Yesterday I warned that the powerful rally we saw on Wednesday was suspicious, the title of the article was 'Why I don't Trust this Reaction Rally Yet...'. Today we see the fragility of the Market, people worried that the rate hikes won't be enough to control inflation, that the main economies worldwide are slowing down, that the unemployment claims rose more than expected. I'm not saying those things aren't important or that we shouldn't keep an eye on them, I'm saying those same news have been repeating for months now that I can hardly call them news.

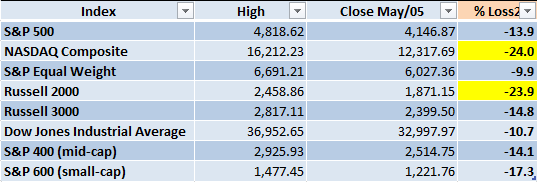

If we stop and see how the main USA indexes have declined the past months, the Nasdaq Composite and the Russell 2,000 lead the pack. They are already in confirmed Bear Marked territory again (a decline of 20% or more from the previous highest level).

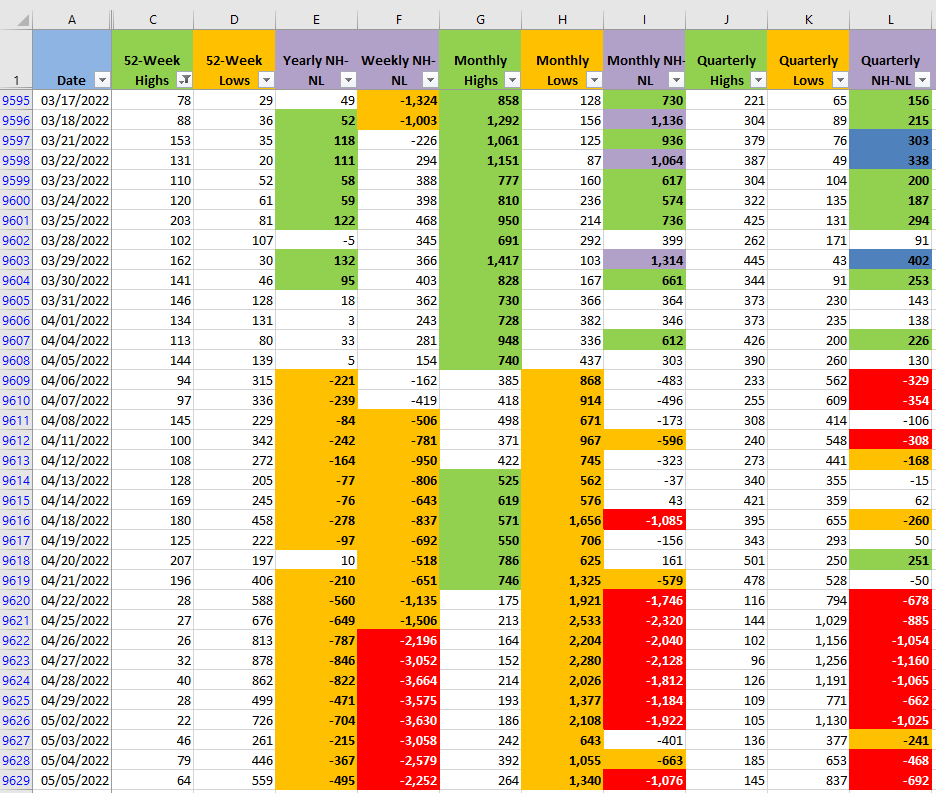

Unfortunately, I think this Correction will continue testing the 4,191 weekly support level in the S&P 500 chart. If we review the numbers for the New Highs and New Lows (NH-NL) they are still deteriorating with a high number of Lows. The most important columns are the Monthly columns because they are the fastest moving timeframe from the ones that I keep track of. If we look for clues about the short-term situation columns G, H and I are one good option.

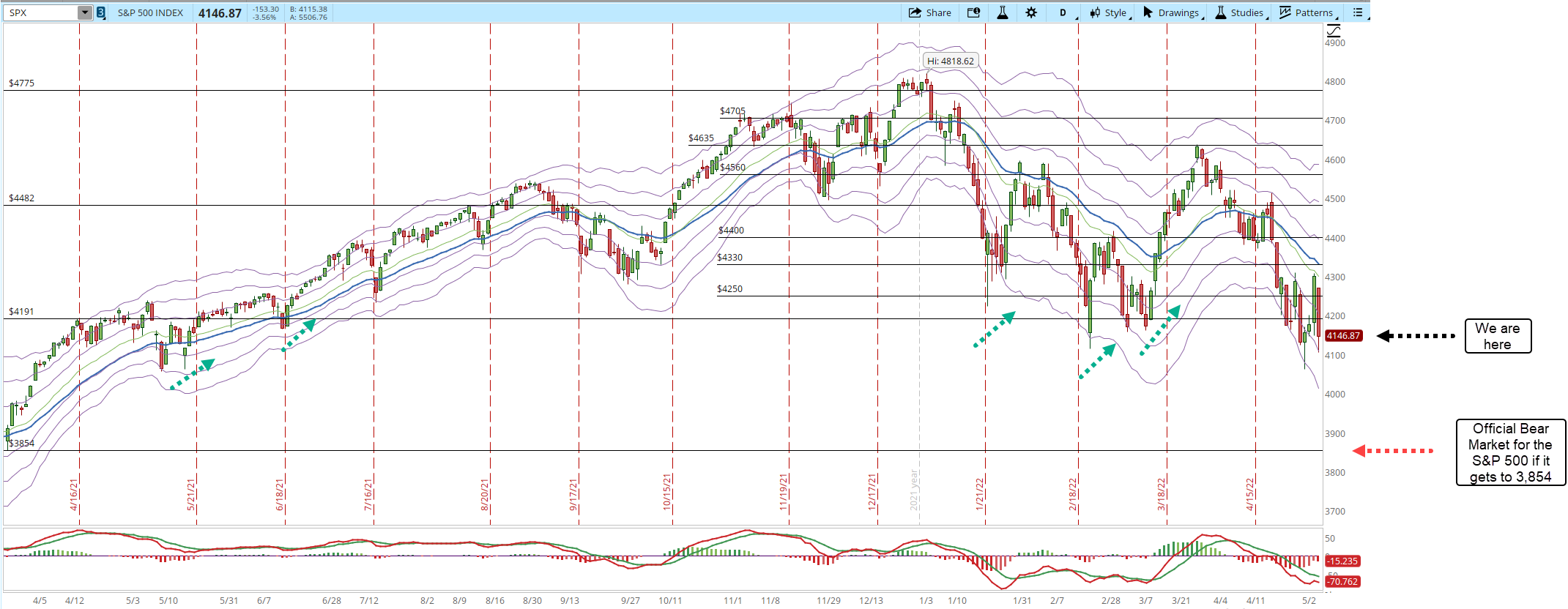

Reviewing the daily chart of the S&P 500 I have added the level at which the index will be officially in a Bear Market which is 3,854 (red dotted arrow in the screenshot below). The big issue I see is that in previous tests of the 4,191 weekly support (green dotted arrows), the index was able to rally and stay above the support in a short period of time.

What I see now is weakness, an index that was in oversold conditions (-3 Keltner Channel) and it seems closer to test the 4,100 and 4,000 levels rather than being close to having an important rally.

Since we are humans and we like certain round numbers, if the index gets as low as 4,000 that will spark a lot of fear in the Market. During the weekend if the weekly support breaks I'll add additional support lines to get an idea where this Correction could end.

Since I closed all my positions already, I'm not really worried if the Market continues falling. Until I see that a strong bottom is forming I'm unlikely to open any new long positions. If you still have long positions open, keep in mind the importance of risk management. Things can still get pretty ugly in the Markets in the next few days.