It's easy to forget that no matter what type of Market we are going through, there will always be ups and downs in the charts. No chart in the Market moves in a completely straight line. We are living a Bear Market and today the main indexes rallied with force. There are a few technical factors that I would consider before going into a shopping spree mode.

The daily S&P 500 chart gives some clues about the Market strength. One statistic that I have repeatedly mentioned in past articles is that since Oct/2021 only two rallies have been able to last more than 4 days (black dotted arrows). This isn't a rule that guarantees that the next rally will also be short-lived, however, it gives a good idea of how weak the Market is. Eventually, we will see a powerful multi-week rally that starts breaking one resistance after another, monitoring the past behavior will give us a good parameter to compare the force of the Market when that powerful rally finally arrives.

Another important behavior during 2022 is that in the daily chart the 30-day EMA (blue line) has been acting as a resistance. Five out of six times, when the S&P 500 reached that 30-day EMA line, it declined (orange circles). This is a similar situation than the one mentioned in the previous paragraph, it isn't a rule, there aren't rules that work 100% of the times in the Markets. It's understanding the past behavior so that we can be ready when the Market starts to change, and we are able to notice the change in behavior.

If the Market continues behaving in the same way, a realistic target for the rally would be 4,100. That gives a good parameter to see how strong the Bulls will attack, if they get past 4,100 with a lot of force, maybe it could be the start of an interesting upward movement.

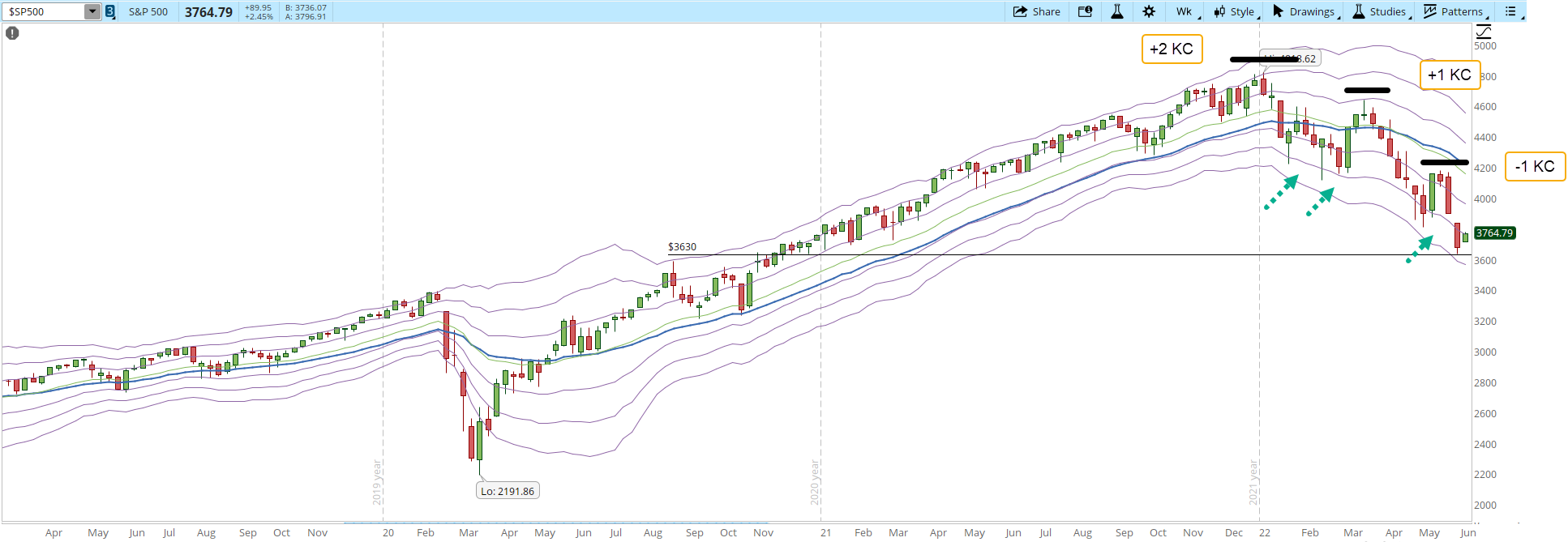

In order to keep a good perspective of where the Market is, the weekly chart shows the challenges ahead if the Market is indeed starting a recovery. Back in January the index reached its historical high at 4,818 around the +2 Keltner Channel (KC). After that, it started to trace a downtrend pattern, lower highs and lower lows (horizontal solid black lines). The next high reached only the +1 KC at around 4,640 and the latest high reached only the -1 KC at around 4,180.

When the S&P 500 has reached oversold levels during 2022 (-3 KC or below) it has had a rally that takes the index to higher levels but every time with less force (green dotted arrows).

For me a rally of a single day means nothing, the gains of the rally can be easily erased during the rest of this abbreviated trading week. The reason I'm not being that optimistic about the rally are the factors behind the downtrend. The inflation, the Ukraine War, the Supply Chain crisis, tensions between USA and China are just some of the main negative catalysts that have been around for months and they don't seem to be close to a resolution.

If your trading plan is conducive to the current Market environment, by all means, take advantage of it. I'll wait until I see more evidence of a real recovery, and the first step is that the index closes with force above 4,100, otherwise I'll continue on the sidelines, maybe trading just a few pilot stocks.