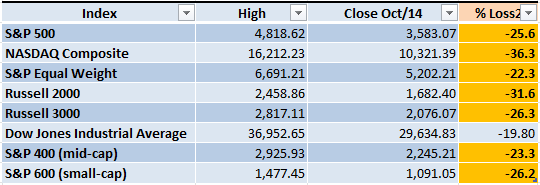

On Thursday Oct/13 there was some hope that the Bulls would finally start a rally, on Friday the Bears managed to kill that dream once again. The only important index that isn't officially in Bear Market territory (a loss of 20% or more from the previous high) is the Dow Jones Industrial Average with a loss of 19.8%. This week I have added a special section in order to understand better the nature of the Bear Markets from 1929 until now.

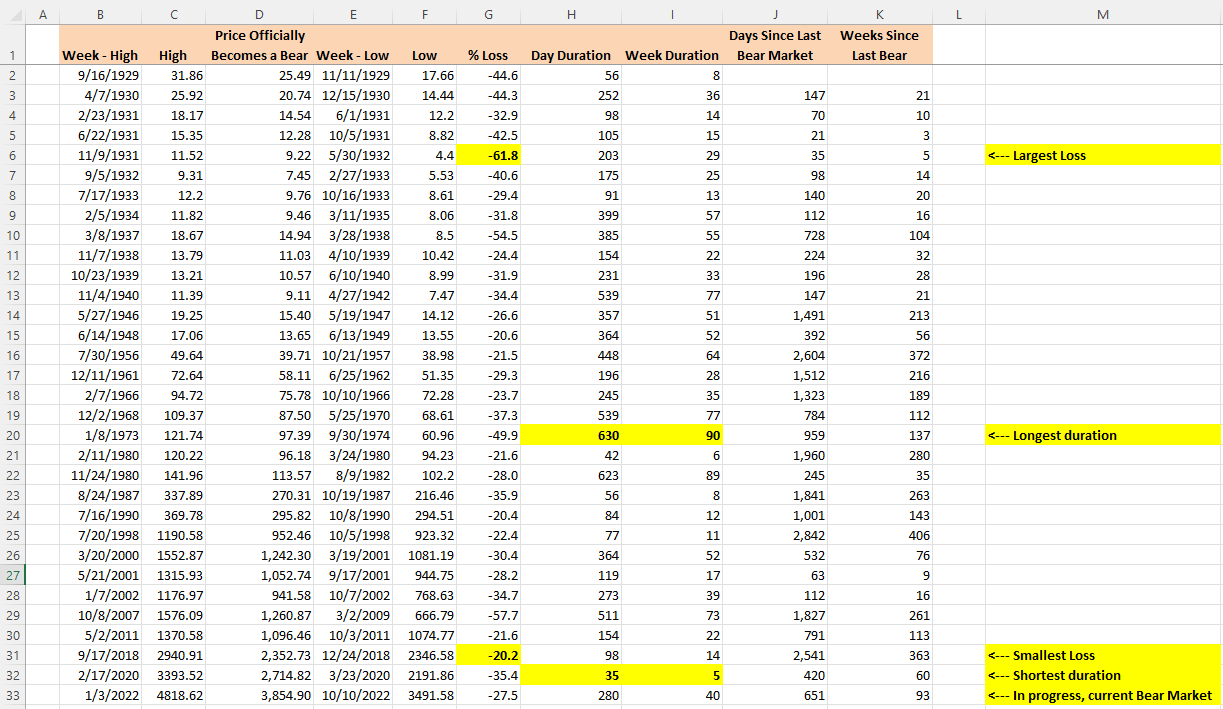

Historical Duration of Bear Markets

There aren't any guarantees in the Markets, that's part of what makes them difficult to trade. However, we can get an idea of the likelihood of an event when we review the history. Below you will find the duration of each Bear Market from 1929 to Oct/2022 and the reference dates that I took in order to calculate the duration. Everything is based on weeks, not days and the duration is calculated based on the time it took to move from the highest to the lowest point. It was a time consuming, error prone, manual process, but I want to convey the idea that Bear Markets don't last forever. You can click on the image in order to magnify it.

From the table below we can get a few statistics. The average duration of a Bear Market is 37 weeks, the current Bear Market has been active for 40 weeks. The longest duration of a Bear Market so far is 90 weeks (row 20). In terms of losses the average loss is 33.3% with a maximum loss of 61.8%. The current Bear Market has lost up to 27.5%.

The amount of time between the last Bear Market and the next one varies a lot. During the Great Depression there were multiple Bear Markets (rows 2 to 12) with some Bull Markets in between, but then the decline resumed pretty quickly, for example row 5 where there was only a separation of 21 days between one Bear Market and the next one. In more recent times, during the dot-com bubble there were a couple of Bear Markets with a separation of 63 days (row 27).

History won't necessarily repeat, but it's important to get the idea that the Bears won't be able to keep the selling pressure at extreme levels forever. Eventually there will be demand entering the Market that will start to absorb the current supply, it's impossible to predict when that will happen, but even with an extreme situation like the Great Depression, it eventually happened.

Market Overview

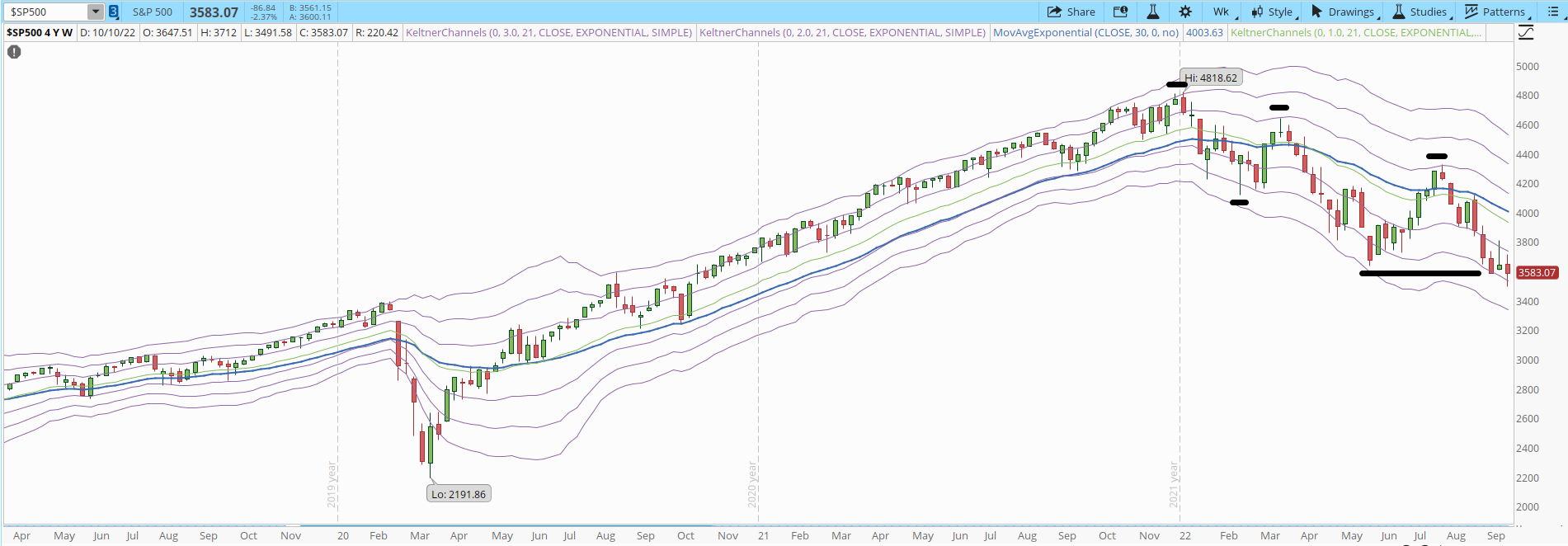

It's still uncertain if the Bear Market will be able to breach the 3,600 support. The S&P 500 did close below that level, but it rejected the prices around 3,500 and it bounced back to close the week at 3,583. If the selling pressure continues and effectively manage to keep fueling the decline, the next strong support will be around 3,400. I added the horizontal solid black lines to the weekly chart in order to highlight the downtrend (lower highs and lower lows). The structure of the downtrend will be strengthened the closer the chart gets to 3,400.

I didn't find anything incredibly interesting in the daily chart. It only confirms that the Bears are in control and the Bulls don't have any real force so far. There are a few reaction rallies when the index gets to oversold levels (-3 Keltner Channel or below, black dotted arrows) and those rallies are losing force. The first rally got to the +3 KC, the next one only to the +1 KC and the last two didn't even manage to get to the 30-day EMA (blue line).

There was some hope of a powerful rally on Oct/13, when despite the bad news about the inflation the Market managed to rally with a powerful reversal. The next day unfortunately the Bears killed that advance.

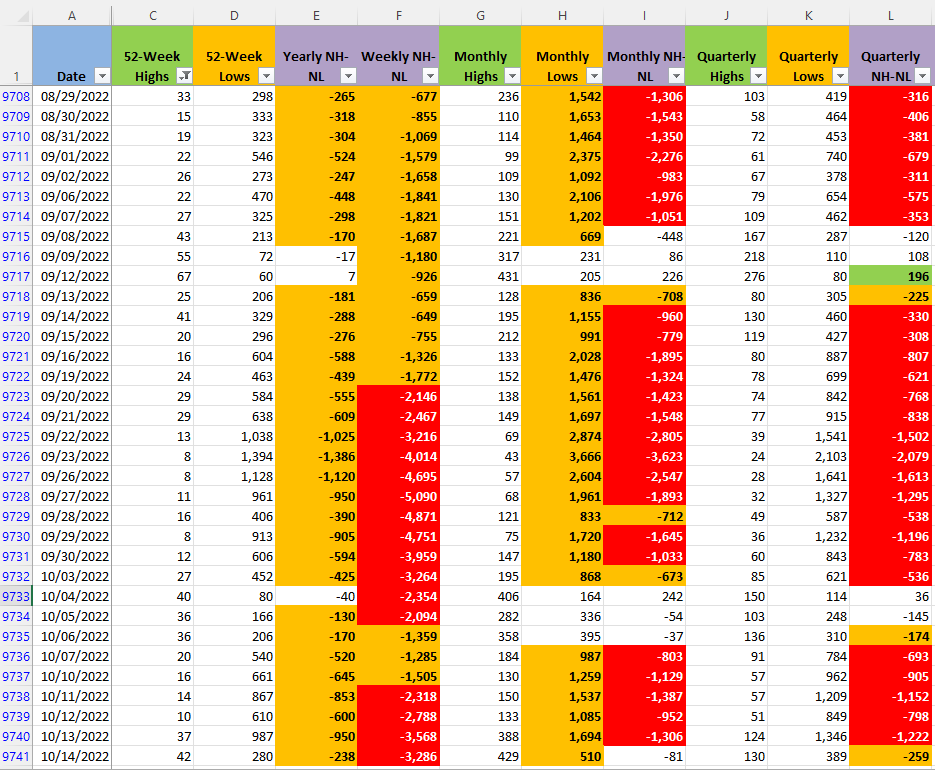

There's some indication that the selling pressure is decreasing. If we review the Monthly New Highs and New Lows (NH-NL) we can see that during Oct/14 (row 9,741) the Bears lost a lot of the power displayed during the week. On Oct/13 there were 1,694 tickers making a New Low, the next day only 510. This isn't a guarantee that things are changing, one day doesn't have a strong impact on my personal way of trading. However, if the Bulls manage to stop the decline and start reverting the numbers by increasing the Monthly NH and decreasing the NL there is hope that a reaction rally can start.

Industries

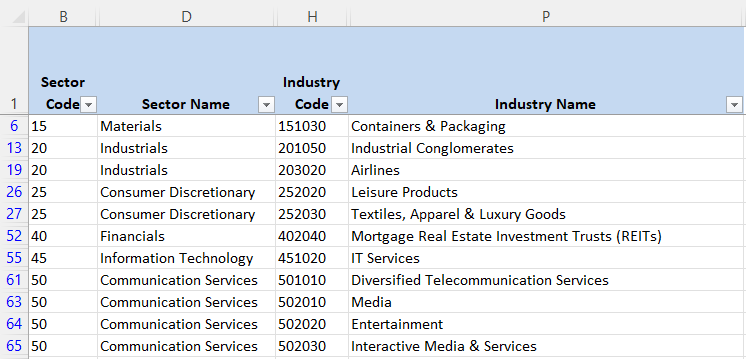

There aren't news in terms of strong Industries, from the 68 that compose the Global Classification Standard (GICS) I wouldn't dare to consider any of them as having a strong uptrend. I have mentioned that there are a few Industries that have been severely punished this year (screenshot below), it's important to track the strong ones but also get an idea of which Sectors and Industries are being affected the most.

The importance of this section, even if it doesn't change often, is that eventually there will be a few Industries that, despite the force of the Bear Market, they will manage to rally and could become the leaders of the next Bull Market. This is something I monitor on weekly basis.

Scenarios

Scenario #1: I still think there could be a reaction rally, with the lack of force that the Bulls displayed during the last trading week, a realistic target would be 3,900. The reason I still think that a rally could happen, is that the Bears haven't managed to close decisively below 3,600. Another factor is that the Monthly New Lows decreased significantly last Friday Oct/14. Even if there's a rally I still won't trade anything, the current environment isn't conducive for my trading plan, a lot of volatility and lack of bullish momentum.

As I have mentioned multiple times in past articles, a reaction rally isn't necessarily a change in the Market direction. It could be just an upward movement because of reasons such as greedy traders trying to catch a bottom or short sellers trying to cover their positions. In a reaction rally, some demand enters the Market but if the big players don't keep buying during multiple days or weeks, that rally, if it happens, will die pretty fast.

Scenario #2: The second most likely scenario, from my point of view, is that the Bears manage to continue fueling the decline. It's important to notice that since mid-August the rallies haven't lasted more than 4 days. The selling pressure is high, it can decrease for a few days but then it spikes again. The Bulls need to be able to break this pattern, if the earnings season brings good and surprising news, that could be a catalyst for a rally that lasts longer than 4 days.

If the feeble rallies continue, the negative catalysts eventually could resume the decline. Monitoring the 3,600 support will be key, it's important to recover that level soon before panic starts to take over the Market again.

Scenario #3: With the current situation I don't think that it's very likely that the Bulls manage to start moving the index sideways in order to start tracing a bottom. It would be great if that happens, that would start to form the base of a potential multi-week rally. However, what I have seen is that everything has been mostly bearish with some failed attempts from the Bulls to rally. The negative news about the inflation and potential recession have been one of the key catalysts affecting the Market and the solution doesn't seem to be close yet.

Summary

Bear Markets don't last forever, however they can last for a long time and sometimes the situation is more tricky when there is a short Bull Market in the middle. My account is all cash at the moment, waiting on the sidelines doesn't give the adrenaline rush that trading in this kind of environment can generate. Whatever your trading plan is, remember that capital preservation is the most important thing in this game, if you lose it you can't keep playing.

My personal impression about the current situation is that it's too late to find interesting shorts and it's too early to trade trends on the long side. When this Bear Market is finally over it will definitely open interesting opportunities. In order to trade those opportunities your account must be protected at all costs. When a rally starts, the Fear of Missing Out (FOMO) or the "attractive" stock prices could trigger the impulsiveness that damages or blows up accounts.