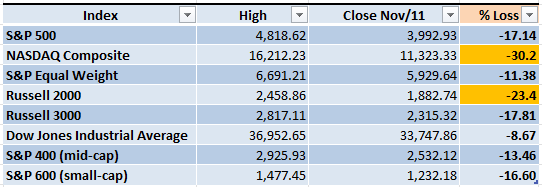

Finally, some good news about the inflation made the Markets rally. Most of the indexes exited the Bear Market territory (a loss of 20% or more from the previous high). Some people will get greedy and will rush to buy "cheap" stocks, it will be Fear of Missing Out (FOMO) taking control of their trading account. Some others holding shorts will be fearful and will rush to cover their positions.

There is a famous quote that says, "risk is a price that you pay for opportunity" and I believe that it's true. If we forget about the news and the Market noise, what is the message that we get from the charts? is it worth the risk of trading at this point?

Market Overview

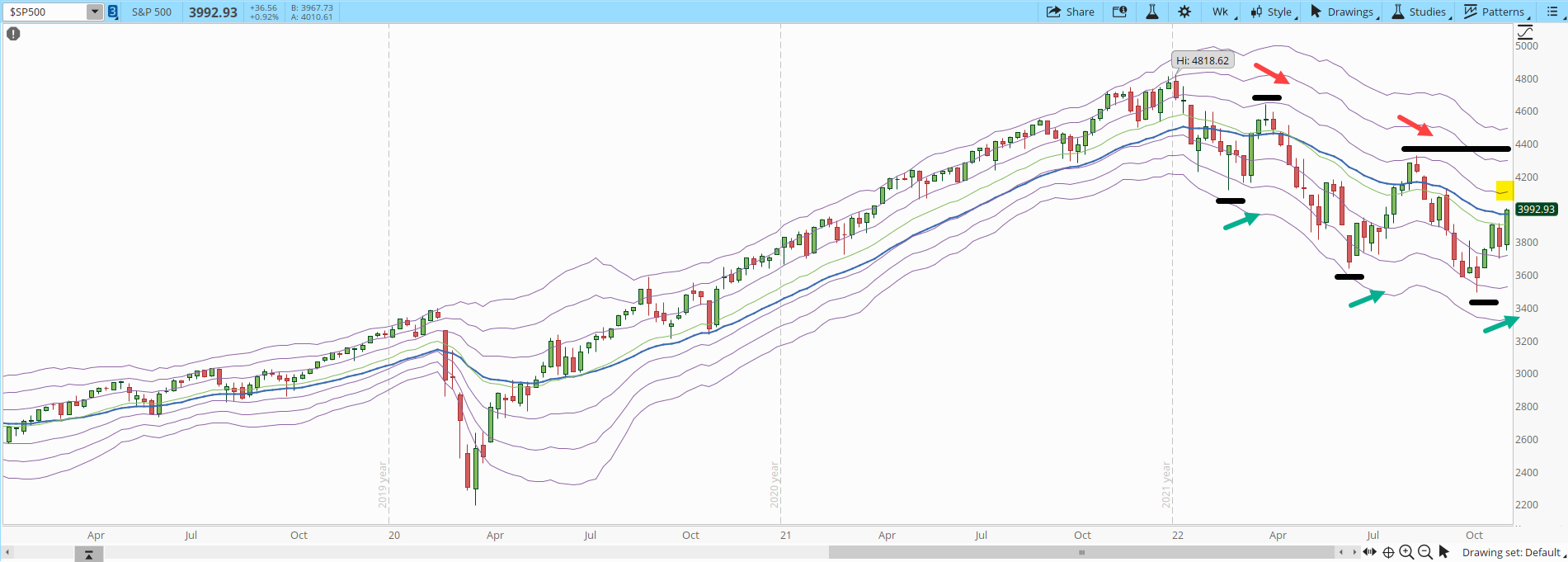

The Market had a stronger reaction than I expected, for me 3,900 was going to be a resistance that Bulls were not likely to break last week. However, I have to act as the party pooper, the weekly downtrend is still intact.

The behavior for the last few months in the weekly S&P 500 has been relatively predictable. Eventually the pattern will stop working, however, we can see that the downtrend structure (lower lows and lower highs, highlighted by the horizontal solid black lines) hasn't been damaged at all.

In the screenshot below is easy to observe that when the S&P 500 gets to the +1 Keltner Channel (KC) it has a sharp decline (red arrows). When the S&P 500 gets to oversold levels, that is the -3 KC or below (green arrows) there is a rally. Right now, the weekly +1 KC of the S&P 500 is at 4,100, that level will act as a resistance. The other level that will be important to monitor is 4,350 if the Bulls are able to break that level then the structure of the downtrend will be damaged.

Trading the Markets is a risky business, eventually if your plan lets you start opening positions, you have to be able to pull the trigger and accept the losses if the plan doesn't work as expected. There is a lot of literature about risk management, if the rally doesn't continue, the losses shouldn't damage significantly your account.

Reviewing multiple timeframes can be a very useful tool, it can change the perspective of a Market scenario. Reviewing the daily chart of the S&P 500, it can be expected that during next week we see an increase in the selling pressure. The daily chart has reached overbought levels (+3 KC or above). During 2022 we have seen this kind of strength only two times, one toward the end of March and the other one during mid-August. In both cases there was a sharp decline (yellow areas).

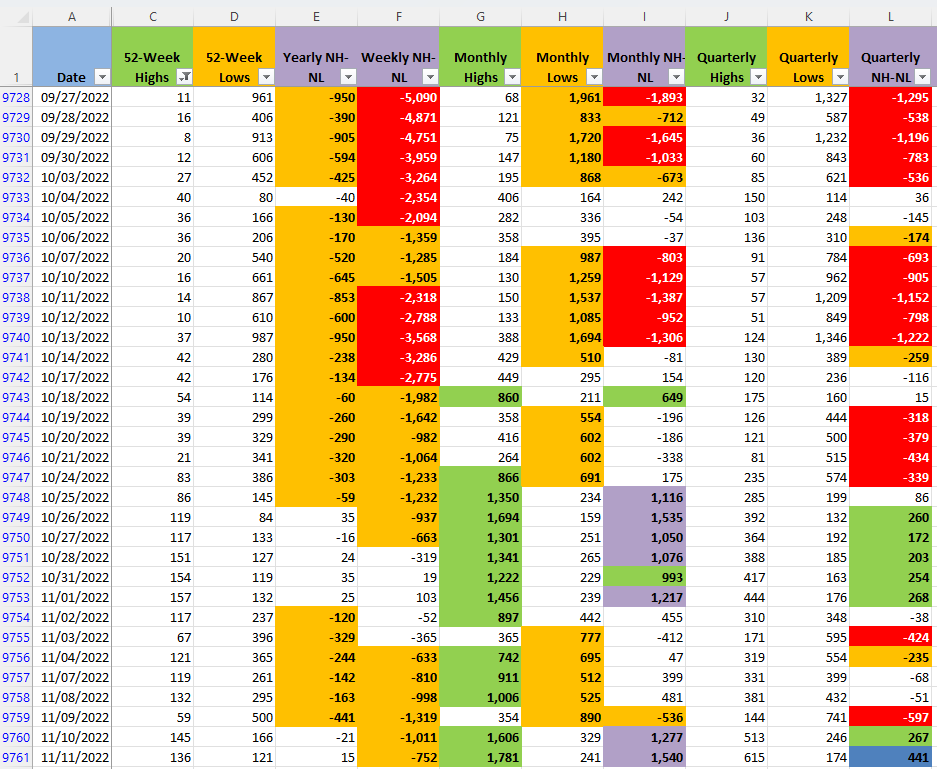

The New Highs and New Lows indicator (NH-NL) confirms the force of the Bulls. The Monthly and Quarterly timeframes display numbers significantly higher for the Bulls than Bears. The 52-week timeframe takes longer to reflect the change. The Monthly timeframe is the one that changes faster than the rest in the table below, if important supply starts to offset the demand, it will show in columns H and I.

Industries

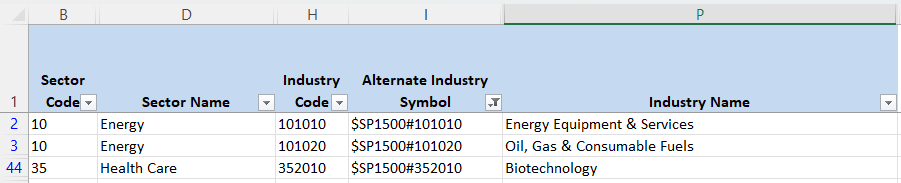

With the powerful movement that we saw last week, finally I found one Industry that has the potential to continue its uptrend. It's still not very encouraging, only one Industry out of the 68 Industries that compose the Global Classification Standard (GICS) is still a low number. The 'Construction and Engineering' Industry ($SP1500#201030) is displaying some force in its weekly chart.

The screenshot below displays the Industries that are attempting to have a significant breakout:

The interesting part of this section is to find out which are the Industries that will eventually lead the next multi-month Bull Market. Entering at the right time into the next Bull Market could be very well worth the wait and analysis.

Scenarios

Scenario #1: I never try to forecast what the Market will do, I do think about what are the most likely scenarios that can happen and then I act accordingly once one of those scenarios starts to take shape in the Market charts. Next week I think we will see a pullback that can take the S&P 500 below 3,900. The rally might even go as far as 4,100 but eventually during the week I think it will stop and then start to pullback.

I did open during last week four pilot trades. One of them was GEO Group (GEO), I was already stopped out of that trade by a deadly gap that triggered my stop at a much lower price than expected. If the rally continues, I'm more than happy to enjoy the ride. If not, none of those pilot trades will have a significant effect in my account.

Scenario #2: The second most likely scenario, from my point of view, is that the rally will stall, unless there are really surprising good news that can keep fueling the rally even at overbought levels, the index will start to pullback or stall. Reviewing the historical behavior of the Market can be an edge, nothing guarantees that the history will repeat but eventually in the chaos of the Market some patterns start to emerge.

Since we have only seen the daily chart of the S&P 500 get to the +3 KC during 2022, and after the index reached that level in both occasions the index had severe losses, I'd be careful before opening positions aggressively.

Scenario #3: The least likely scenario is that the rally continues. Greed is an emotion that can last for a long time, if the Market decides that there is still room to keep going up, so be it. The probabilities don't really favor this scenario, most of the rallies during 2022 have lasted at most four days. Anything can happen in the Markets, if the rally continues I might even open more pilot trades if I can find good setups.

Summary

Last trading week had a powerful upward movement of 186 points in the S&P 500. It's a nice recovery, but the weekly downtrend is still intact. The key levels to monitor are 4,100 and 4,350 where there is likely to be a significant increase in the selling pressure. In March and August we saw rallies much more powerful that what we have so far in the current rally and the Bears were able to kill them and send the index to oversold levels.

The FTX implosion in the crypto world is a clear example that even the most powerful companies must respect risk. Years of success can be destroyed in days when risk management is ignored. Most of the important indexes are out of Bear Market territory, that doesn't mean that we will immediately see a powerful Bull Market. Follow your plan and if in fact we see that a Bull Market is starting, the opportunities will present themselves.