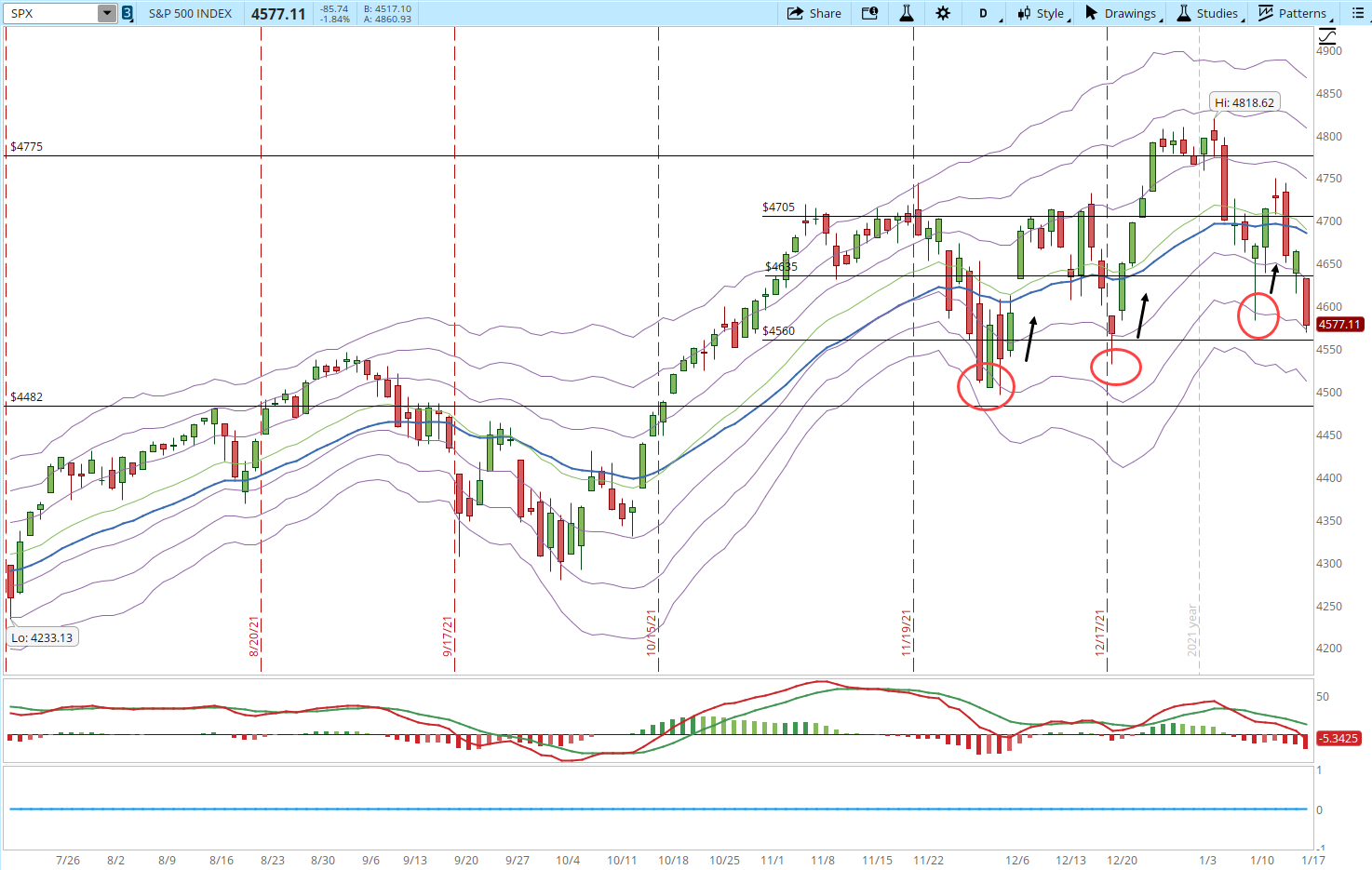

Today is a significant day in the Markets from the Technical Analysis perspective. The possibility that the weekly uptrend gets damaged or broken is now very real. If we take that the weekly uptrend began around March/2020, during that time the lower trend line has been tested four times (red arrows in the weekly S&P chart below). There is no rule that mandates that whatever happened in the past will happen this time or the next, but at least the previous three times that the lower trend line was tested, the next week the S&P had a rally.

The difference this time is that previously the S&P was displaying a lot of strength, so it tested the lower trend line and it rallied. This time the S&P has been almost three months in a consolidation and showing weakness.

If by the end of the week the price closes below the lower trend line, the S&P won't necessarily collapse, it could keep going sideways for a while before finding direction. However, such a weakness will seriously compromise the potential that the S&P gets back and breaks the 4,800 barrier.

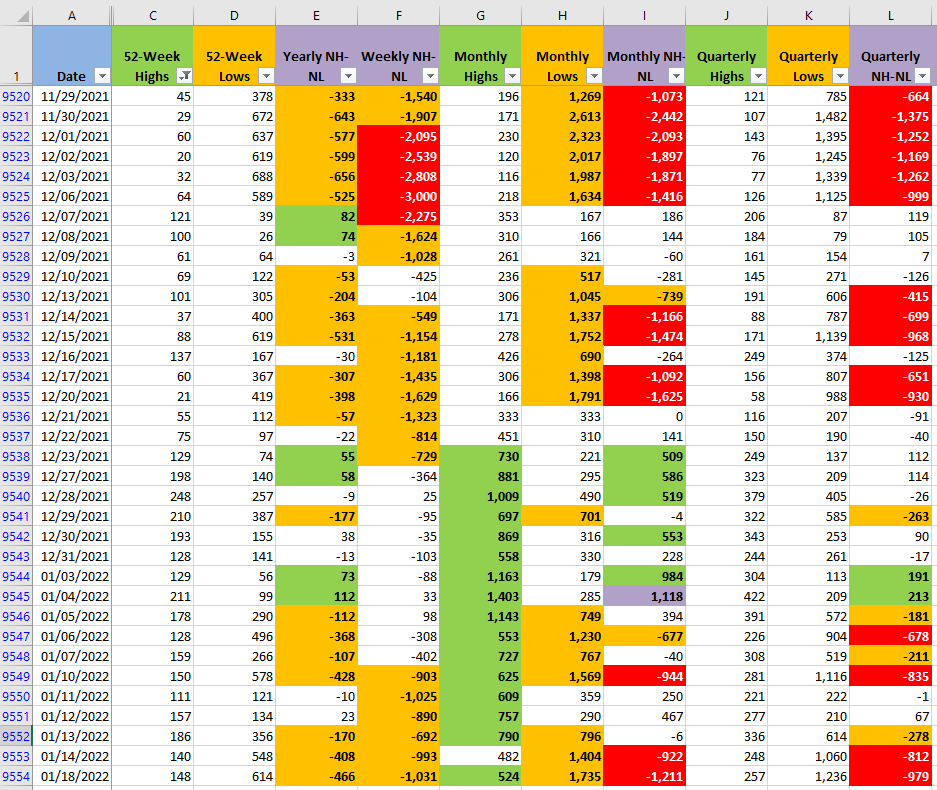

The numbers for the New Highs and New Lows in all the timeframes show the dominance of the Bears.

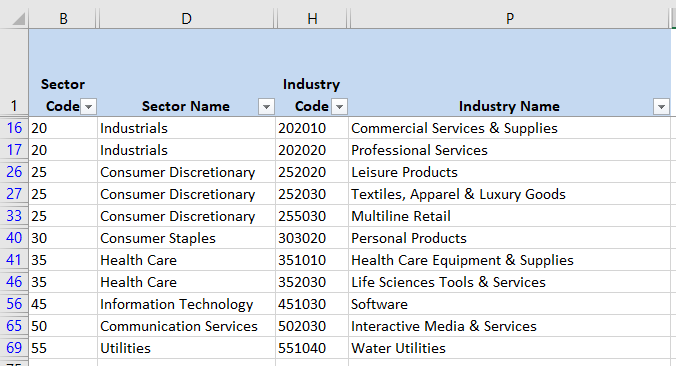

I have already started looking through Industries displaying weakness (screenshot below). If the S&P is still unable to recover the 4,635 level and the New Lows keep increasing I'll think about opening short positions in those Industries.

Reviewing the daily chart of the S&P (screenshot below), we can see that when the price got near or below the -2 Keltner Channel (KC) there was a relief rally after that. Again, there is no rule that says that this has to repeat, but a relief rally after today's sell-off would be a great way to assess the force that the Bulls have in case they have any force left.