Independently of your religious views, or if you have none, I hope that you enjoy the last few days of 2021, Merry Christmas. Another trading year is ending and it's time to enjoy the people we care about the most but also to prepare for whatever the Markets will bring next year.

On my Weekend Market Overview a couple of weeks ago, I was discussing how the Markets were testing the resistance levels. We are back at that situation.

Weekend Market Overview - Dec/12/2021 - Uncertain times around Market ResistanceMarket Overview

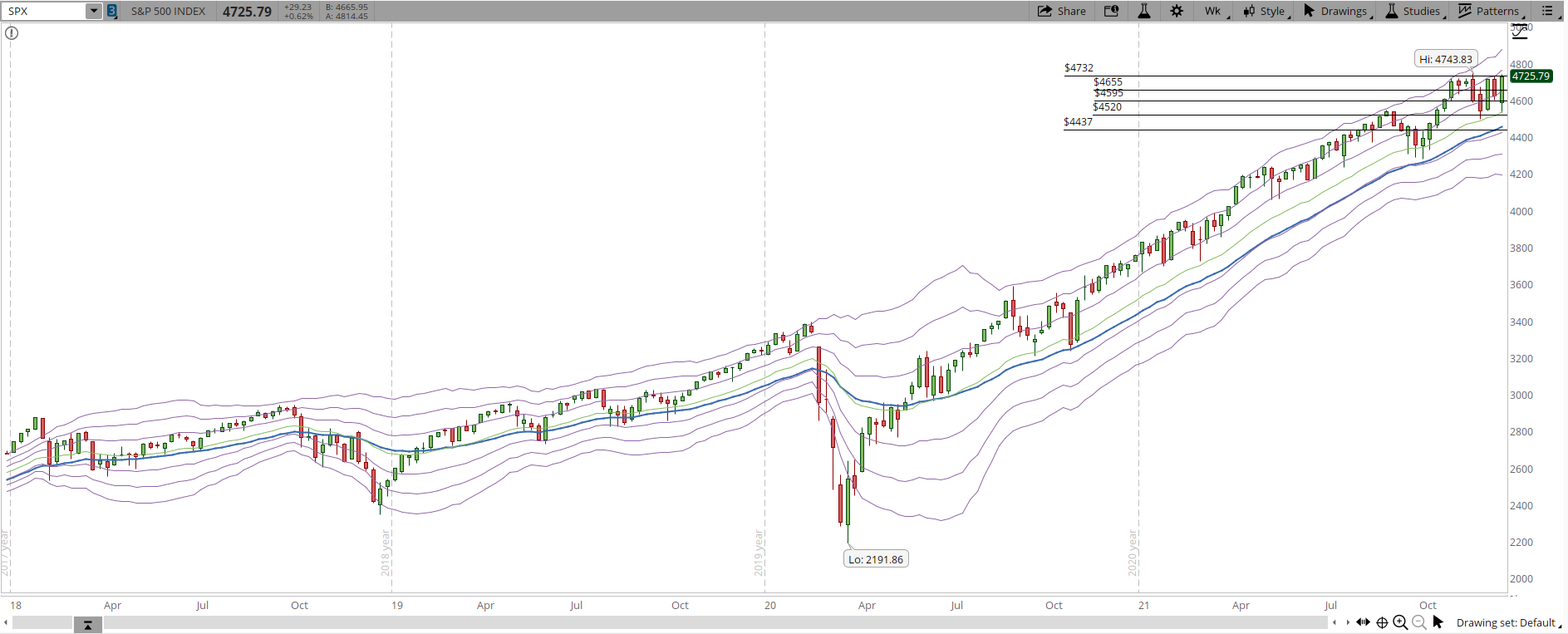

There has been some strength shown by the Bulls the last three trading days of the week. The strength was enough to take back the S&P to the weekly resistance levels. I have recalculated the weekly support and resistance, previously I have set them at 4,721 and 4,426. I get the data from StockCharts (link below) and the parameters that I use in order to calculate the weekly support and resistance can be found in the FAQ section of the blog. The new values are slightly different, weekly resistance at 4,732 and the weekly support at 4,437. For the short-term support/resistance lines that I add for illustration purposes I kept them at the same levels 4,655 - 4,595 - 4,520.

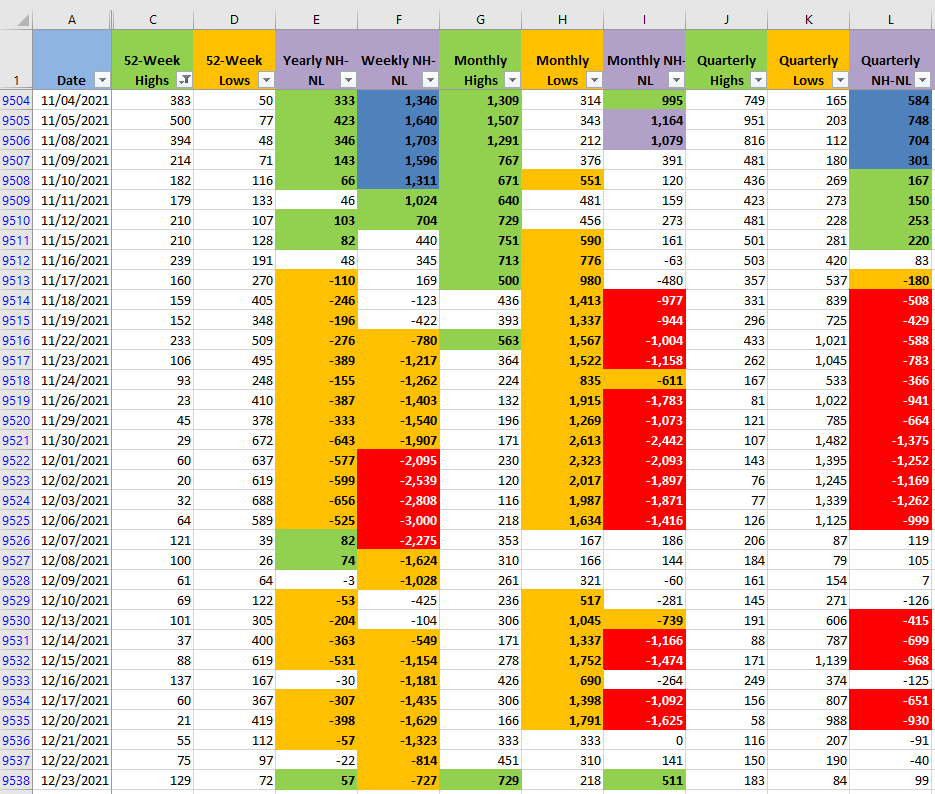

Starting with the 39-min chart shown below (you can click on the image in order to zoom in), my main concern is that when the S&P 500 gets close or past the resistance line it has never closed decisively above that line, it just tests the price and rejects it. If the Market is going to continue with the weekly uptrend it needs to stay above the 4,732 line, the amount of New Monthly Highs needs to expand and the New Monthly Lows needs to stay at the current level or below.

StockCharts

Reviewing the balance between New Highs vs New Lows (NH-NL) the number of Lows have decreased considerably while the New Highs just started to expand on Dec/23. I mainly check the Monthly timeframe (columns G and H) but the other timeframes confirm that the selling pressure has been decreasing. There is an entire book about the NH-NL written by Dr Elder and Kerry Lovvorn about this indicators that can be found at SpikeTrade.com, the data is from Barchart.com :

SpikeTrade.comBarchart.com

As in preview posts I like to check the same data from different timeframes. The 39-min chart provides a nice way to understand how the Market action is moving on daily basis. Zooming out a little bit to the daily chart (screenshot below), we can see that same action in perspective during the past nine months. It's a different way to see where the resistance lies.

Could this be a distribution phase? Definitely, but the Bulls aren't giving up yet, so until there is a clear Market direction it could be just a pause in the weekly uptrend, eventually the uptrends slow down and later they end, the next few days hopefully will provide some additional clues about whether this is just a pause or the Market is reaching a top.

The weekly chart below shows the uptrend, still intact despite the bearish warnings that have been constantly flashing for the past few weeks.

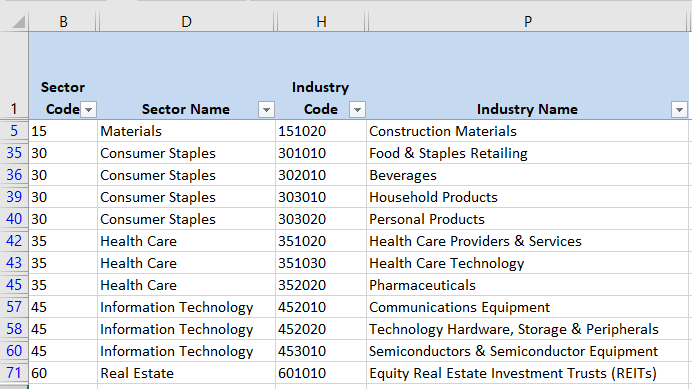

Industries

In terms of the Industries that I see as the strongest ones (screenshot below), there isn't much change from last week. Industries from the 'Consumer Discretionary' Sector are gone and 'Real State' is back. I added a detailed description of why I personally think this Industry shift is happening in the following post:

Dec/15/2021 - Stock Market Contradictions

Scenarios

- Scenario #1: If the resistance line is finally broken (not tested, but actually broken) and the S&P 500 manages to stay above 4,732 then for my particular methodology based on Stan Weinstein's book, it will be a good time to trade on the long side. In order to confirm the Bull power the New Monthly Highs need to keep expanding and the Lows need to stay at the current levels.

- Scenario #2: If the movement next week just keeps testing and rejecting the 4,732 level then in the best-case scenario the S&P will just stay in the trading range between 4,655 and 4,732. If this happens, I'll just stop opening positions unless there is something really attractive.

- Scenario #3: If the 4,732 level is rejected and there is a significant increase in the New Monthly Lows, selling pressure will test the 4,655 support and maybe break it. Depending on how strong the Bears could get, in the last 30 trading days they have managed to take the S&P down below the 4,520 support line. In this scenario, some of my stops might trigger and the new positions I opened this week might need to be closed early.

New Positions

I have opened a couple of new positions, one already described in detail in the link below, a Real State stock that fits the patterns I look for, Cushman and Wakefield PLC (CWK):

Bulls Fight Back - For nowThe second position that I opened on Dec/23/2021 is American Equity Investment Life (AEL). I'm not crazy about the volume levels, but the rest of the setup is basically an A trade. In the Markets we have to take decisions based on what we get from the Market, and sometimes the situation isn't perfect, the textboook patterns are rare. Even for a perfect pattern setup, nothing guarantees that it will be profitable. Additionally I want to stop opening positions in Real State and start looking at other sectors with upside potential.

Nothing is certain with CWK and AEL, they could both be losing trades. The book 'Trading in the Zone' by Mark Douglas is full of great quotes that I review from time to time, one of them resonates when I hesitate buying or selling a stock:

'The best traders can put on a trade without the slightest bit of hesitation or conflict, and just as freely and without hesitation or conflict, admit it isn't working. They can get out of the trade - even with a loss - and doing so doesn't resonate the slightest bit of emotional discomfort. In other words, the risks inherent in trading do not cause the best traders to lose their discipline, focus, or sense of confidence.

If you are unable to trade without the slightest bit of emotional discomfort (specifically, fear), then you have not learned how to accept the risks inherent in trading. This is a big problem, because to whatever degree you haven't accepted the risk, is the same degree to which you will avoid the risk. Trying to avoid something that is unavoidable will have disastrous effects on your ability to trade successfully.'

Mark Douglas

Summary

The Market has been rallying for the past three days, next week we will be able to see if the Bulls are strong enough to break the weekly resistance at 4,732 or not. The money seems to be moving to Health Care, IT and defensive Consumer Staples stocks. Eventually this powerful bull Market will end and risk management will prove to be essential to limit the damage to the accounts.