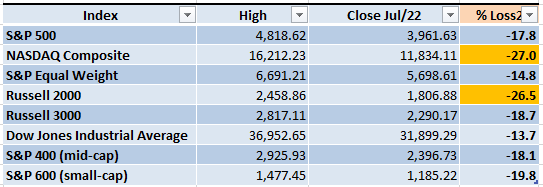

After the trading week that just finished, there are only two important indexes that are still officially in a Bear Market (a decline of 20% or more from the previous high). I don't think that the Bear Market is over yet, it would only require a strong negative catalyst to send the indexes back to Bear Market territory. During the week, the S&P 500 gained 98 points, however there are other factors to consider, some of them I find them troubling despite the rally we had this week.

Market Overview

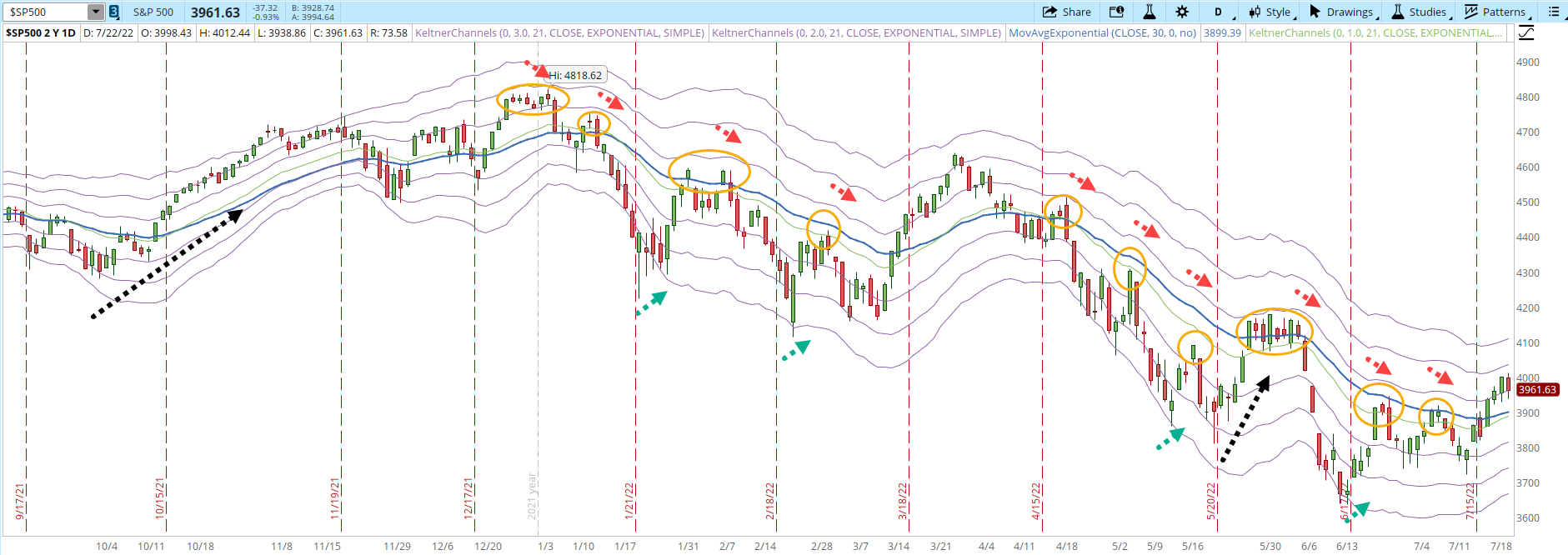

I have mentioned in past articles that the S&P 500 is having some consistent behaviors during 2022. They aren't going to last forever, but they can provide clues about potential changes in the Market direction. This trading week there were a few bullish deviations from the expected behavior:

Behavior #1: Only two rallies, since Oct/2021, have lasted more than 4 days (black dotted arrows). The current rally lasted for 5 days and with a little bit of luck it could still continue next week. One extra day is not a huge achievement, however this small change could be a clue that Bulls are at least gaining some force.

Behavior #2: Each time that the daily chart of the S&P 500 got to oversold levels (-3 Keltner Channel or below, signaled by the green dotted arrows), there was at least a modest rally that took the index out of the oversold zone. For the current rally, it doesn't apply since the S&P 500 hasn't been at oversold levels since Jun/16.

Behavior #3: Almost every single time that the S&P 500 reached the 30-day EMA (blue line), there was a pullback (orange circled areas). Since June/28 the S&P 500 has tried and failed three times to get past the 30-day EMA. This week was different, the daily chart of the S&P 500 not only crossed the 30-day EMA, but it also almost got to the +2 Keltner Channel (KC). It faced some selling pressure when it got to 4,000 but it was able to display some force not seen since Mar/25.

Two weeks ago, I estimated a rally at least to 4,000 and that's where the index is currently at. There's no evidence yet, that the current rally is something more than a reaction rally. I do have a few long small pilot trades open in order to get a better feeling of the current Market situation. Until I don't see the S&P 500 close decisively above 4,200 I'll still consider that the dominating feeling of the Market is fear.

The weekly chart of the S&P 500 still displays a clear downtrend, lower highs and lower lows that started after the historical high of 4,818 back in Jan/2022. The force of each new rally continuously diminishing. The first rally got to the +2 KC, the second only to the +1 KC and the last two only to the -1 KC.

The New Highs and New Lows (NH-NL) indicator went bullish on the Monthly timeframe (columns G, H and I of the screenshot below). The Monthly NH-NL hasn't been that bullish since Nov/2021. The force of the current Monthly NH-NL is displaying an annoying behavior, it seems to be displaying more force than the previous rallies that started in Oct/2021 and Mar/2022 but the price action doesn't seem to be matching that power. The rally isn't necessarily over yet, it could continue during the trading week about to start. However, if there is no follow through, the rally will turn from a signal of strength to weakness.

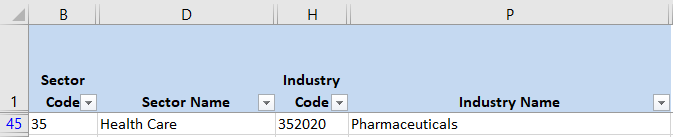

Industries

There hasn't been much change in terms of strong Industries, last week there were three, this week only one. Low numbers considering the 68 Industries that compose the Global Classification Standard (GICS). The important part is not how many Industries appear on the list but the increase that will eventually happen. Even more important is that eventually some of those Industries will become the leaders that will trigger a new Bull Market.

Scenarios

Scenario #1: The most likely scenario, from my point of view, is that there will a pullback where the S&P 500 will be testing a level around 3,750. The last time the index closed in the +3 KC was back in Mar/29 and before that in Nov/2021. The amount of negative news acting as Market catalysts (inflation and recession, Ukraine war, supply chain crisis, China tensions, etc.) are still far more powerful than the impact of the positive news. The index rejected the 4,000 level and only two times in the last 12 months the index has reached the +3 KC. Put together all these factors and that's the reason I think we are headed for a pullback.

Scenario #2: The second most likely scenario is that a sideways movement could start to oscillate between 3,800 and 4,000. This would be a very interesting development, it could be the beginning of a Market tracing a bottom. The Bulls getting stronger waiting for a chance to break a meaningful resistance, the first one of them 4,200.

Scenario #3: The least likely scenario is that the rally continues and gets at least to 4,200. Something that might trigger this kind of positive movement would be some surprising news in the earnings that will be reported next week. That kind of movement would require that the rally continues at least for three or four days.

Summary

The Market is starting to display some force. Some of the expected negative behaviors that have been repeating during 2022 in the S&P 500 didn't happen during the last trading week. The NH-NL is also turning more bullish, however the price action is still not matching the force of the indicator.

Trying to pick a Market bottom is a very risky business, it can end blowing up a trading account. There are some signals that the Market could be starting to trace a bottom, or maybe if there are some surprising news the rally might continue. The reality is that the Bears are still controlling the Market, we are 857 points below the Jan/2022 historical high, that's almost an 18% loss.

Strict risk management is the best tool to protect an account from fatal damage. It only takes a strong negative catalyst to send all the indexes back to Bear Market territory. There's no point in taking huge risks if that implies losing your capital. Follow your plan in order to keep playing this game.