The last couple of weeks have been a little bit boring, the Bears still aren't able to increase significantly the selling pressure. From 4,195 to a low on Friday Feb/17 of 4,047 which is a decline of 148 points in the S&P 500. On the other side, the Bulls are still not able to generate enough demand to break and hold above the milestones that I have been monitoring for weeks 4,150 and 4,350.

Market Overview

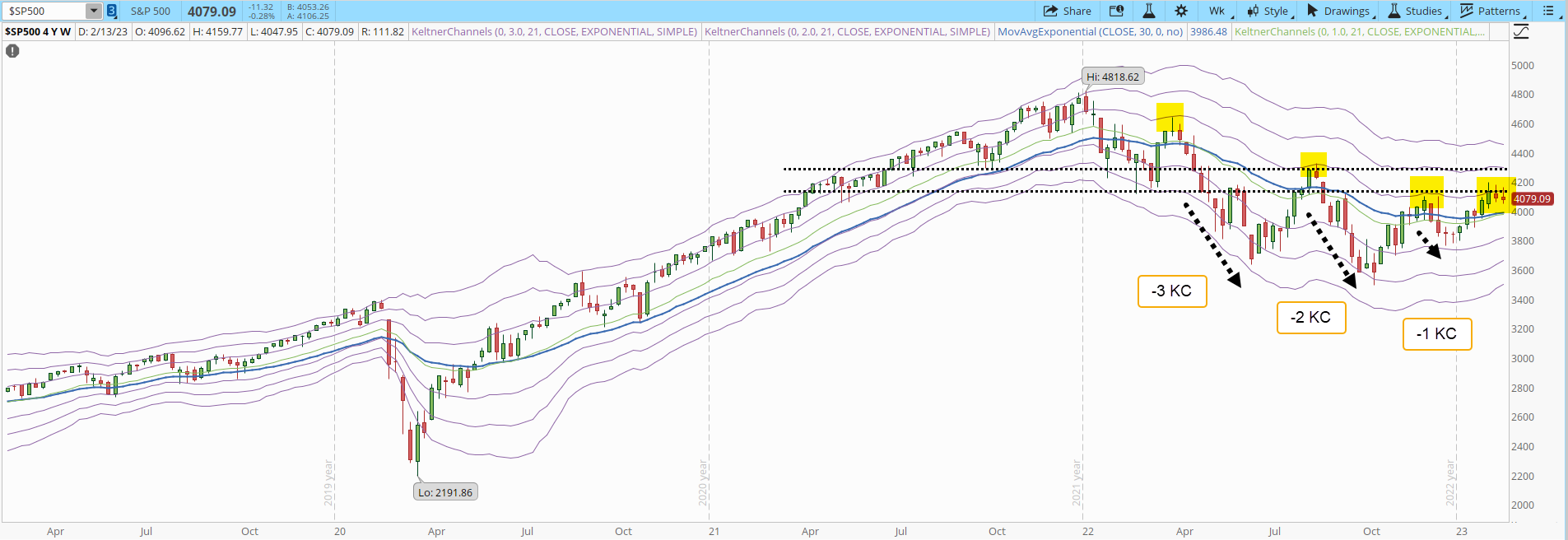

It's important to review the high-level perspective of the S&P 500 chart. Last week I mentioned that the Bears are losing power. The sharpest declines have moved from reaching the -3 KC to the -1 KC only in the weekly S&P 500 chart. Unfortunately, the +1 KC has been acting as a strong resistance level (yellow highlighted areas).

Scenarios

The daily chart of the S&P 500 is no longer at overbought levels (+3 KC or above) which opens a couple of likely scenarios for the trading week of Feb/20:

Scenario #1: The most likely scenario, is that the S&P 500, will get close to 4,000 and then attempt to rally. A realistic target for next week would be 4,250. If the week closes above 4,150 that will be a signal that finally the Bulls are building an interesting amount of demand.

Scenario #2: The second scenario is that the Bears test the 4,000 level of the S&P 500 and they can break that support. The selling pressure is still way too low to support this scenario, the Monthly NH-NL closed the week at -235, still far from the levels of the most important declines of 2022 where the number was between -2,000 and -3,600. If the decline accelerates its pace, the index could close the week at around 3,900.

Summary

The S&P 500 could be finally tracing a bottom, there isn't enough supply yet to go back to the level of 3,400 like there was in Oct/2022. There isn't enough demand yet to break past 4,150. The index will keep oscillating and trying to find a direction based on where the higher amount of volume comes from, buying or selling.

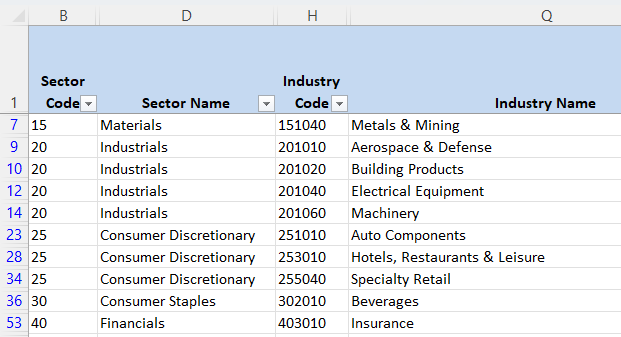

I still keep 10 long positions open, the rest have already stopped out. I'm avoiding completely the Industries that are still in a weekly downtrend.

The concern I have is around the recession, measures are still being taken to control inflation and usually the stock market has negative returns at the early stage of the recession. The Bears aren't necessarily done yet.

I don't care if the Market ends going up or down, I have a plan for both scenarios, I won't even try to forecast in which direction it will go, I'll just act accordingly to the price action, the Market is the final judge. The news, my opinion or anything else becomes irrelevant when trading on the technical side.