The Market rallied today based on better than expected earnings from some mega-cap technology companies. The comments from the Fed Chair Jerome Powell accelerated the rally towards the end of the trading session, according to the declarations, Powell thinks that the job creation is robust, the USA isn't in a recession and eventually the rate increases will eventually slow down.

Reviewing the daily chart of the S&P 500 I still think that we are headed towards a Market pullback. This is the 3rd time during 2022 that the index has reached the +2 Keltner Channel (KC). During the first two occasions the Market had a sharp decline (orange circled areas). Even if the Market continues rallying it will be get to a short-term oversold condition around 4,100.

It would be a great display of power if we see that kind of rally where the Bulls take the index to 4,200 despite the negative news and despite the oversold condition. At this point that's just a distant scenario, the S&P 500 is facing selling pressure around 4,000 and it's important to keep track of it's reaction. Will the current demand be able to absorb the incoming supply?

There's not much change in the weekly chart yet, the downtrend is still intact (lower highs and lower lows signaled by horizontal solid black lines). In order to start breaking the patter the rally would need to close above 4,200 (pink horizontal solid line).

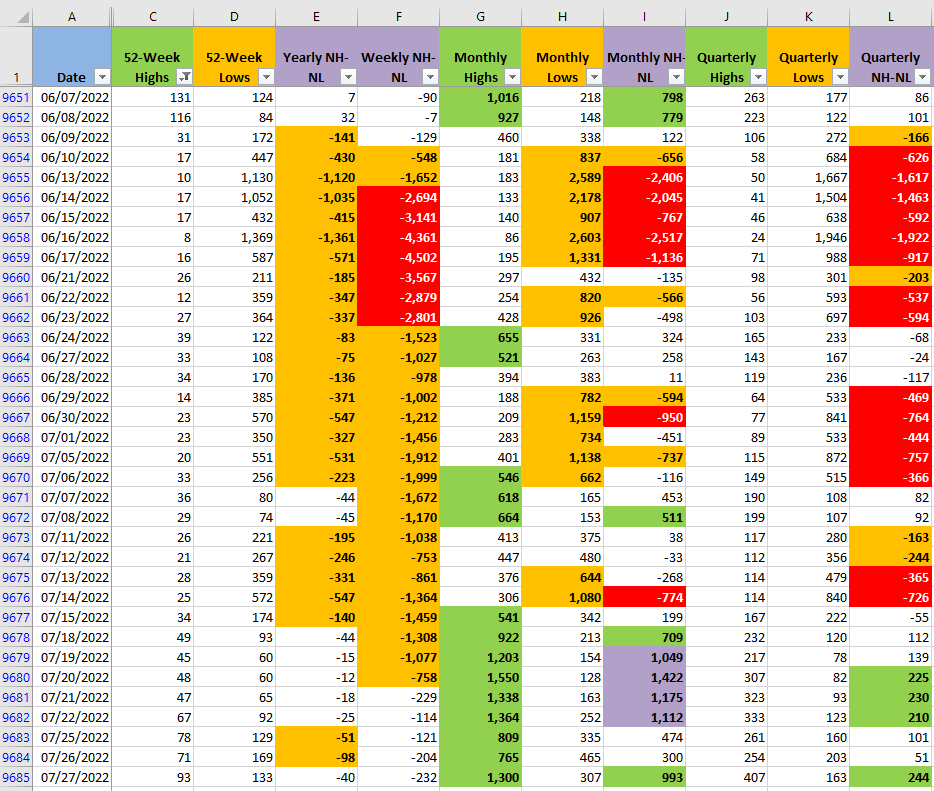

The New High and New Low numbers (NH-NL) are still bullish in the Monthly timeframe, which is the fastest changing dimensions from the ones I track. However, the price action is not confirming those bullish numbers, at least not yet. The NH-NL is a leading indicator, so a discrepancy is expected in terms of timing. The S&P 500 closed on Monday at 3,966 and today at 4,023, a difference of 57 points. It would seem that the rally that started last week and reached a high at 4,012 is stalling.

Forecasting the future is a risky endeavor, at this point no one has been able to predict what's going to happen on consistent long-term basis. It's especially difficult in the daily timeframe, anything can happen. Whether we see a pullback or not in the next few days, the most important part is that the Bulls aren't displaying a dominating force yet.

The positive news we had today need to continue in order to fuel the rally at least to 4,100. During a Bull Market is easy to forget the importance of strict risk management. Now that the Bears are in control, it's essential to keep a tight control over risk in order to prevent fatal damage to your account.