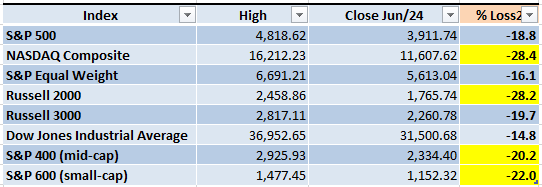

After the rally we experienced during the last trading week, some of the main indexes left the Bear Market territory (a decline of 20% or more from the previous high). I don't think that the Bear Market is over yet, however I did open a couple of long trades to get a better grasp of the current Market situation.

Market Overview

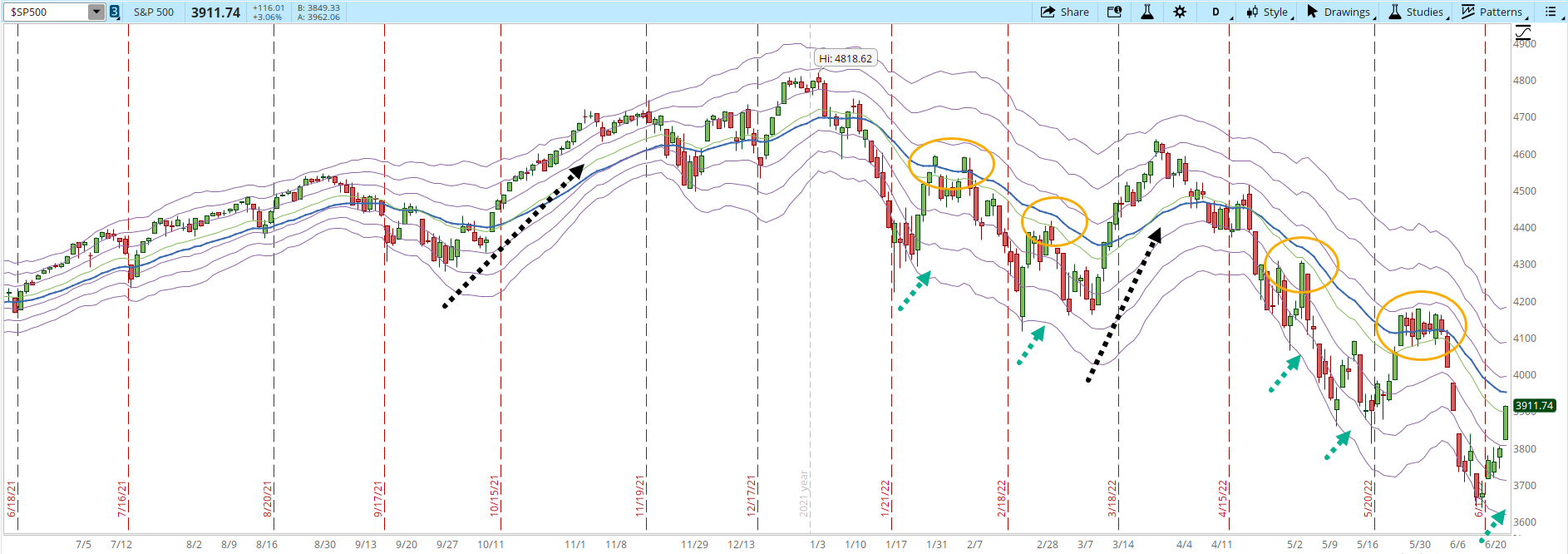

When it comes to the daily S&P 500 chart, there are good news and bad news. The good news is that the chart is still behaving consistently during 2022. The bad news is that if that consistency continues the rally doesn't have that many probabilities to go too far.

I have mentioned multiple times that only two rallies, since October/2021, have lasted more than 4 days (black dotted arrows), any other rally was consistently killed in four days or less. During 2022 the 30-day EMA (blue line) has been acting as a resistance, four out of five times, when the price level reached that line it declined (orange circled areas). The last consistent 2022 behavior is that every time the index reaches oversold levels (-3 Keltner Channel or lower), the index rallies (green dotted arrows).

Those behaviors won't last forever, whatever happened in the Market in the past isn't necessarily going to repeat in the future. Reviewing this kind of behavior is still helpful in order to get clues when the Market starts to change direction. During the article I published last week, I estimated that a realistic target for the current rally would be 4,100 and I still think the S&P 500 could reach that level in the trading week about to start.

If the S&P 500 can't make it even to 4,100 then the selling pressure is higher than anticipated. If the index overshoots that target then the Market situation could turn more interesting as the index starts breaking resistances.

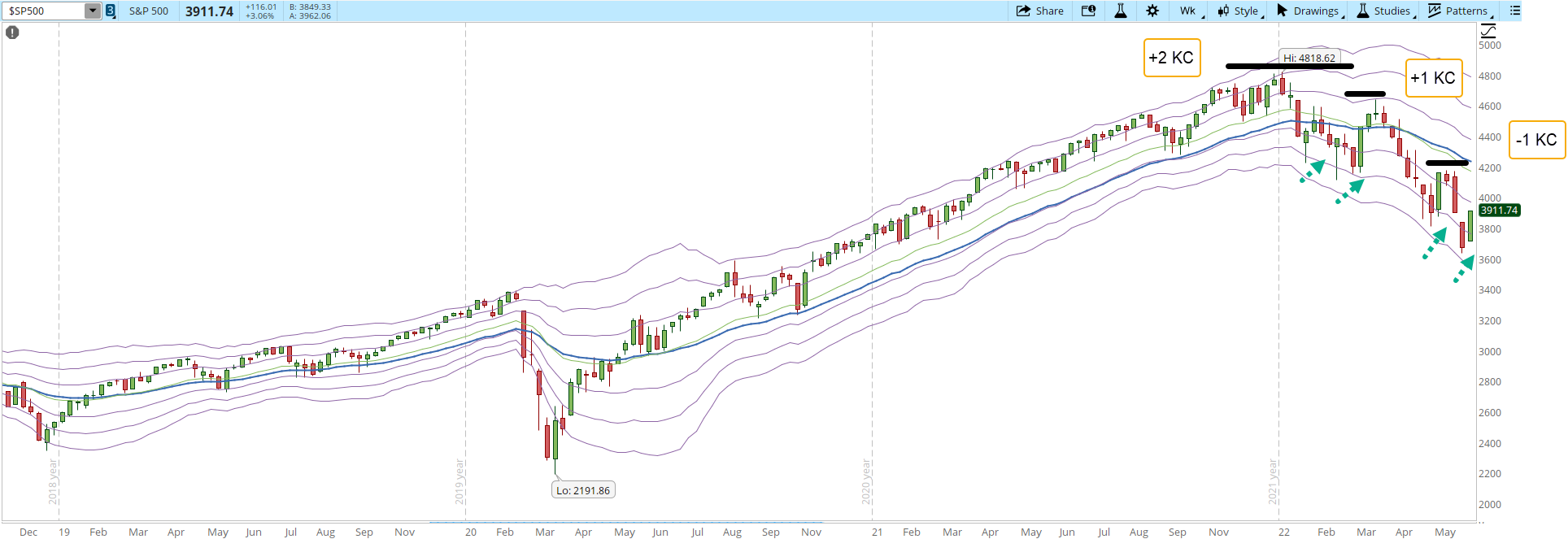

The weekly chart isn't very encouraging yet. Anything can happen on the daily chart, however it takes much more to move the direction of the weekly chart. The main issue is that the weekly downtrend, which wasn't that evident back in April, is now very clear.

Lower highs and lower lows (horizontal solid black lines) which also reach lower levels in terms of the Keltner Channels (KC). The historical high of 4,818 in January reached the +2 KC, the next high towards the end of March only reached the +1 KC. The latest high barely made it to the -1 KC. During the downtrend there have been rallies triggered when the index reaches oversold conditions (green dotted arrows). In order to break the downtrend pattern the index would have to close around 4,300.

It's easy to get lost or carried away by the Market movements. I like to use references that act as a compass when there are rallies or declines. Those levels need to be tailored depending on the type of trader you are. A level of 4,300 could signal a change in the Market direction but for a day trader or a swing trader that level might be too far away.

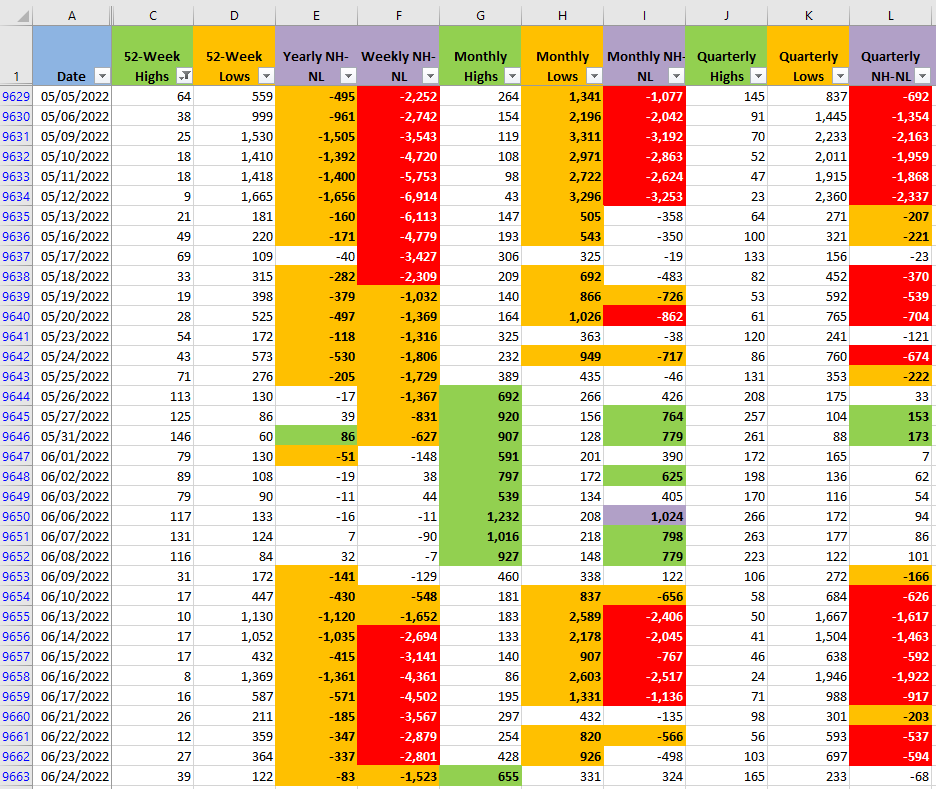

The New Highs and New Lows indicator is turning less bearish in all the timeframes. The Bears are still in control, there isn't any strong evidence yet that the situation has changed. There is a rally in place like there have been several others during the year. Until the rally starts breaking important resistances (the first one of them 4,200) then this is only a natural and expected reaction rally.

Industries

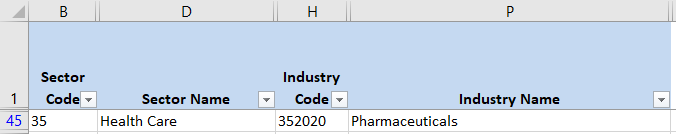

Last week I reviewed the 68 Industries that compose the Global Classification Standard (GICS), I couldn't find a single one that I saw as a strong Industry. This week there is one that has some strength and potential, Pharmaceuticals. I do give importance to the strong Industries, when Bears finally lose control and a new Bull Market starts to emerge, there will be some Industries that will lead the Market.

Tracking the movement of the strong Industries will give some valuable information about where the next potential winners will be. At this point if only a single Industry out of 68 is strong, it's still too early to think about a Bull Market.

Scenarios

Scenario #1: The most likely scenario from my point of view, is that the rally will continue, at least to a level around 4,100 which I estimated last week. I opened a couple of pilot trades to see how they react during next week's Market action. I know this scenario has the big disadvantage that only a couple of rallies since Oct/2021 have lasted more than four days. However, I did like the price action toward the end of the week, only on Friday the S&P 500 gained 116 points and closed strongly at its highs (pink dotted arrow).

Scenario #2: The second most likely scenario is that the decline resumes. There is an abundance of negative catalysts that have been around for months and most likely will continue in the foreseeable future. One of them is the inflation, even if the Fed manages to control it, the next discussion will be how deep the recession will be. Even if that gets solved we still have the Ukraine war, Covid, supply chain crisis, China tensions, etc. It just takes one strong negative catalyst to send all the main indexes back to Bear Market territory.

Scenario #3: The third most likely scenario is that the rally stalls, it will be a series of ups and downs. This scenario wouldn't be necessarily negative, it could start tracing a bottom. Changing the Market direction takes time, even if the index doesn't continue its way up, it could at least start rejecting lower prices.

Summary

Next week will provide some important clues about the direction of the weekly downtrend. A strong rally could at least change things from going further down to start tracing a bottom. The future still doesn't look that bright, the fundamental issues that started the decline will likely take several months to improve.

In order to start testing the Market I opened a couple of positions, Huron Consulting Group (HURN) and Richardson Electronics (RELL). The positions are small, the benefit will come as I get a much better feeling managing them than just looking at the Market from the sidelines. If they fail, the loss will be small, if they start to work I'll likely increase their size or start opening new long positions.

No one knows when the next Bull Market will start, it could be next week or two years from now. It's important to preserve capital and be ready to take the opportunity when it finally presents itself.