Today there was a little bit of relief in the Markets, the rally that started in the morning was able to close near the highs of the day. In yesterday's post, I mentioned that the S&P was behaving for the time being in a predictable manner (link below).

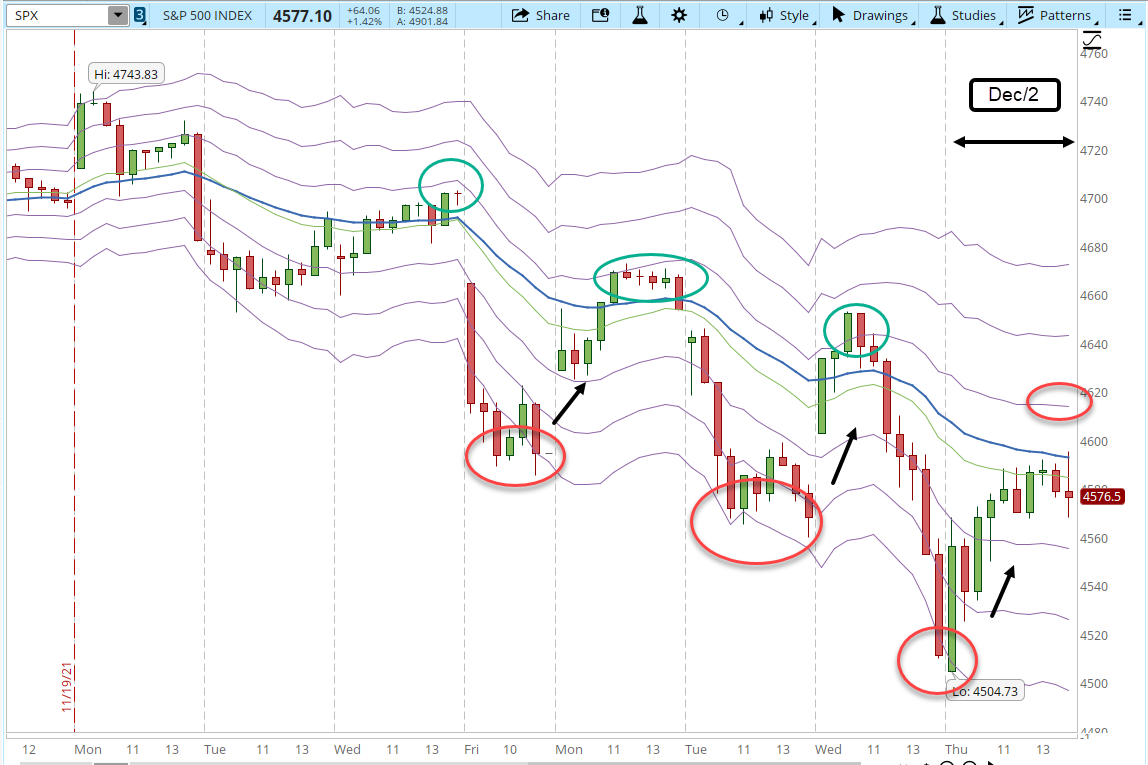

The Correction ContinuesContinuing with the analysis on the 39-min chart, the S&P rallied but hit a resistance at 4,595 at the EMA line (blue line). I didn't like that action, I was expecting it to go to the upper +1 Keltner Channel band at 4,613 (screenshot below).

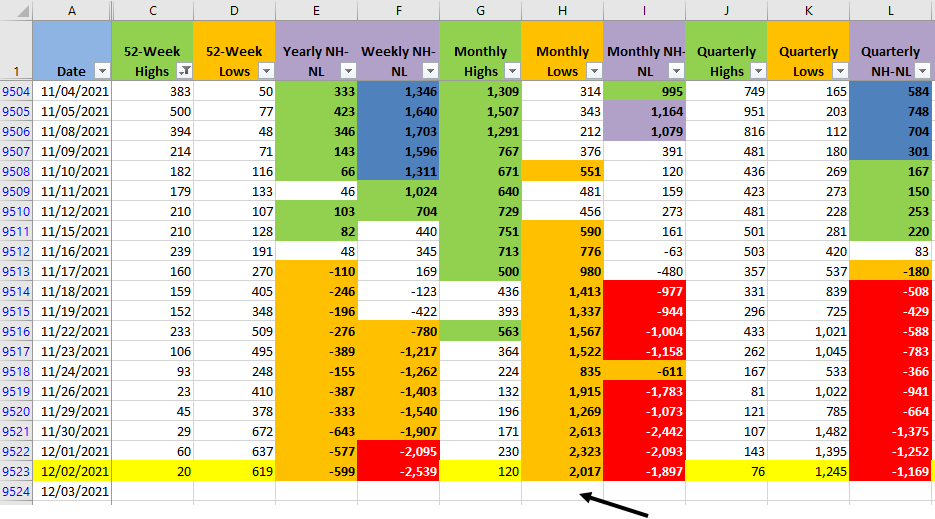

The amount of monthly Lows is still pretty high (remember that barchart.com keeps updating the numbers even through the night sometimes, so the numbers can slightly vary) and the number of new Highs diminished (columns G and H)

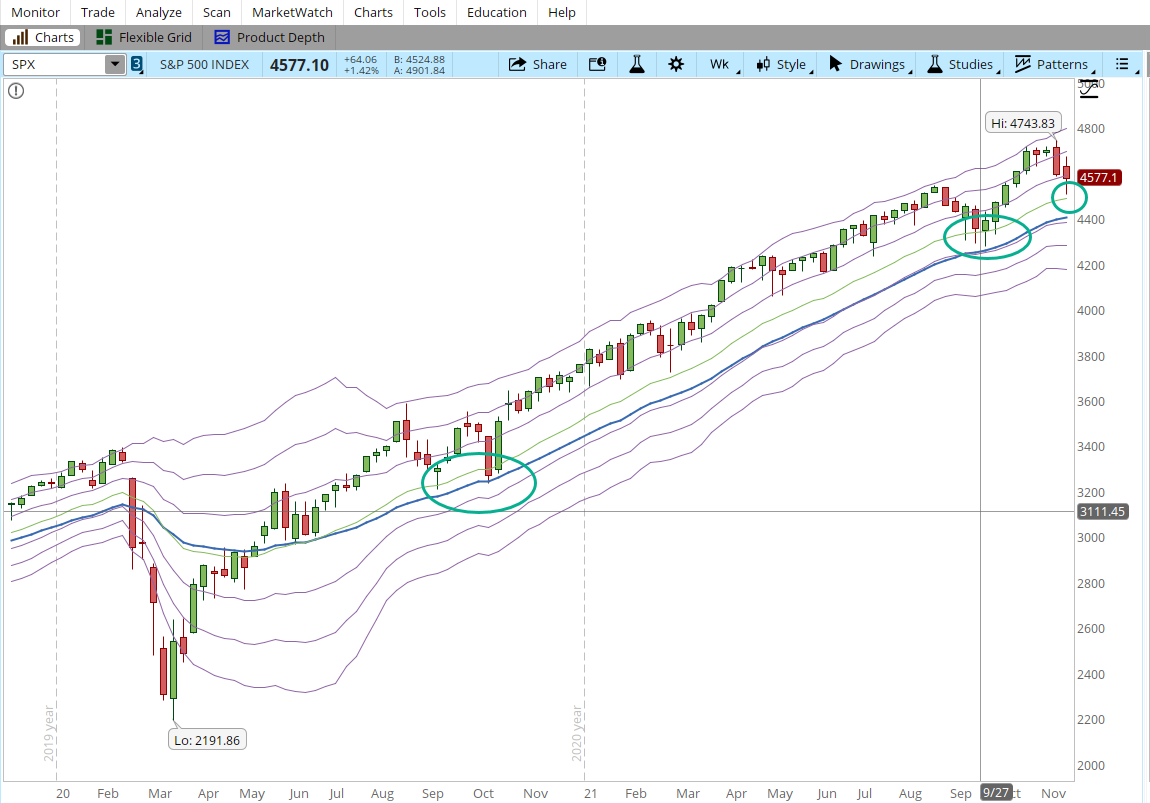

Unfortunately, these numbers still suggest that the bears could do more damage. The weekly trend still looks good, let's see how the week closes, in my last's weekend post I mentioned that the center line of the Keltner Channels on the weekly chart was acting as a trend line, supporting the price, it had been tested but not violated and so far it's still holding (green line in the screenshot below).

If the week closes with another rally and the amount of Lows gets reduced considerably (around 1,000) then there is hope that a consolidation starts or maybe even bulls can regain control.

Nov/28 - Weekend Overview