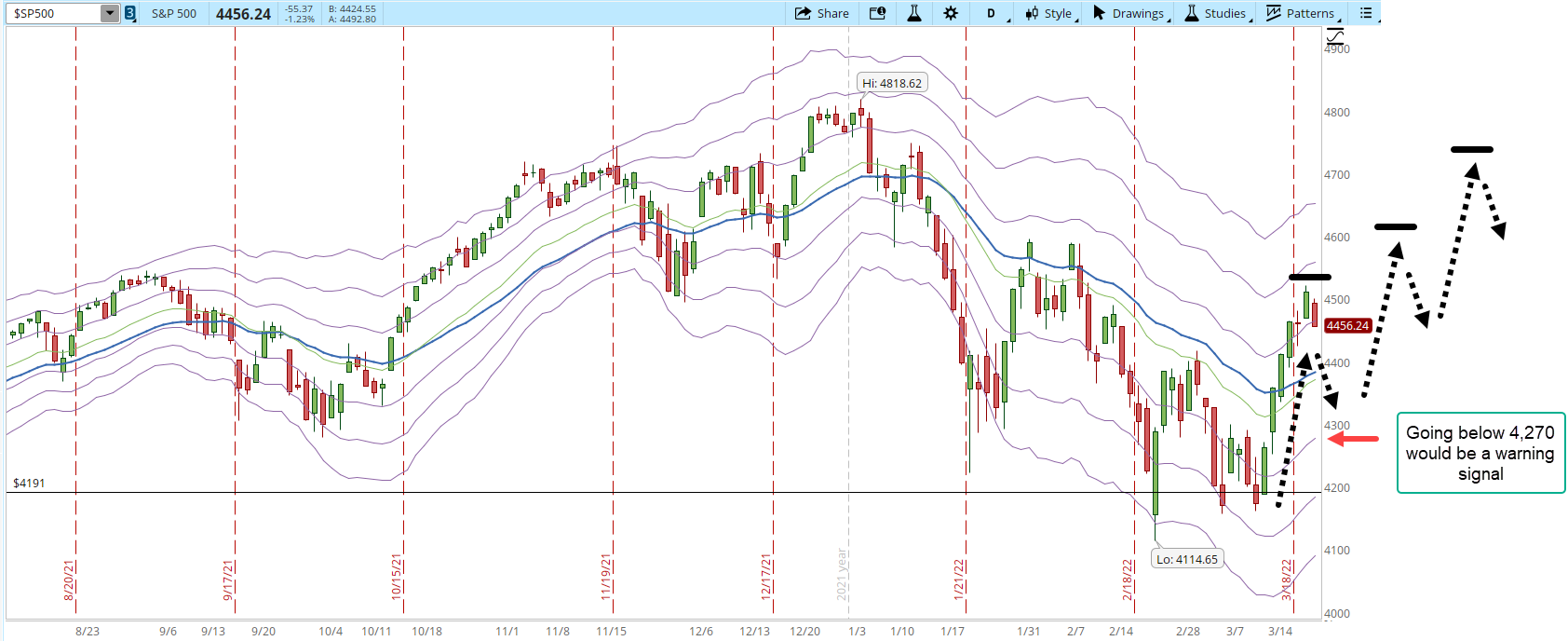

Just yesterday, I was warning about a pullback and today we just faced one that could still continue tomorrow. It will be still considered a healthy price action if it stays within the boundaries of the -1 and +1 Keltner Channels (KC). If it goes below the -1 KC then it will be necessary to evaluate if the Bears are starting to take control over the Market again.

If a new uptrend is going to develop from the movement we just saw, then the first part was to rally from the bottom, now it seems that the price has topped (horizontal black line). The price shouldn't go below 4,270 and if it does then I'll very very skeptical of the health of the rally. If we are about to see a new uptrend there should be controlled pullbacks where every rally reaches higher highs and higher lows (dotted arrows are a simulated scenario of an uptrend).

I won't start opening new long positions yet, as I stated in several previous posts I want the S&P to close and hold above 4,600. The scenario of a new uptrend is realistic but in the Markets anything can happen. If the uptrend fails to develop, I'll be ready for the S&P to start moving sideways or maybe even an scenario where the Correction resumes the downtrend.

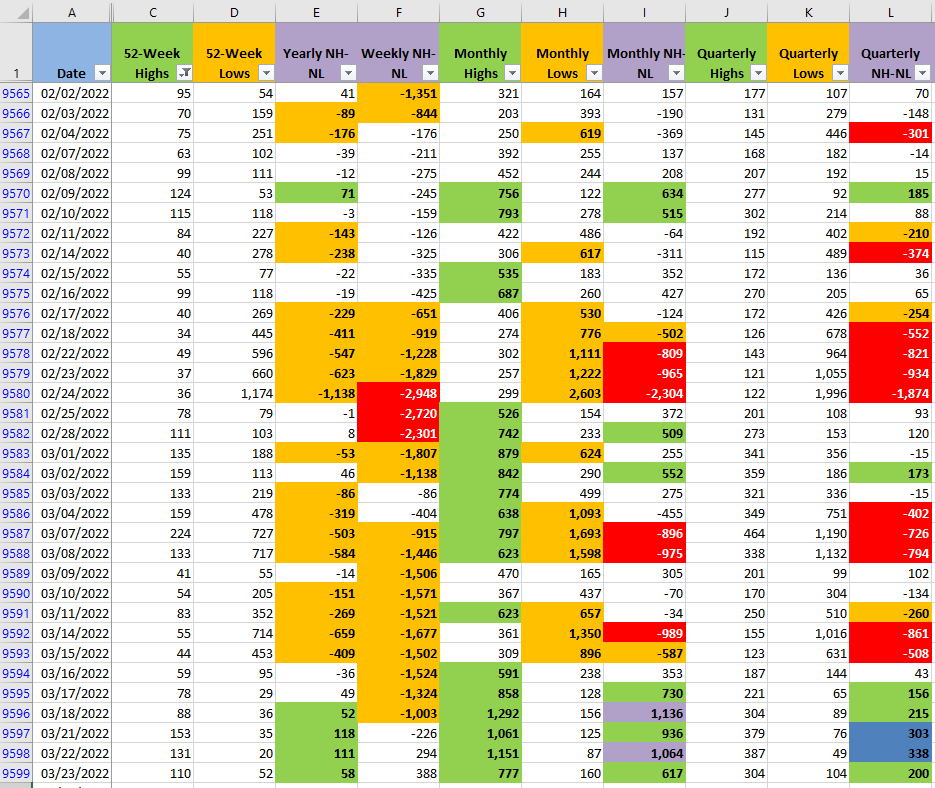

The New Highs and New Lows numbers are still not bearish. The Highs took a hit in all the timeframes but the Lows didn't increase significantly. I'll keep monitoring the Monthly numbers, those will be the first to change if the selling pressure starts to increase.

I'm testing several long positions, from the four I keep open, one is doing great, two have a minimal loss, and there is one getting close to a 5% loss. Having those positions open is giving me a great feeling about the daily action, much better than just watching and analyzing charts. Even if I just break even or with a small loss after closing the four positions, the learning experience is invaluable. Keep your stops in place and strict risk management... preserving capital is what keeps us in the game.