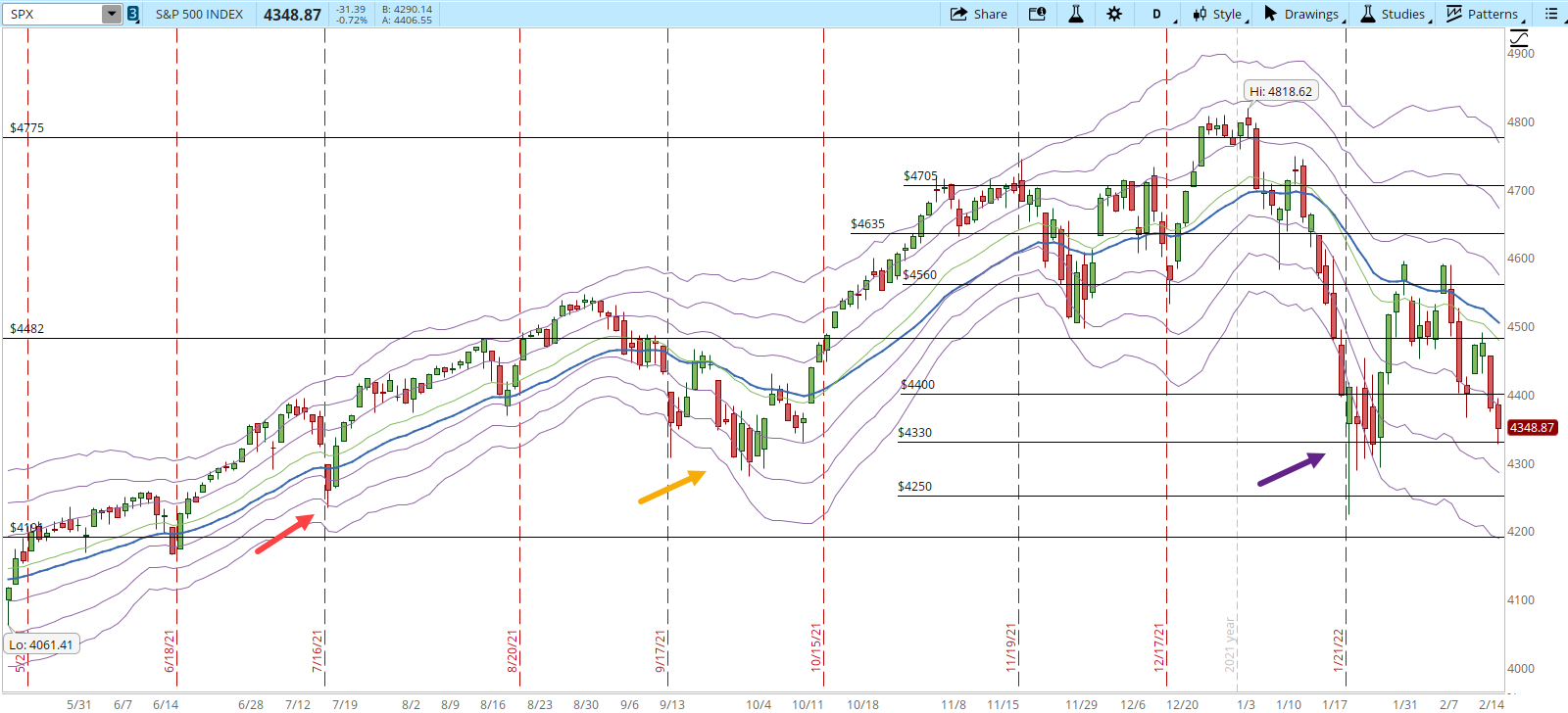

The first chart I would like to review is the 39-min chart. Look at the area where there are a couple of purple arrows, when the S&P reached the level where we are at right now it has rallied. The rallies since Nov/05/2021 haven't lasted more than four days. If the S&P can break through the 4,330 the only hope for support is 4,250. Otherwise, the scenario will be too bearish that there is nothing to stop the S&P from breaking below 4,191.

If we go one level up, to the daily chart, we can see from a different perspective the same rallies from the 39-min chart (purple arrow). There are a couple of other rallies around the same level, one at 4,330 back in Oct/2021 (orange arrow). The other one around 4,250 back in Jul/2021, which will be a critical support to monitor (red arrow).

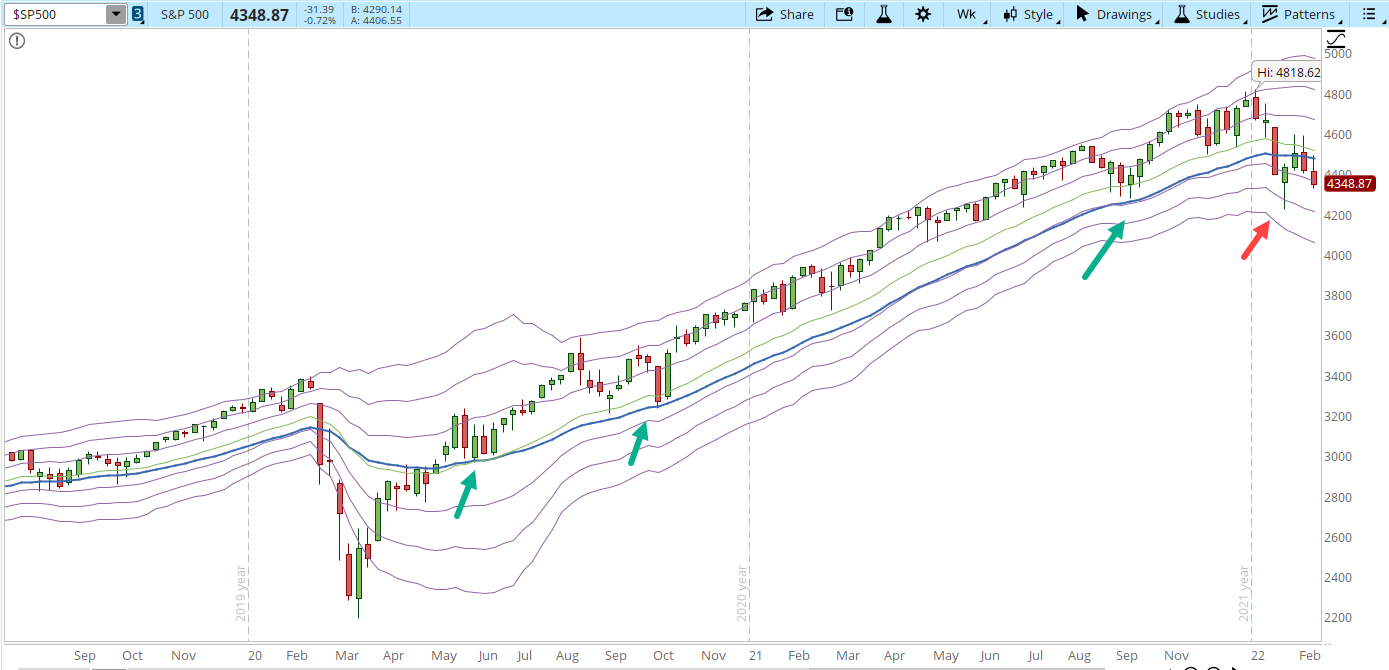

Finally, if we go another level up, to the weekly chart, the main issue is that the 30-week EMA (blue line) has been flat since the 2nd week of January. The Markets move in cycles, the movement that we see right now could be the Market topping after a powerful advance. It could also be a pause in the trend, which is becoming less likely since the S&P has been unable to rally in an important way for months. Even the price keeps its level below the 30-week EMA (blue line). If the Market is really at a top, the next part of the cycle is a decline.

The trend that started back on March/20 had tested the 30-week EMA (blue line) in several occasions (green arrows), this time is different, the S&P broke through the 30-week EMA and hasn't been able to go above it (red arrow).

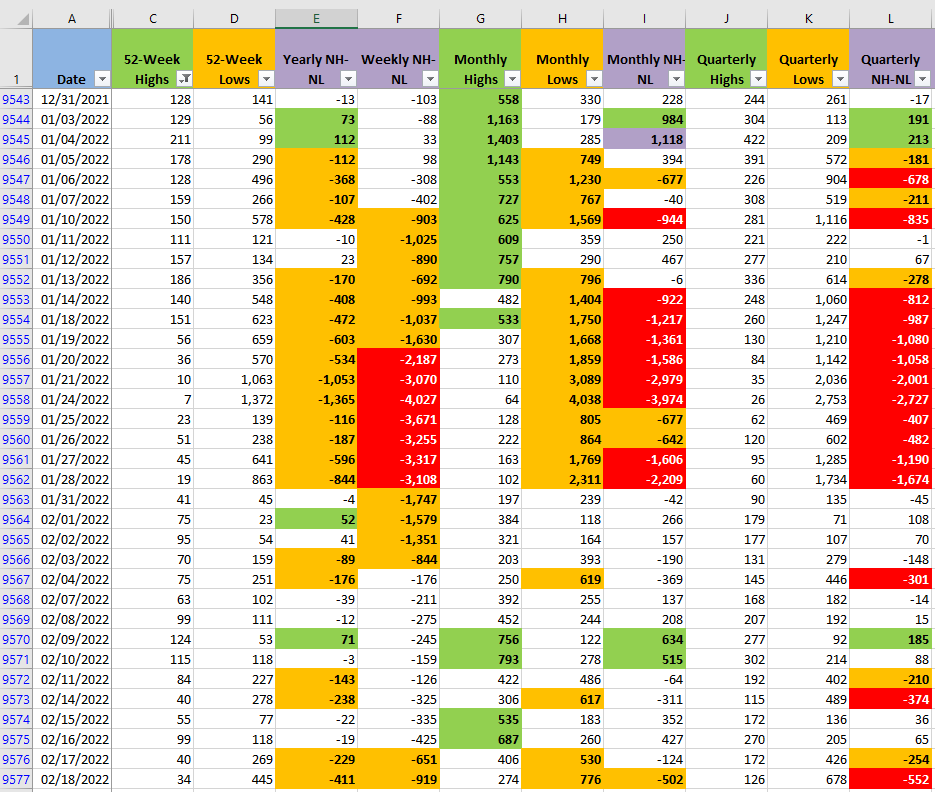

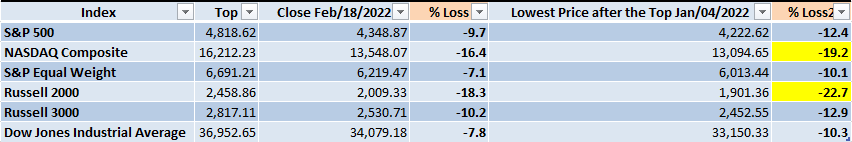

The New Highs and New Lows (NH-NL) aren't very encouraging. They continue to be predominantly bearish. If you review the numbers in the image below, the deeply oversold Market we saw around Jan/24 didn't produce a major rally, in fact we are getting close to be at the same price levels we had that date.

If we review the highest prices we had back in Jan/04 top against the lowest prices on Jan/24, we are not that far from being at the same price levels.

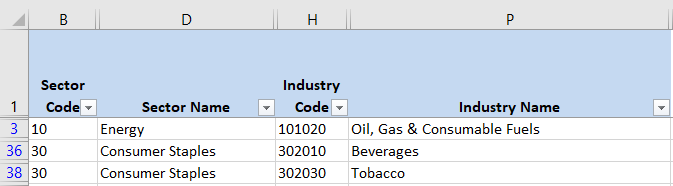

Industries

There isn't much change from last week in terms of strong Industries. Out of the 68 Industries based on the Global Classification Standard (GICS) there are only three Industries where I see strength. One is oil, which is not surprising, the other two are in the Consumer Staples Sector, which is considered a defensive Sector.

Scenarios

Scenario #1: From my point of view the most likely scenario is that the S&P will test the 4,330 level, maybe even fall to 4,250 and then have a rally. Not necessarily an important rally, but I expect some demand to start entering the Market at those levels. For my particular way of trading, I would only start opening new long positions in this scenario if the Oil Industry becomes very attractive or if the S&P manages to get back above 4,600. If the rally fails, then in this scenario the S&P will start moving sideways until there is some catalyst strong enough to make it go in a specific direction.

Scenario #2: The second most likely scenario from my point of view, is that the selling pressure keeps increasing, the 4,250 level gets tested and probably broken. From there we are in bearish territory until a support is strong enough to stop the decline. I keep only three positions open, the others already stopped out, and the ones still open will have small profits or at least I'll exit the position even. So I'm not concerned about this scenario, if this happens I'll stay on the sidelines waiting for better conditions before going long.

Scenario #3: The less likely, but still possible scenario, we see a powerful rally emerge. Maybe we get to see some strong unexpected catalyst, like the Ukraine conflict gets back on track to be solved, or some good news about the inflation in the USA. Everything is about probabilities in the Markets, this scenario is unlikely to happen, but you never know.

Summary

We are heading towards an abbreviated trading week. There are many potential catalysts that will likely weight on the Market when it finally opens on Tuesday, such as the increasing tension in the Ukraine conflict. It will be a very interesting week. Look for clues in the behavior of the Market near the support levels mentioned in this article, if those supports hold, then there is still a chance for the Bulls. If not then the confirmation of a Bear Market is very likely to happen.

In my previous posts I have been repetitive about the Market weakness and the risks of trying to pick a bottom. With the current situation now it's clear why I have been insisting so much on risk management, things could still get worse before they get better.