Lately many heartbreaking images from the Ukraine conflict are available in the media. I hope this madness stops soon. Young people from Russia and Ukraine started to kill each other because one guy decided that it's a strategic decision no matter the cost in lives from both sides. Ukraine cities will be destroyed, the Russian economy will take years to recover from the sanctions, a humanitarian crisis is underway. I will not defend the USA since they have done the same in the past, but if every powerful country just starts invasions as the main strategy to achieve more power, we won't be that far away from seeing nuclear missiles flying around the world.

Market Overview

The ongoing war in Ukraine and the possibility of a rate hike from the Fed next week, are some potential catalysts that will likely have important effects on the Market. From the technical side, there are some concerning signals emerging from the charts.

Starting with the daily chart of the S&P 500 one important factor that eventually will become a good measure for the Bull's strength is that no rally since Nov/05/2021 has lasted more than four days (red arrow).

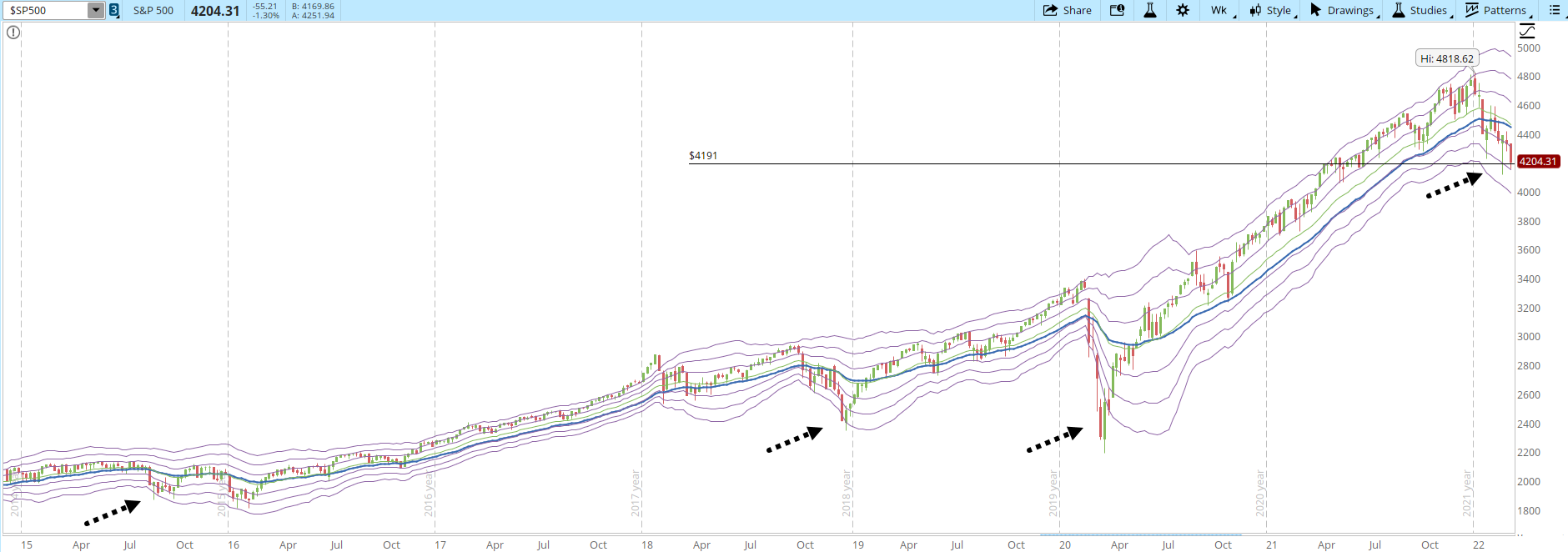

Another important factor on the daily chart is that this Correction is looking more like a downtrend that could continue if there is no demand entering the Market soon. If you review the horizontal black lines, during the historical high on Jan/04 the Market reached almost the +2 Keltner Channel band (KC), then on Feb/02 it couldn't even get close to the +1 KC. Finally, on the latest rally, the price couldn't even get to the 30-day EMA (blue line). Lower lows and lower highs. If the S&P breaks below the previous low at 4,114 and holds below that level then the S&P is likely to continue testing lower levels. The only good thing about this chart is that when the price reaches the oversold level of the -3 KC (black dotted arrows), there has been a small reaction rally to relieve some of the selling pressure.

The weekly support at 4,191 still holds, and has been an area of congestion since April/2021. Next week we will be able to see if the selling pressure is able to break past that level or if finally the Correction stops.

In the weekly chart below you will be able to see the times where the S&P 500 has closed below the -2 KC (you can click on the image to magnify it). Eventually the S&P ended rallying in all of them, we will have to wait and see. When the Correction is finally over, we will find out if there will be a powerful rally that lasts for months or if this time it will be different.

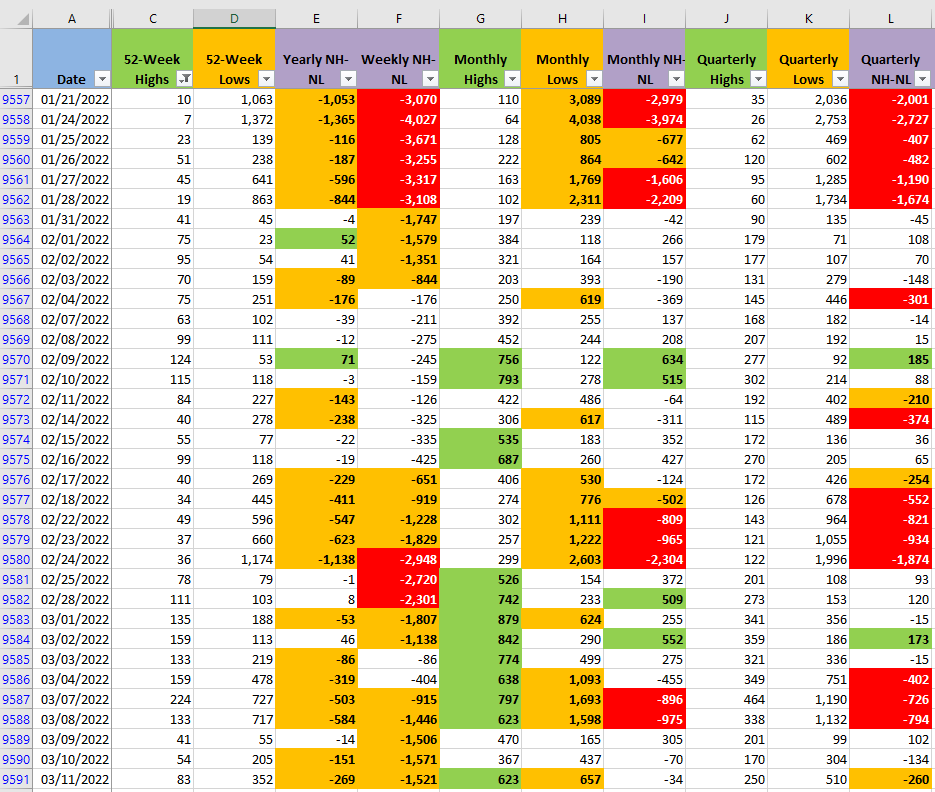

The New Highs and New Lows (NH-NL) numbers don't show yet a clear winner, the most important columns to monitor are the ones from the Monthly timeframe which is the fastest one from the ones displayed (columns G, H, I).

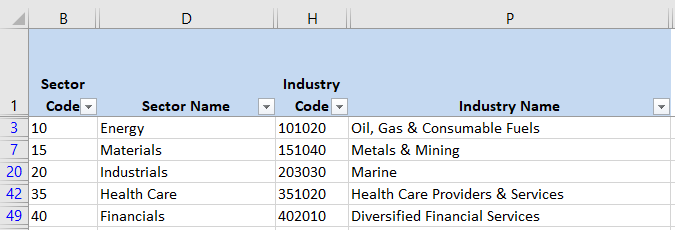

Industries

The number of Industries where I see strength is still low, out of 68 that compose the Global Classification Standard (GICS) I see only five strong Industries, not that different from last week.

Scenarios

Scenario #1: The most likely scenario for next week, from my point of view, is that the S&P will move sideways waiting for some strong catalyst to give it direction. The balance in the numbers of the NH-NL, the inability of the S&P to rally but also it's not going below the previous 4,114 low, seems to signal that temporarily the balance of power between Bulls and Bears is more or less the same. There is a chance that in this scenario the S&P tries to test the 4,114 low, but if the strength on both sides stays balanced, that low is likely to hold. I have opened already a couple of long positions that had a good setup (I'm now following Mark Minervini's methodology), I want to start testing the Market strength with real positions. If I get stopped out, then I'm likely too early or I still haven't acquired a good grasp of the methodology (or both).

Scenario #2: From my perspective, the second most likely scenario is that the selling pressure starts to increase dramatically. The rallies during this correction have been very brief and the bad news very abundant. It takes a lot of good news just to rally a couple of days, but it takes only a comment from the Fed to sink the Market. If the selling pressure increases significantly, I might get stopped out from my two positions and I'll be back to the sidelines, waiting for the Market conditions to improve.

Scenario #3: In this scenario, the Bulls finally wake up and show some real strength. The NH-NL numbers on the Monthly timeframe reflect the force from the Bulls, the Market rallies and holds at least above 4,400 (ideally 4,600). The bad news coming from Ukraine, the Fed or the virus have less impact on the direction of the Market. If this happens, I'll start opening positions more aggressively. I don't see this scenario very likely to happen next week, but anything can happen in the Markets.

Summary

We just saw another week dominated by the Bears. The poor attempt to rally from the Bulls was killed in a single day. However, rallies and pullbacks are part of the game, even during Corrections and Bear Markets, the Market never moves in a straight line. I still don't see any important signal that the Market is ready to move in an uptrend. In the best-case scenario, I see that the Market is starting to trace a bottom. Let's see what the next trading week brings, there is no need to forecast anything, think about what are the likely scenarios that can happen and be prepared to act accordingly to your plan. Risk management is essential as the Correction could resume at any moment.